For centuries we have relied on a consumption model that made the implicit assumption that natural resources are infinite: the linear model, or ‘Take, Make, Use, Waste’. As a result, we are reaching our planet’s boundaries as our economy uses, in just the first seven months of the year, as much of our global natural resources as can be replenished in a full year. This model is clearly not viable over the long term: at this pace and at the current level of technology, it is estimated that by 2050, 3 planets will be needed to meet the needs of humanity.

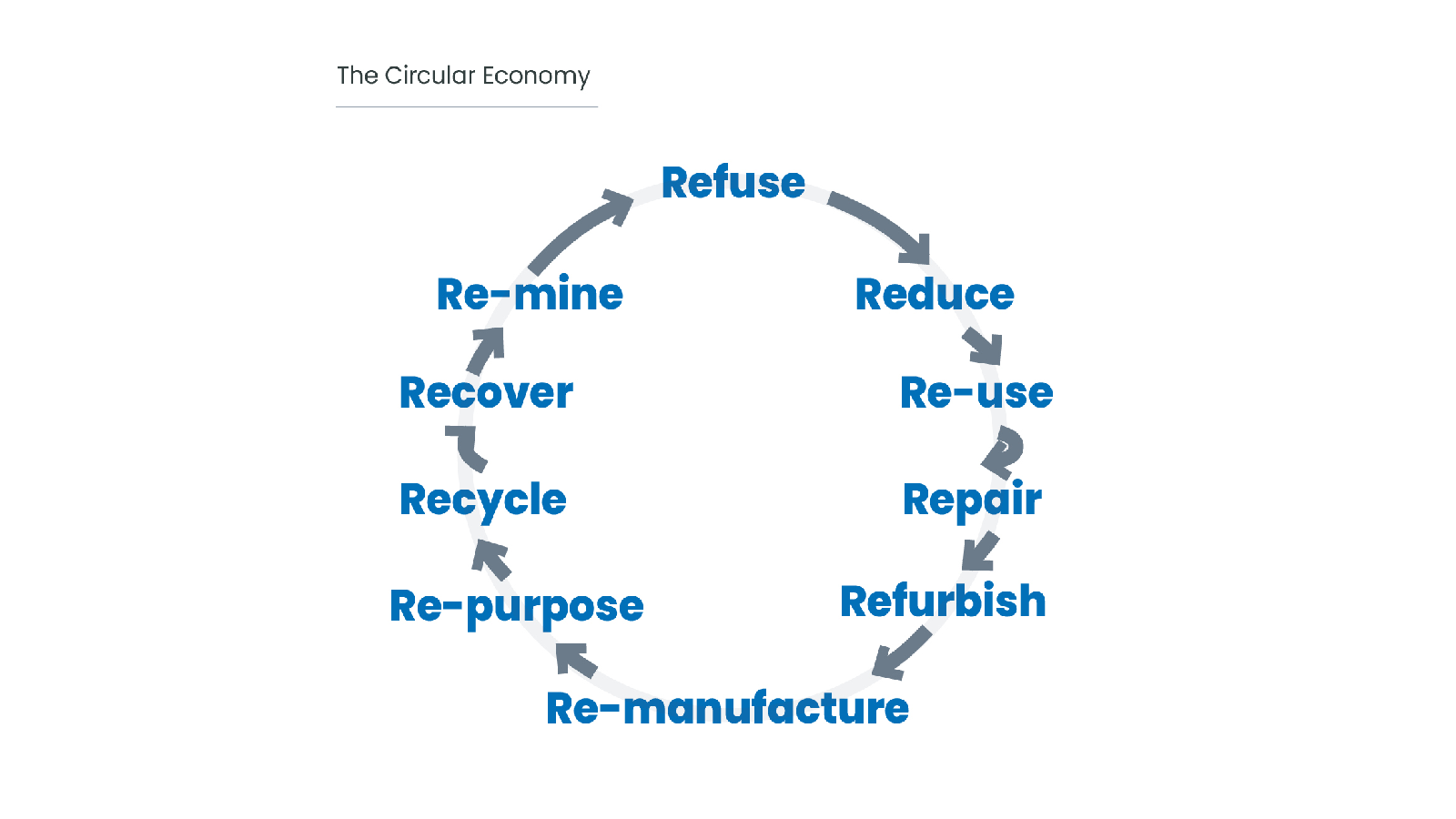

Instead, we should collectively impose a new paradigm, a more circular model, that aims to regenerate goods rather than dispose of them: this means reusing, recycling, refurbishing and sharing.

How to invest in a more circular future? Backed by 25 years of ESG expertise combined with 25 years of thematic investing, our conviction is that companies able to provide real circular solutions will produce added value for shareholders over the long term.

David Czupryna, and Bastien Dublanc, Senior Fund Managers, explain how an investment strategy on the theme of the circular economy can benefit from a sizeable investment opportunity while contributing to a more sustainable economy