Last week in a nutshell

- Global flash PMI on manufacturing and services activity started the summer on a soft footing.

- US retail sales edged up an underwhelming 0.1% month-over-month in May, below forecasts of 0.2%.

- The euro zone consumer confidence rose slightly to its highest level since February 2022 but it is still trailing its long-term average.

- The Swiss National Bank cut its key interest rate by 25 basis points to 1.25% while the Bank of England appears ready to cut at its next meeting

What’s next?

- The focus will be on inflation as preliminary readings from a handful of EU members, final readings from Canada, Japan’s CPI and the US PCE are due.

- Mortgage applications, new home sales and house price index in the US will give us the pulse of the real estate market.

- The Bank of Japan’s Summary of Opinions will shed some light on the latest central bank policy meeting and its commitment to trim back JGB purchases.

- On the political front, key events include the first US presidential debate between Donald Trump and Joe Biden, an EU leaders summit and the first round of the general election in France.

Investment convictions

Core scenario

- Facing a rise in political uncertainty, a higher risk premium appears justified in Europe. In the US, the hawkish repricing of the monetary policy from the Federal Reserve is now largely behind us.

- Beyond the election uncertainty in the euro zone, the activity pick-up from quasi-stagnation should represent a support for equity valuations. Forward-looking indicators point into that direction.

- Global disinflation trends have been confirmed by the most recent inflation data. At the current juncture interest rates have peaked and growth remains resilient.

- In China, economic activity has shown some fragile signs of stabilisation but the evolution of prices remains deflationary as consumer confidence remains at very low levels.

Risks

- Gains for the far-right in the European Parliament elections have prompted French President Emmanuel Macron to call for a national vote. This development has brought political risks back into focus for financial markets, especially for French stocks and government debt.

- Geopolitical risks to the outlook for global growth remain tilted to the downside as developments in the Middle East and the war in Ukraine continues.

- Bond yields are to be monitored especially given the diverging paths taken by the US central bank and its European counterpart.

- Although unlikely, a stickier-than-expected US inflation path while economic growth slows down too much and unemployment rises, could force the Federal reserve to reconsider its course.

