Last week in a nutshell

- In the US, seasonal factors have helped consumer price inflation to fall from again one full point, from 4.0% in May to 3.0% in June.

- In the UK, wages advanced at 7.3% YoY while the unemployment rate rose to 4.0%, the highest level since January 2022.

- In the Eurozone, investors took note of a poor outlook as per the ZEW survey, and a worse-than-anticipated 2.2% decline in industrial production from a year ago.

- The NATO summit confirmed that Ukraine was closer to the alliance than ever before, pledging advanced military equipment.

What’s next?

- In the Euro area, consumer confidence for the whole region and business confidence for France will give insights on the start of Q3.

- Retail sales, industrial production and housing data will be the focus in the US, just one week before the next FOMC meeting.

- On the geopolitical front, the Black Sea Grain initiative will expire and could jeopardise exports of Ukrainian agricultural products.

- General elections will take place in Spain, opposing the incumbent PM Pedro Sánchez to Alberto Nunez Feijóo. PM Sanchez called the early elections after his Socialist party took a serious battering in local and regional elections last May.

Investment convictions

Core scenario

- Our main scenario incorporates an ongoing taming of inflation by central banks and an accompanying slowing growth, both in the US and the euro zone. The magnitude of the market downside risk will depend on the upcoming economic slowdown. Overall, it should translate into a lateral move of financial markets.

- During the second half of 2023, we expect a less supportive market environment than in H1 when financial markets were resilient, reflecting a better growth/inflation mix than expected by consensus at the start of the year.

- In the euro zone, more specifically, the expected next stage of lower economic growth and increasing cyclical worries have already started as deterioration in economic data has been widespread in recent weeks.

- Emerging markets should see growth accelerating faster than developed countries over the coming year, while their central banks’ monetary policy could shift gear towards policy easing.

Risks

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions. Financial stability risks could return.

- After the dramatic drop in growth surprises in all major regions outside of the US, the global outlook could become less supportive.

- Markets appear to have a second thought on the “terminal rate” of several central banks in developed markets, as their restrictive job is likely not finished yet. This repricing of upcoming expected monetary policy decisions implies that the outlook for growth is tilted to the downside.

Cross asset strategy

- We have a more cautious equities allocation than during the first half of the year, considering the limited upside potential. At current levels, a positive economic outcome with a softish landing seems already priced in for equities. We focus on harvesting the carry and are long duration.

