Rising rates, changing regulations, whipsawing and rapidly-reversing input costs – Investments in clean energies have both never been as high and never been as challenged as in 2023.

While the markets seem to be throwing the whole sector out with the inflationary bathwater, it’s time to separate the structural shifts from hiccups that inevitably arise when industries scale up … and which are likely to ease.

The transition continues

Despite wars, supply disruptions, inflation, and geopolitical uncertainty, clean energy remains at the top of the agenda for most governments -- just consider the number of participants in the recent COP 28 in Dubai. Not only does climate change remain the major global challenge of this century, but the need for decisive climate action is only going to grow in importance as the window of action closes in on us.

We have not (yet) seen a slowdown in the pace of the energy transition. To the contrary, the International Energy Agency -- IEA -- forecasts another record year, with 2023 renewable capacity new additions estimated to accelerate to 440GW, up more than 100GW from the 2022 additions. This is despite increasing costs in most areas. The electrification of passenger vehicles is occurring at a rate which the IEA describes as close to that required by its very ambitious Net Zero scenario. One out of five cars sold in 2022 was electric, versus only one out of 25 a mere two years previously.[1]

Yet financial markets have not been very supportive of clean technologies in 2023, and particularly not for renewables. Following several years of strong performance driven by strong regulatory support, the sector now suffers from the macro, geopolitical, and sector-specific headwinds.

Will the clean energy space deliver on the Paris-aligned global goal of tripling renewable capacities by 2030? Simply put, it will depend on governments’ ability to sustain long-term investment incentives in the changing economic environment.

Profitability? It’s complicated.

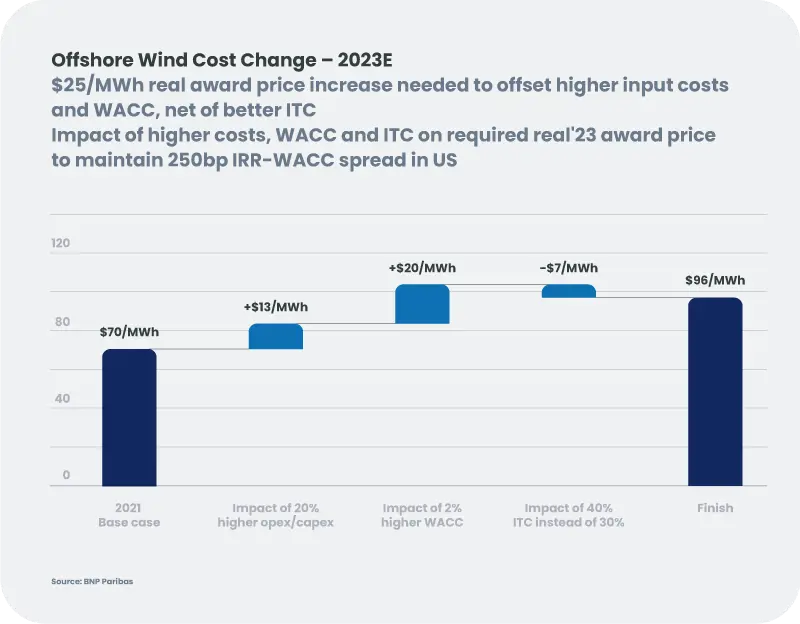

After several years of improvement, the economics for renewables deteriorated for most of 2023. The Levelized Cost of Energy (LCOE)[2] for the broadly-defined clean energy sector increased around 15% to 25% from 2020 to 2023,[3] even including some segments where costs actually decreased. New fossil energy builds remain a much higher-cost choice, and themselves suffered input cost pressure from gas and coal in 2022.

The profitability of the renewable energy sector is heterogenous, both by technology and by region – more politics than geography. But higher LCOE does not always mean lower profitability, as higher power prices have benefitted the installed base of existing renewable generating assets.[4]

Rising rates are decidedly a secular change. Yet despite the sharp rise in interest rates and the high capital expenditure in this industry, the cost of capital was only part of the explanation for the 2023 deterioration of renewable economics. The LCOE had deteriorated even before the hike in interest rates, due to rising input costs. (For clues, examine a steel price chart.) Whether you believe general inflation is a blip or a secular trend, the dramatic supply disruptions and squeeze of the last two years is hopefully not the new normal for future input cost increases. Already input costs in the fourth quarter of 2023 are easing from the sharp pain of 2022 and early 2023.

