On both sides of the Atlantic, inflation was undoubtedly an important theme throughout 2023. At the end of last year, the multiplication of good news on this front fuelled the fall in long-term interest rates and expectations of lower short-term rates from the European Central Bank and the Federal Reserve. The latter even seemed to pivot at its monetary policy committee meeting in mid-December, arguing in particular that it would be careful not to make the mistake of maintaining an overly restrictive monetary policy... for too long! Is the battle against inflation, begun by central banks in 2022, coming to an end?

Today we launch a series of posts offering updates on this issue.

A battle not yet won

The facts

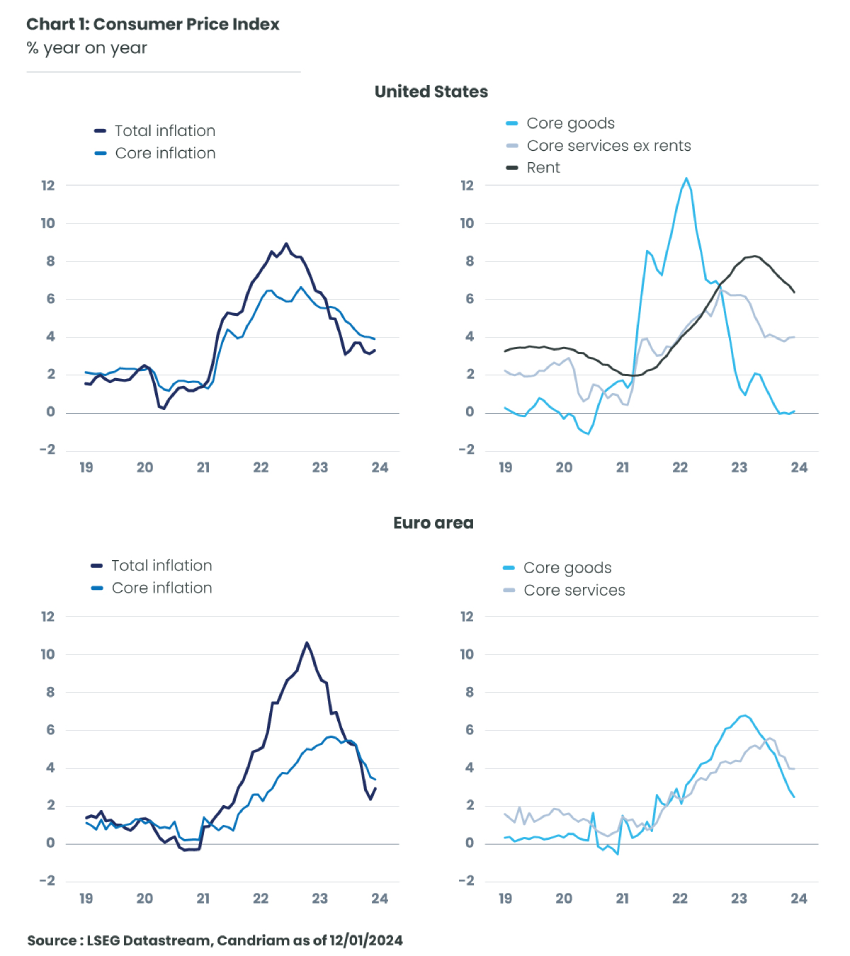

In both the US and the Euro zone, inflation eased in 2023 (Chart 1). Initially fuelled by falling energy and agricultural commodity prices, this downturn was then sustained by falling core inflation (i.e. excluding energy and food).

