;

;

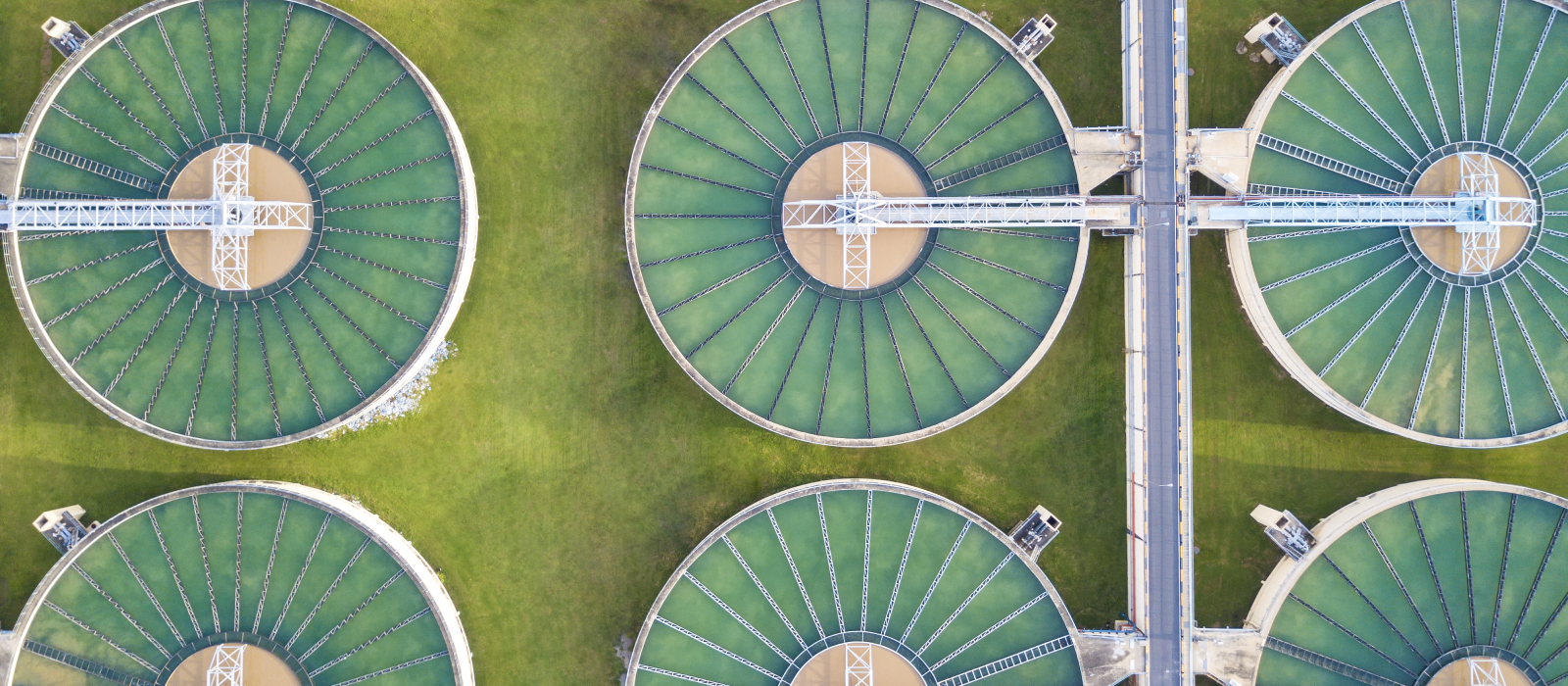

Managing risks and uncovering investment opportunities

In many industries, water is already, or increasingly becoming, an operational risk, and as such it should be integrated into strategic planning and capital allocation. Besides, water is by essence a local issue, linked to the precise location of companies’ assets – their closeness to freshwater sources, the quality of these sources, the potential climate change impacts...

A comprehensive analysis of companies’ - or issuers’ - strengths, weaknesses, risk and opportunities, cannot ignore the water factor.

Bastien Dublanc and David Czupryna, our thematic investment managers, highlight their approach in an interview, sharing their perspectives on the promising opportunities available to investors willing to explore this secular thematic.