Renewables remain competitive. But not all clean technologies are equal

Despite the rise in rates and the whiplash of input costs over the last several quarters, renewables remain very competitive on an LCOE basis, and we expect this to continue through at least 2030 both from technological improvements and supporting regulation such as the Inflation Reduction Act in the US.

However, the various technologies, and many parts of the renewables value chain, have shown differing levels resiliency to changing economic conditions. Technological positioning, level of integration, and size are all key.

Look behind the averages. As with any maturing industry, there are leaders and laggards. Some clean energy solutions are ramping up a bit more swiftly than others, such as solar PV (photovoltaics) and EV (electric vehicles), because of technology and cost reductions. Among the weak spots are the insufficient investment in energy grids, and offshore wind projects. Without re-designed grids, some renewable wind and solar energy is ‘curtailed’, that is, simply dumped because it cannot reach the end-users. And let’s not forget that half the growth is coming from China – so look behind the ‘headline’ growth figures.

The overall growth potential is strong. Doubling efficiency and tripling renewables are necessary preconditions for the 1.5°C Paris-aligned scenario. Much of the valuation debate, and questions, centre on the order pipeline and which technologies will predominate. But as with any new technology – from railroads to dot-coms – high growth prospects can lead to overinvestment and overcapacity. Investors should analyse these technologies and business models with in-depth traditional analysis and emphasize ongoing competitive advantages, profitability, predictable regulatory environments, and financing conditions. Projects have mostly up-front cash flow, but some companies and equities within the sector face an almost constant need to raise capital to sustain the expected growth embedded in valuations – a problem if the sector falls out of favour.

Regulation remains the major secular trend

Today, most renewables projects more than cover their cost of capital.[5] But with all the factors involved, the picture can change like a kaleidoscope. Regulation must be predictable if private-sector investment is to succeed.

Europe and the US are holding elections in 2024 in which prominent candidates are fossil fuel supporters. Europe could also adopt a less climate-focused tone. Geopolitics, too, will play a decisive role. How will Europe and the US respond to China’s prominence in clean tech supply chains? How will the source-in-the-US provisions of the IRA affect the marketplace? Will Europe double down on ‘green protectionism’?

The goal of the authorities is to decarbonize our economies and to ensure energy supply security at an affordable cost for citizens. This energy ‘trilemma’ is all the more daunting when energy prices are high, as evidenced by recent government dithering over unsuccessful renewables auctions. The complexity will increase as use of renewables increases and potentially clashes with the current centralised “merit order-based” functioning of European power markets.

Renewable energies are an accelerating secular trend. The pace of the acceleration, as well as the resilience and profitability of the renewables, depends on leadership. Governments must decisively commit to the energy transition. They must simultaneously adapt to the more difficult macroeconomic environment and the intensifying climate urgency. Geopolitics is likely to become a key new factor in this structural energy ‘trilemma’, as clean tech becomes a new arena for trade strategies and a show of power.

This communication is provided for information purposes only, it does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction, except where expressly agreed. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.

[1] International Energy Agency, World Energy Outlook 2023, October 2023.

[2] To put the generation technologies on a comparable basis, we look to Levelized Cost of Energy (LCOE) – in which, of course, renewable energy has upfront capital costs with varying levels of maintenance, while fossil fuel energy requires upfront capital and ongoing annual fuel costs.

[3] International Energy Agency, Renewable Energy Market Update, June 2023.

[4] The recent cost comparison between renewable and thermal electricity generation is virtually useless for long-term forecasting, as the 2022 energy crisis in Europe caused thermal generation costs to soar in 2022 and drop in 2023, but thermal generation costs remain above long-term averages.

[5] For example, according to Bernstein, based on recent auction prices, the projected internal rate of return (IRR) for all onshore wind and solar projects easily covers their weighted average cost of capital (WACC), except for the November 2022 Spanish onshore wind auction, which took place at the peak of steel prices.

The IEA is optimistic on the growth of renewable, in part because there is significant existing manufacturing capability in solar. For example, some Chinese solar manufacturers are believed to operating at only 25% of capacity.