Demographic shifts, from ageing populations to rising middle classes, present long-term, diversified investment opportunities, as these structural changes are reshaping the global economy.

As the world's population rapidly expands, ages and becomes more affluent, demographic shifts are reshaping economies around the world. These transformative changes are creating new demands for healthcare, technology, consumer goods and infrastructure.

A growing global population

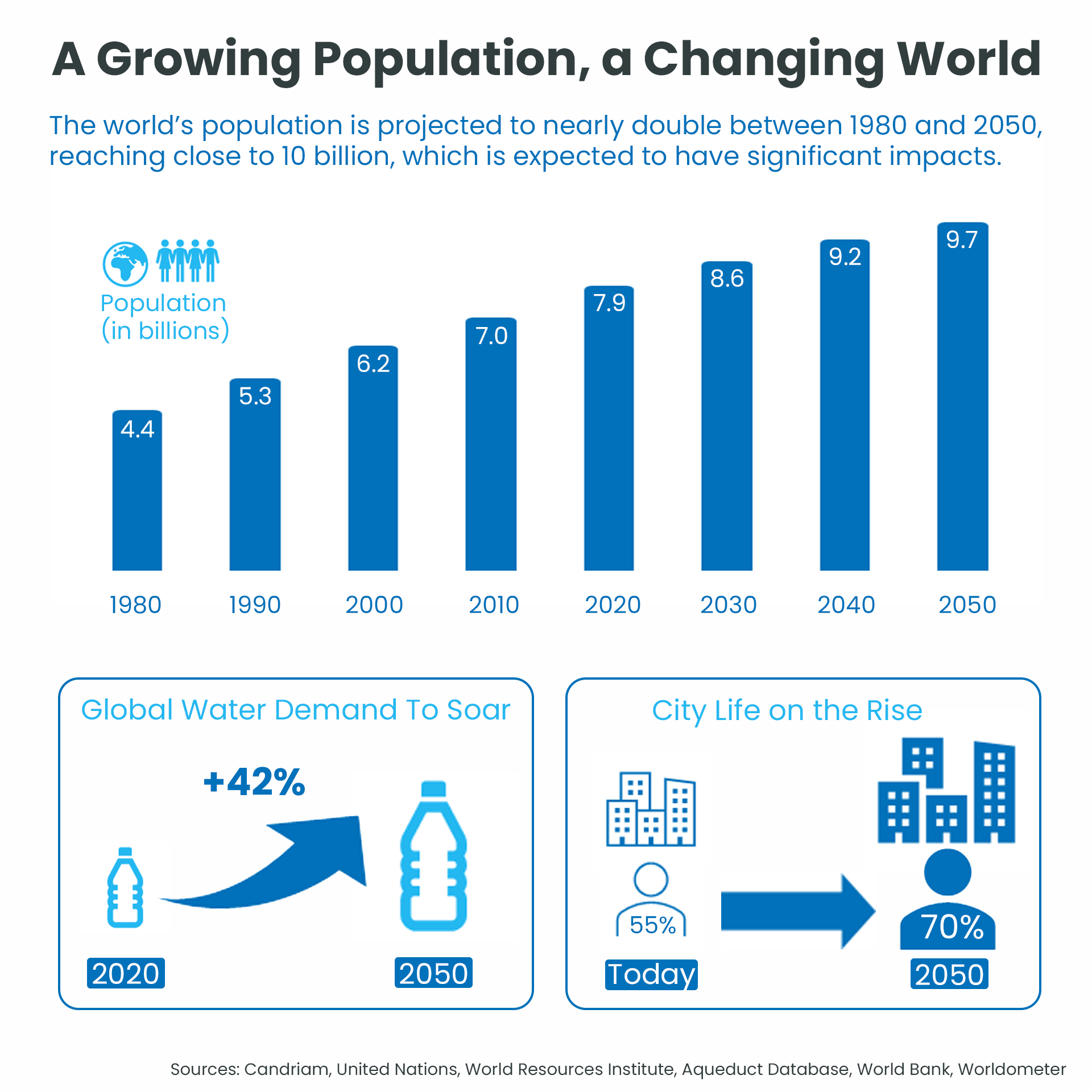

The world's population is growing at a staggering rate. According to the United Nations, the world's population is expected to reach 9.7 billion by 2050, up from 7.8 billion in 2020. This represents an increase of 24% in just three decades. Such growth is expected to significantly increase demand for natural resources and infrastructure projects, all with a focus on sustainability.

Here are some of the key impacts of a growing world population:

- Increased demand for key resources: With population growth, global food production will need to increase by 60%[1] and water demand is expected to rise by more than 40%[2] by 2050. This increase creates long-term investment opportunities in agricultural technology, infrastructure and sustainable water management solutions, including smarter water use, advanced metering and water reuse initiatives.

- Urbanisation: The shift to urban living is accelerating, with 68% of the world’s population expected to live in cities by 2050, up from 55% today[3]. This shift is expected to double the urban population[4]. As cities expand, the demand for infrastructure, including efficient public transport, smart cities, and advanced waste management, will increase significantly.

