In the new interest rates environment, is it time to update our asset allocation standards?

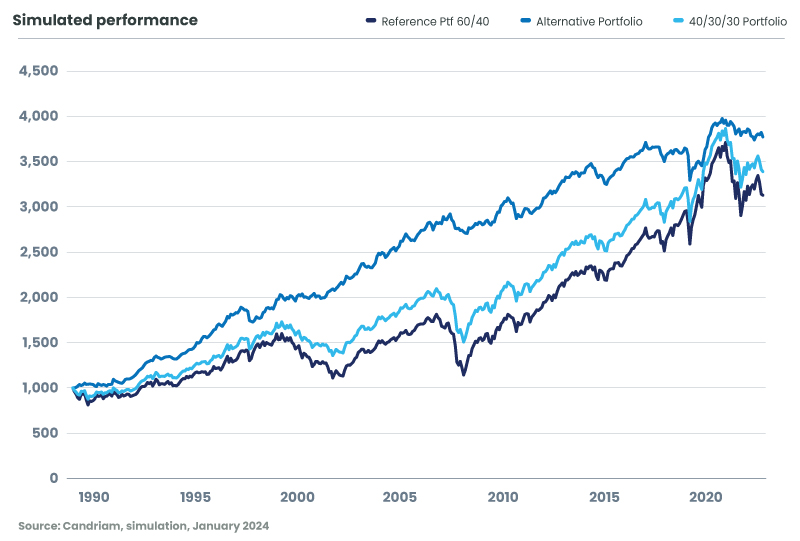

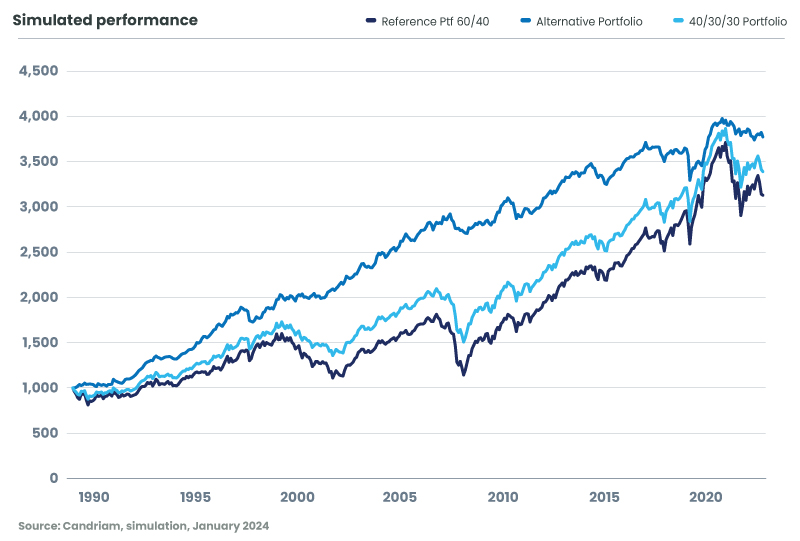

In our paper, we show that introducing the right alternative strategies may enhance the return/risk profile of a balanced portfolio. The 40/30/30 portfolio, with variable allocation adjusted to the economic phases, offers higher performance than the 60/40 portfolio.

The scenarios presented are an estimate of the performance based on evidence from the past on how the value of this investment varies, and/or current market conditions, and are not an exact indicator. What you will get will vary depending on how the market performs ad how long you keep the investment.

What mix of strategies should investors favor in the current environment? That may depend on the scenario.

Find our answers in our white paper

Ready for the next step? We demonstrate a framework for adapting your choice to the market environment.

See our explanation of how to allocate to functional alternatives

;

;