Last week in a nutshell

- The release of the Q1 US GDP report indicated a slowdown in growth alongside higher-than-expected prices and sent US Treasury yields up.

- Euro zone business activity creeped up to its highest level in almost a year, driven by a robust service sector.

- Euro zone's preliminary consumer confidence estimate stayed just below expectations but reached its highest level since February 2022.

- Despite mounting concerns about the yen's continuing depreciation and its adverse economic effects, the Bank of Japan kept a dovish position.

What’s next?

- The US Federal reserve bank is meeting and Chairman Jerome Powell will hold a press conference which should emphasise that the progress on inflation has slowed in the first quarter.

- The monthly US job report will be the arbiter on the strength of the labour market, in particular following the recent drop in employment in business surveys.

- Preliminary inflation figures for April are due in the euro zone and some of its members, including France, Spain, Germany, and Italy. Preliminary GDP growth estimates of the past quarter will also be in the spotlight.

- Final numbers on industrial production and retail sales from developed countries will help investors gauge consumer spending and provide insight into the state of the economic cycle.

Investment convictions

Core scenario

- In the forthcoming months, our scenario is that cyclical sectors will outperform defensive ones. This expectation stems from the uptick in Purchasing Managers' Indexes (PMI) and expected rate cuts by central banks, now that they successfully built room for manoeuvre. Clearly, 2024 is bringing more visibility as the economic uncertainties decline in the US and in Europe, where the energy crisis was avoided.

- The goldilocks environment characterised by positive growth surprises and negative inflation surprises is broadening throughout the euro zone. Growth surprises are positive in all major regions while inflation surprises upwards only in the US.

- In China, economic activity has shown some fragile signs of stabilisation while the evolution of prices remain deflationary.

Risks

- An overshooting in US yields, the price of oil or the US dollar are key variables to watch. Geopolitical risks to the outlook for global growth remain tilted to the downside as developments in the Red Sea unfold and the war in Ukraine continues.

- Bond yields are to be monitored especially given the diverging paths taken by the robust US economy and its stabilising European counterpart, which triggers an increasing spread in yields.

- A stickier than expected US inflation could force the Federal reserve bank to reverse course. In our understanding, it would take more than just the bumpy data registered during the first quarter of the year.

Cross asset strategy

- The recent market correction of 5-7% (from its peak) provided us with a good opportunity to add global equity via developed markets and our outlook on equity remains positive.

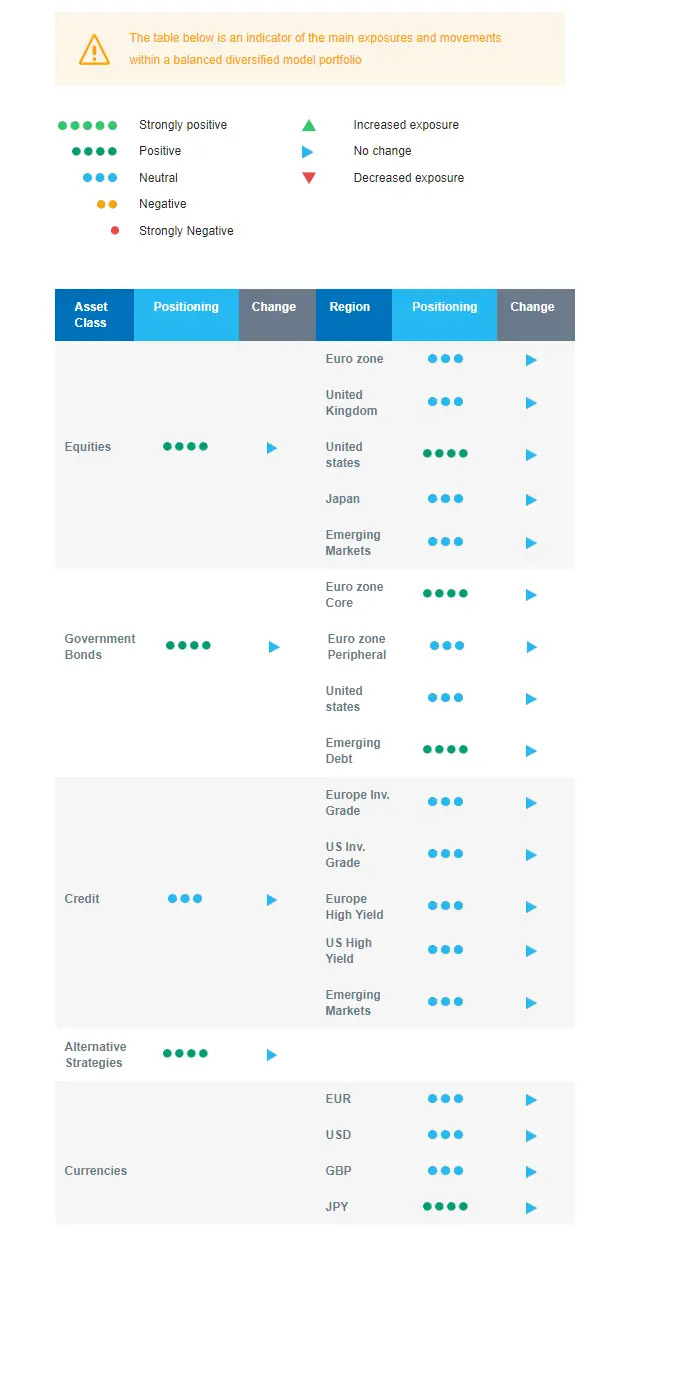

- We have the following investment convictions:

- Our equity allocation is slightly overweight, via a more constructive view on developed markets.

- Specifically in the euro zone, we add beta and cyclicity, via small and mid-caps, likely to catch up to larger capitalisations, as well as banks while reducing exposure to the health care sector.

- In the fixed income allocation:

- We have a positive stance on European duration and aim for the carry in a context of cooling inflation in the region.

- We maintain a neutral stance on US government bonds, looking for a new, more attractive, entry point.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry, i.e. coupons.

- We have a neutral stance on European Investment Grade credit.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets.

Our Positioning

Our outlook on equity remains positive. Underpinned by a solid earnings season underway, we believe that the recent market correction of 5-7% (from its peak) provided us with a good opportunity to add global equities via developed markets. With the addition of cyclicity to the portfolio, the strategy benefits from PMIs picking up and central banks cutting rates. The latter should act as a cap for long-term bond yields, underpinning our positive view on euro zone duration. Regionally, we keep a positive stance on US equities amid a strong economy and a positive EPS momentum. We are neutral on Europe, Emerging markets, and Japan.