Today, ageing populations and rising chronic-care needs, coupled with a rapid cycle of technological innovation, are expanding the sector’s opportunity set - even as valuations sit near multi-decade relative lows. That combination of durable demand and mispriced growth creates a rare entry point for long-term investors.

Why invest in healthcare now?

From mispricing to momentum

Ken Van Weyenberg, Head of Head of Client Portfolio Management Fundamental Equity, explains why healthcare remains a long-term growth opportunity.

Under-owned, under-valued, underappreciated

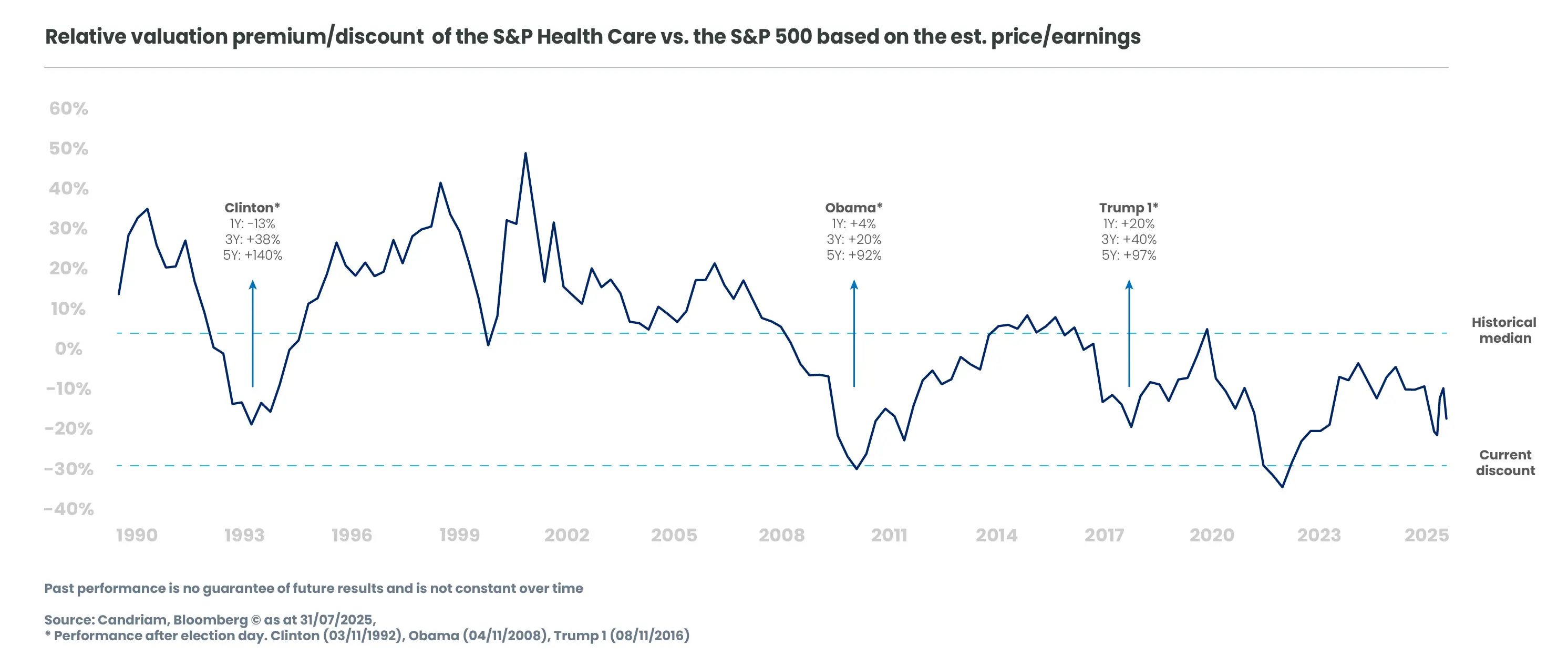

After a multi-year reset, the healthcare sector is now trading near 35-year lows in relative valuations, while its weight in the S&P 500 has fallen to a 24-year low.[1] This creates meaningful room for sustained momentum in a sector that remains heavily under-owned.

Four drivers behind the shift

- Valuation reset — After a multi-year derating, healthcare trades at a rare P/E discount and lower index weight, leaving room for mean reversion.

- Policy clarity — A more workable pricing framework and steady regulatory throughput reduce headline risk and should refocus investor attention on fundamentals.

- M&A strength — Active strategic corporate buyers are consolidating pipelines and platforms, creating share price catalysts alongside organic growth.

- Easing rates — A lower cost of capital supports the valuation of established companies with long-term cash flow visibility, aids refinancing for young product-based companies, and encourages continued industry investment in innovation.

[1] As of 1 November, 2025

Where we focus: Two strategies, one theme

Biotechnology, where innovation meets maturity

We focus on the new wave of scalable biotech platforms. With many mid-sized companies now growing into larger-sized firms, they are at the point where robust science meets disciplined balance sheets and growing market access. This provides multiple paths to value through de-risked pipelines, partnerships, and selective M&A.

Discover the Candriam Equities L Biotechnology fund

Oncology, investing in the ecosystem of life-saving science

Our oncology approach spans a full ecosystem — established pharma, high-conviction biotech, and life-science tools and services. These are the “picks & shovels” behind discovery, positioned to benefit from steady regulatory momentum and sustained research spend across therapies and technologies.

Our Commitment

Candriam’s thematic strategies seek to combine financial performance with positive societal impact.

By investing in healthcare innovation, we aim to contribute to a better life for patients, while seeking to offer sustainable value for investors.

;

;

”Candriam has been investing in the Healthcare sector for over 20 years. We owe this success to our combined clinical and financial analysis, and most importantly, to the share experience and complimentary expertise of the women and men who make up the Investment Management Team

Why is healthcare investing attractive today?

Because the sector combines resilient demand, innovation, and attractive valuations — offering a defensive yet growth-oriented profile.

What makes Candriam’s approach unique?

We combine deep sector expertise with ESG integration and a focus on companies that drive measurable health impact.

Which themes are central to Candriam’s healthcare strategy?

Biotechnology, oncology, life sciences tools, and digital health innovation.

Expert Insights

Gain insights into how powerful secular trends — from ageing demographics to breakthrough therapies — are creating lasting opportunities for investors.