Monthly Coffee Break, Asset Allocation

Irresistible

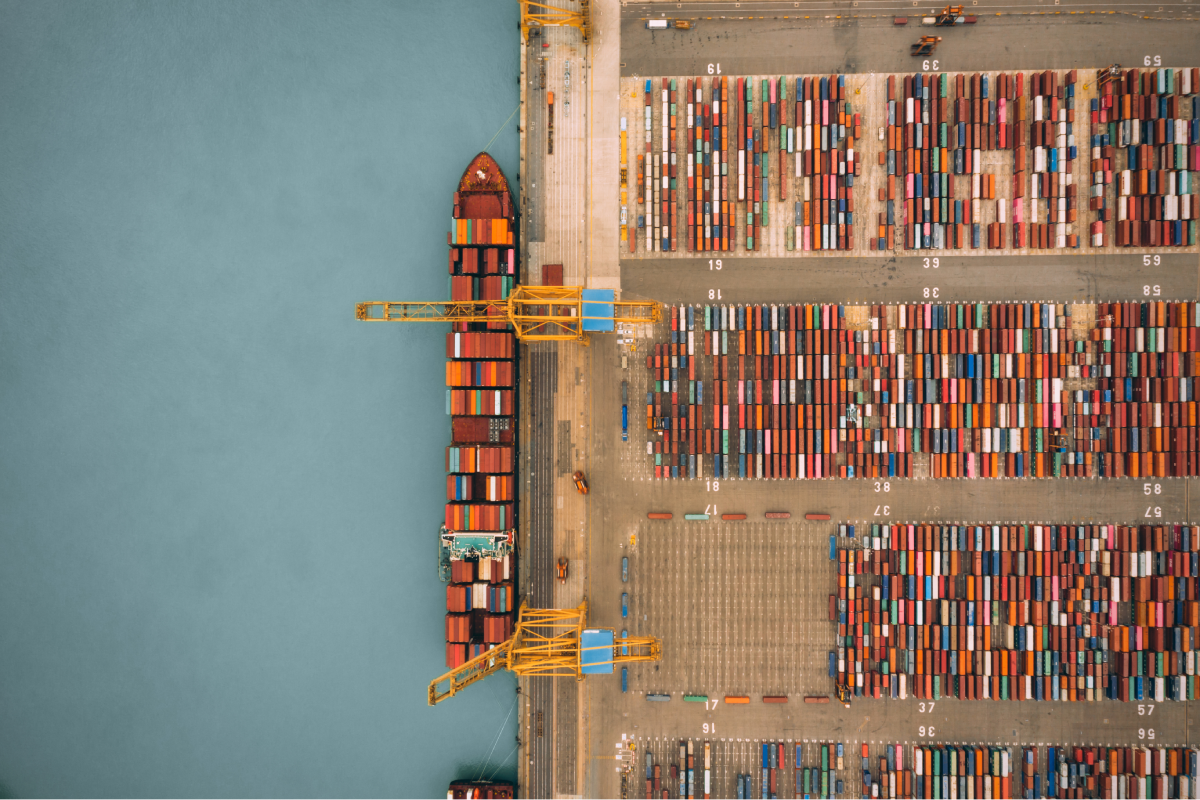

An irresistible momentum is shaping global markets, as investors face a paradox of rising risk perception alongside rallying assets. Economic data releases, trade tariffs and geopolitical signals remain noisy – yet financial markets continue to advance.