An Ageing Population

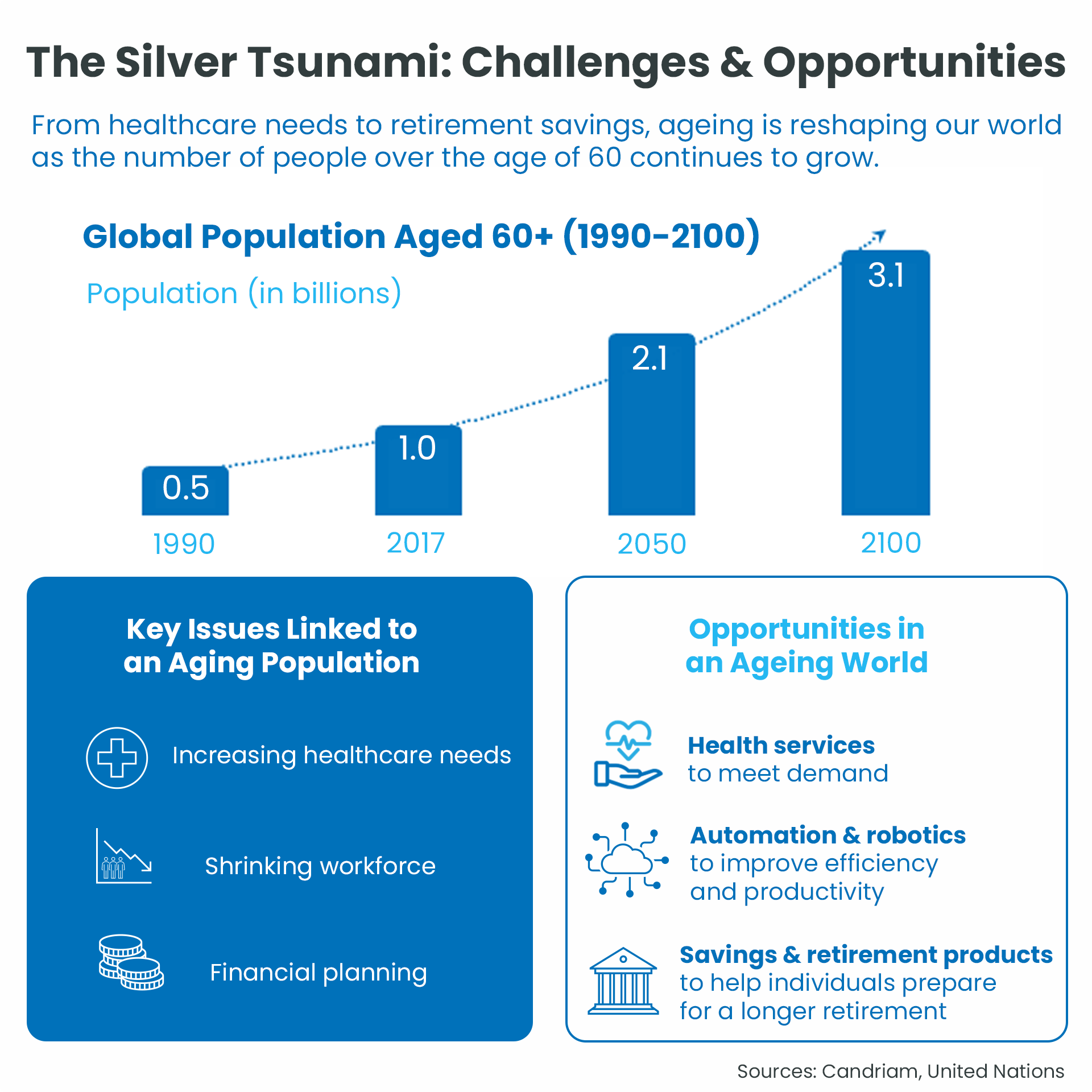

The global population aged 60 and over is expected to double by 2050, driven by rising life expectancy and falling birth rates[5]. Average life expectancy has risen from around 50 years in 1950 to over 73 years in 2020, placing greater demands on healthcare systems to manage chronic diseases and age-related conditions. Meanwhile, declining fertility rates in developed countries are leading to ageing populations and shrinking workforces, particularly in Europe and Asia.

This demographic shift creates investment opportunities in sectors such as chronic disease management, pharmaceuticals, elderly care, telemedicine and medical technology. In addition, the shrinking workforce underscores the need for automation, making robotics and AI sectors with significant growth potential. As life expectancy increases, extended retirement planning and financial security services will become increasingly important.

A Wealthier Population

In recent decades, strong economic growth in developing countries has led to a rapid expansion of the middle class, particularly in Asia, where it is expected to grow from 2 billion people in 2020 to 3.5 billion in 2030. By contrast, the middle class in the Americas is projected to grow only slightly, from 647 million to 689 million over the same period. As a result, two-thirds of the world's middle class will be in Asia by the end of the decade[6].

This economic growth, fuelled by globalisation, improved education and industrialisation, has brought spending patterns in these regions into line with those in the developed world. As incomes rise, consumers are increasingly spending on education, leisure and digital technology, with growing demand for global brands in sectors such as luxury goods, cosmetics and sportswear.

Technological integration is also transforming economies and consumer habits. The rise of the subscription economy and advances in AI, cloud computing and big data are reshaping business models and enabling companies to offer more personalised and efficient services. This is creating new opportunities for innovation and growth in various sectors.

Investing in demographic trends offers a strategic avenue for those seeking to capture future growth across multiple sectors. By aligning themselves with these dynamics, investors can capitalise on long-term structural changes across a globally diversified landscape, both geographically and sectorally, including cyclical and non-cyclical opportunities.