Have the excesses been digested?

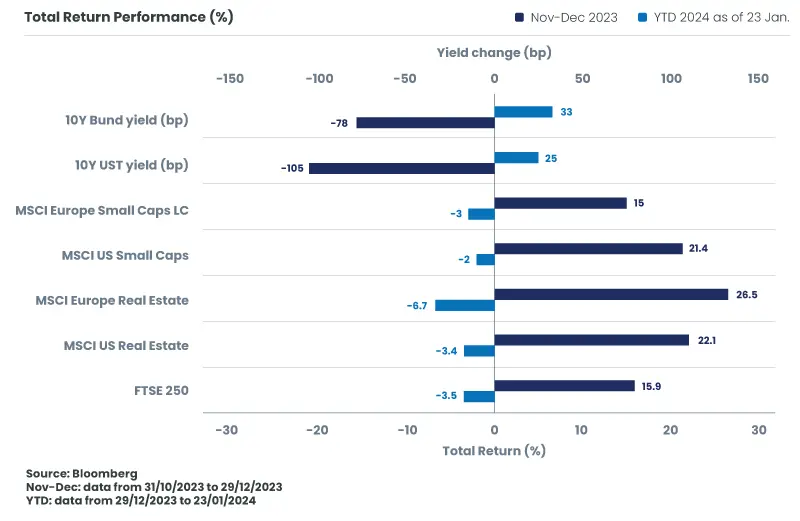

Following the strong rebound in financial markets in November and December of 2023, the assets most closely correlated with interest rates have partially retraced their exceptional end-of-year performance. Some of the possible excesses seem to have been corrected, with US rates thus returning to the level reached at the December 13 FOMC meeting.

Since the beginning of 2024, the market has once again been driven by large caps in the technology sector, once again resulting in the S&P500 outperforming the S&P equal-weighted index[1]. Conversely, the smallest caps and sectors closely linked to interest rates, such as real estate, posted negative returns.

A lot of short-term noise, but relatively contained volatility

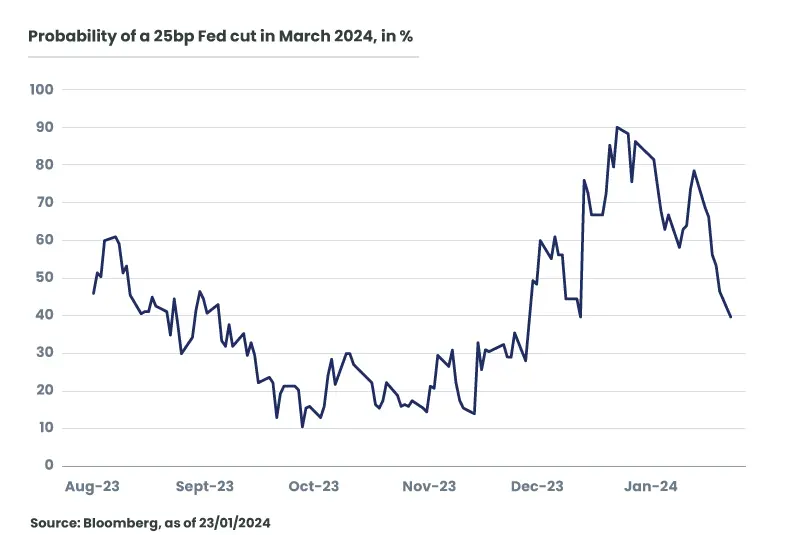

Nevertheless, markets are likely to remain highly dependent on expectations of rate cuts by central banks, particularly the Fed, which is expected to make the opening move in this new monetary cycle. Any release of economic indicators with a possible impact on the inflation trajectory is closely scrutinized. Fed rate cut expectations are hovering between five and six cuts this year, well above the Fed's ‘dots plots’ and above what we consider necessary in our ‘soft landing’ scenario. Similarly, the date of the first possible rate cut is a sensitive issue. The probability of a first drop in March 2024 is evolving rapidly. Today it is around 40%, lower than at the end of 2023.

The evolution of these expectations and anticipations is one of the main factors explaining market movements since the beginning of the year, and should continue to produce noise, without giving a clear vision or direction for 2024.

Can we use history as a guide to anticipate the direction of the markets in 2024?

One of the Convictions we have today is that the rate hike cycle ended last year, and that the next decision by the Fed and ECB should be a rate cut.

Eight times out of ten, the Fed's ten rate cuts since 1984 have been followed by positive equity market performance over the subsequent 12 months. This holds for all of cases where the economy has not fallen into recession. We are emerging from a phase of ‘normalization’ in which the correction in financial markets (equities and bonds) was triggered by the rate hike cycle. In cases of ‘normalization’, equity markets have historically (three occurrences since 1984) been positive before the first rate cut and positive afterwards. On the bond side, a large part of the rate cut typically takes place before the first effective central bank cut, and continues less markedly afterwards.

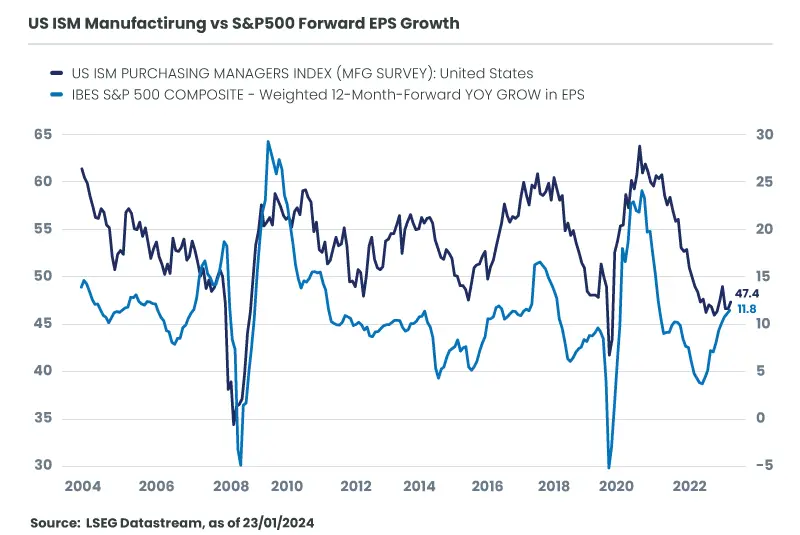

If the USA succeeds in soft-landing its economy, these historical observations seem rather constructive for stocks and bonds in 2024. Nonetheless, we remain a little more defensive for the time being, considering that this soft landing scenario has now been largely incorporated. The market expects 160 bp of Fed rate cuts, corresponding to an ISM rebound to 57/58. Similarly, the rise in profits expected in 2024 (just over 10% in the US) also corresponds to a rebound in the ISM to around 55.

As a result, we are likely to see a slightly longer phase of digestion in the financial markets as we await evidence of this soft landing for the economy and a possible rebound in leading indicators (without a resurgence in inflation). We will therefore need to be a little patient, or seize the opportunity of a better entry point into the equity and bond markets to get back on a positive track for 2024.

[1] Source: Bloomberg, as of 23/01/2024

SP500: +1.99%

SP500 equal-weighted: -0.71%