Cross asset strategy

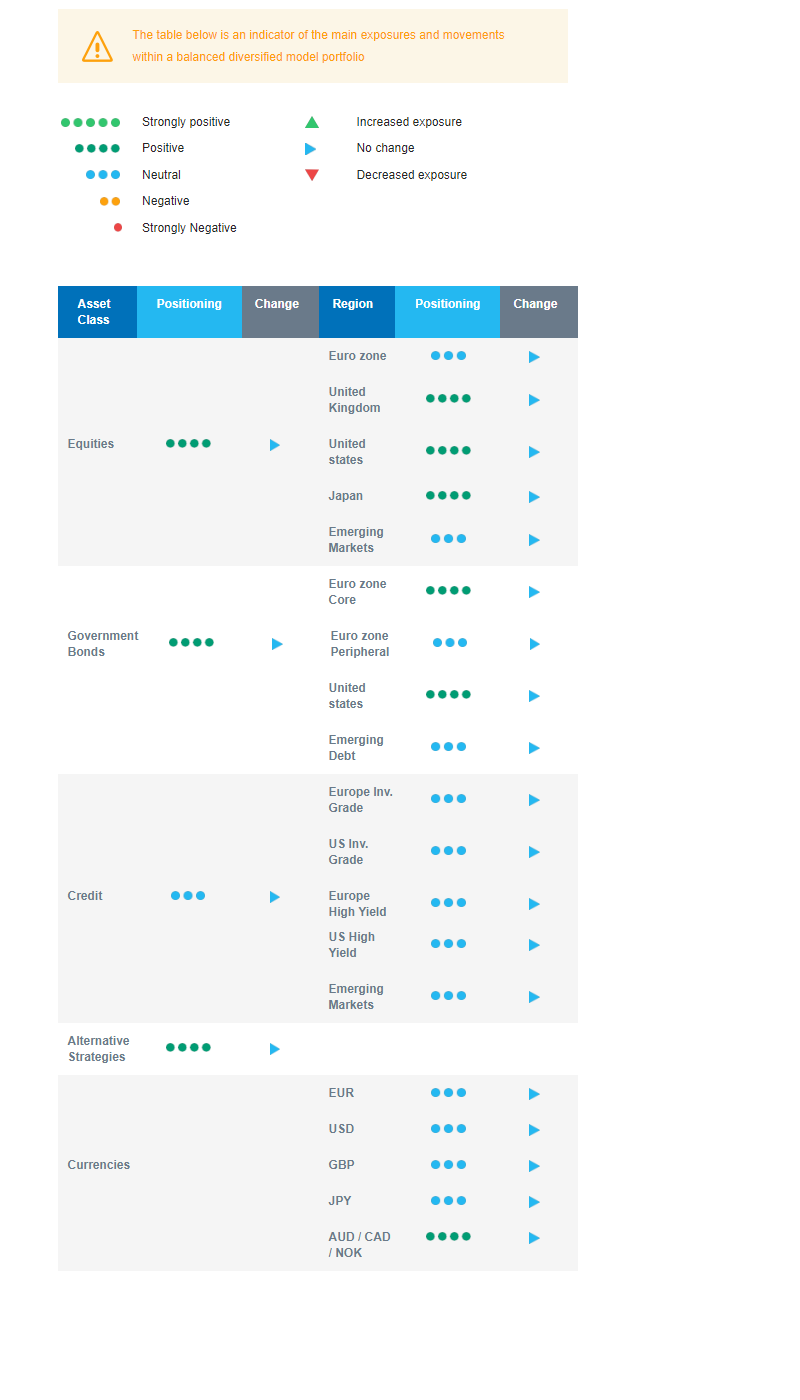

- As the recent rise in political uncertainty spilled over into financial markets and French assets, leading to somewhat higher volatility in the region, we are currently slightly overweight equities.

- We have the following regional equity investment convictions:

- Neutral euro zone equity as the bloc faces a rise in political uncertainty and a higher risk premium appears justified.

- Slight overweight US, UK and Japan, neutral Emerging markets.

- In Japan, exiting the multi-decade long deflation as well as corporate governance reforms bearing fruit should more than counterbalance a less dovish Bank of Japan.

- In the equity sector allocation:

- We have a positive view on the Tech sector: good Q1 earnings and guidance, peaking long-term yields, reasonable valuations, broad market leadership within IT and the industry’s relative insensitivity to the upcoming US presidential elections.

- A Pan-European small cap bias gives us the benefit of lower inflation, lower central bank rates and higher growth than expected.

- In the fixed income allocation:

- We prefer carry to spreads, with a focus on quality issuers, hence we are neutral peripheral European bonds and prefer core countries.

- We seized an attractive entry point on US government bonds as yields shot back up to 4.7% in April.

- We have a relatively small exposure to emerging markets sovereign bonds amid very narrow spreads and a strong US dollar.

- We are neutral on investment grade and high yield bonds, regardless of the issuers’ region.

- In our forex strategy, we are positive on commodity currencies as the global manufacturing cycle picks up.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets and keep an allocation to gold.

Our Positioning

Our outlook on equity remains positive but we take into account the latest developments in France. We are slightly overweight developed markets equities and neutral euro zone. We are overweight US Tech and pan-European small and mid-caps, a reflection of our conviction in lower inflation, lower central bank rates and higher-than-expected economic growth. We are neutral Emerging markets equity until consumer confidence gains traction. On the fixed income side, we are positive on Core European duration, as a safe haven, and UK duration. The objective is to benefit from the carry in a context of cooling inflation and pending rate cuts by the ECB and BoE this summer. In credit, we remain neutral - high yield and emerging debt - amid very narrow spreads and a strong USD.