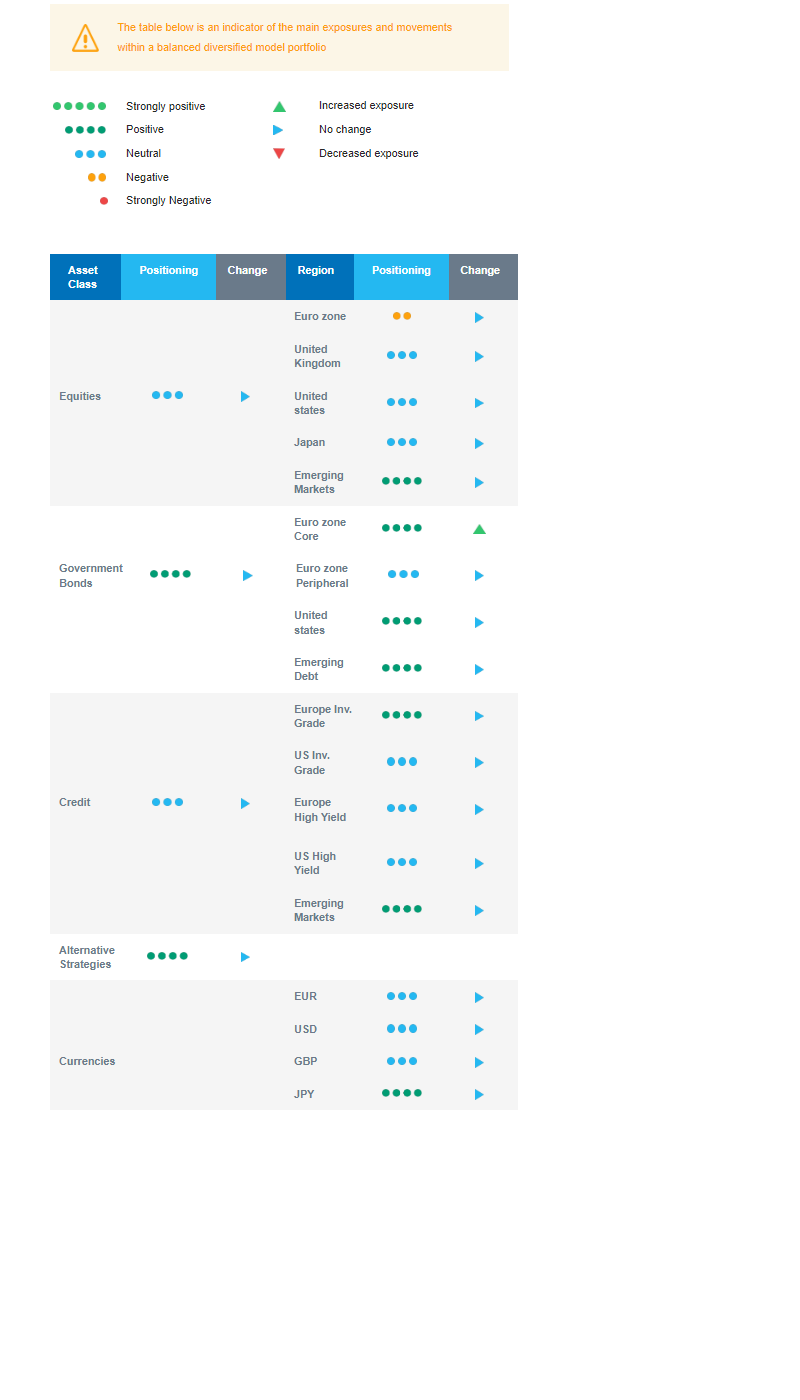

- We have the following investment convictions:

- Our positioning on equities is somewhat more defensive and we are underweight euro zone equities as pricing has become too complacent in our view given the restrictive monetary and financial backdrop.

- We believe in the upside potential of Emerging markets, which should benefit from improving economic and monetary cycles vs developed markets, while valuations remain attractive.

- We prefer defensive over cyclical names, such as Health Care and Consumer Staples, as cyclicals are already pricing a strong improvement and economic recovery. In addition, defensive sectors have better pricing power while further margin expansion is unlikely.

- Longer-term, we favour investment themes linked to the energy transition due to a growing interest in Climate and Circular Economy-linked sectors. We keep Technology in our long-term convictions as we expect Automation and Robotisation to continue their recovery from 2022, albeit at a reduced pace compared to the first half of the year.

- In the fixed income allocation, we have a long duration positioning:

- We are positive on US and European government bonds. We do not expect the Bank of England to go as far as markets are pricing now; and on the other side, we don’t expect a Fed easing as early as markets do.

- We are overweight investment grade credit: A strong conviction on European issuers since the start of 2023 as carry-to volatility is attractive.

- We are more prudent on high yield bonds as tightening credit standards should act as headwind and the buffer for rising defaults has decreased in recent months.

- We are buyers of Emerging bonds, which continue to offer the most attractive carry. Dovish central banks should become a support as soon as H2 2023. Investor positioning is still light post-2022 outflows. And the USD is not expected to strengthen, which represents a tailwind for local currency debt.

- We have exposure to some commodities, including gold and commodity-related currencies.

- Further to the currency strategy, we hold a long position in the Japanese Yen (vs. the US dollar), a good hedge in a potential risk-off environment.

- On a medium-term horizon, we expect Alternative investments to perform well.

Our Positioning

Our convictions translate into an overweight bonds vs equities at the start of the second half of the year. Within fixed income, we identified European Investment Grade bonds as attractive and remain confident in the asset class. More recently, we gradually added US and European sovereigns to a build a long duration. Within equities, we see value in a barbell approach: overweight Emerging markets mitigated by an underweight on euro zone. Further, we acknowledge a supportive momentum and a US goldilocks episode: more positive surprises on economic growth and less negative surprises on inflation. However, our exposure to the US market comes with a derivative protective strategy as sentiment, positioning, and market psychology are stretched. Markets are increasingly reflecting our soft-landing outlook, limiting the performance potential going forward. Our “late cycle” asset allocation strategy is also axed around defensive sectors over cyclicals.