Goods inflation back to normal

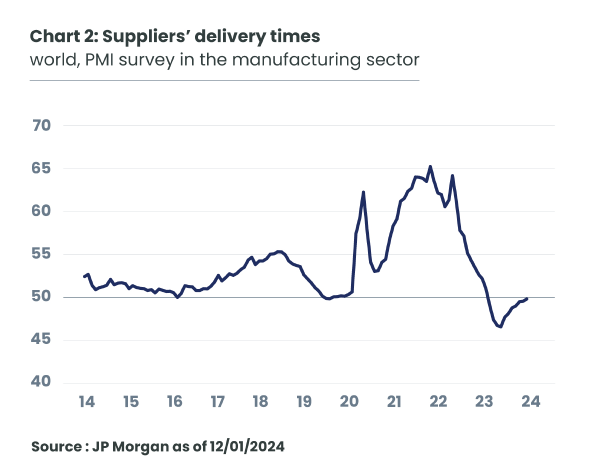

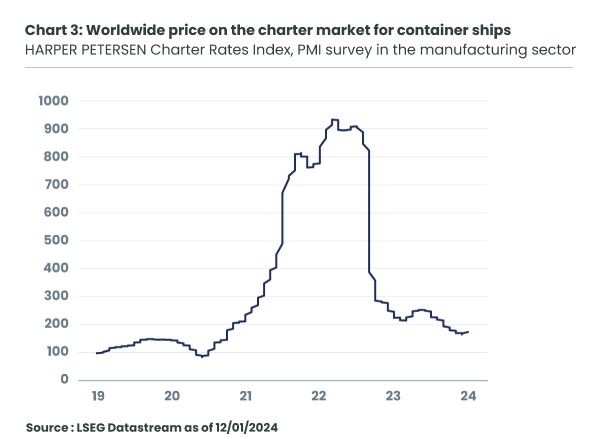

Supply chains and world trade were profoundly disrupted during the pandemic: the resulting rise in the price of goods was spectacular in the United States and, to a lesser extent, in the Euro zone. Four years after the outbreak of the pandemic, these tensions have dissipated: companies in the manufacturing sector report that delivery times have returned to normal (Chart 2), and sea freight costs have almost returned to 2019 levels (Chart 3).

In the United States, goods inflation returned to its pre-pandemic level of close to 0%. If this return to normal took longer in the Euro zone, it's because we had to digest a very specific shock: the rise in the price of energy... natural gas in particular! However, the downward trend in manufactured goods inflation is also well underway, with prices actually falling over the last three months!

Recent events in the Red Sea are a reminder of the vulnerability of world trade to geopolitical tensions. Following a series of attacks in the Red Sea, several major shipping companies have diverted their ships from the Suez Canal: this lengthens transit times for goods (the detour via the Cape of Good Hope increases the length of journeys between Europe and Asia by 30% to 40%) and leads to significant increases in insurance and fuel costs. The longer this situation continues, the greater the risk of further pressure on property prices.

Rent inflation: a U.S. problem on its way to normalization

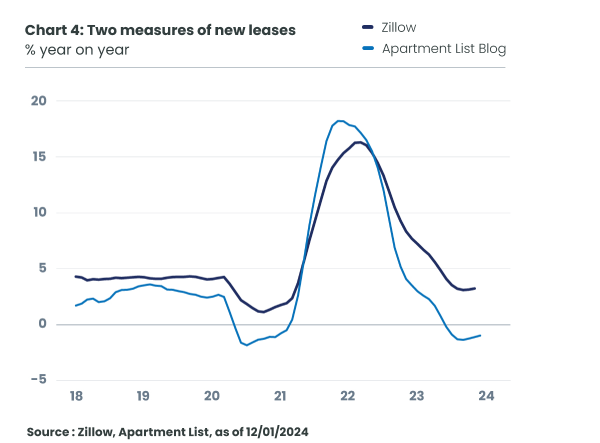

The United States also faced a very specific problem: the spectacular rise in rents. Here again, however, things are moving in the right direction. For over a year now, rents for homes coming onto the rental market have decelerated markedly (Chart 4) and even fallen slightly, according to the index published by Apartment List. It should come as no surprise that this deceleration is not fully reflected in the rental price index published by the BLS: the latter measures not only rents for new properties put up for rent, but all rents paid by American households. It is therefore naturally more inert. Its marked deceleration since the beginning of last year is reassuring, however, and should continue into 2024. This is all the more important given that rents account for almost 33% of the consumer price index (and 41% of the underlying price sub-index)!

Service prices: an unfinished slowdown

While goods prices (and rents in the US) have normalized or are in the process of doing so, a sustainable return of inflation to a pace more in line with central bank targets will require a sharper fall in services inflation. Yet for most of these services, labour represents the largest share of production costs. For central banks, winning the battle against price inflation therefore seems to require controlling wage inflation.

More in a future episode...

This communication is provided for information purposes only, it does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction, except where expressly agreed. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.