Historically, diversified portfolios have been relying on the ability of government bonds to mitigate the impact of equity corrections.

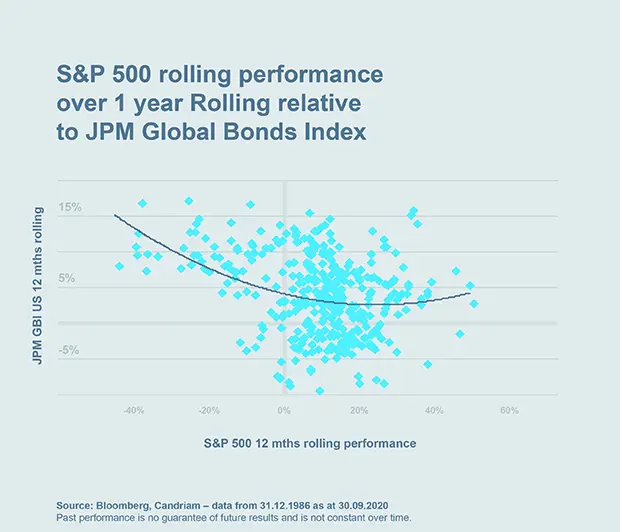

As we can see, government bonds historically provided a positive carry (coupon plus the price appreciation of your bond) during equity bull markets (right part of chart 1) while delivering strong performance during equity corrections (left part of chart 1). In the times of equity market stress, investors tend to reallocate their assets from equities to bonds, which typically translates to attractive price appreciation for fixed income during such periods. This can be seen in the left part of the chart, which shows that reinvesting in fixed income would mitigate the level of risk in your portfolio during the periods when the equity market suffered declines.

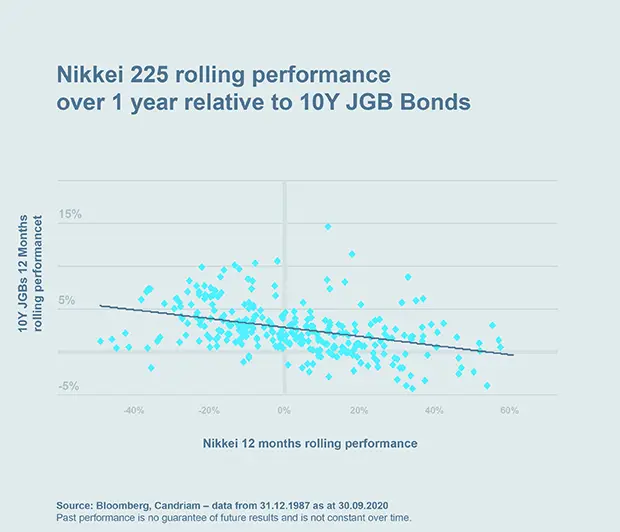

Today, with interest rates close to zero or even negative, how likely is it that government bonds will continue to provide this important risk mitigation function going forward?.Japan can be a good historical example as it experienced long periods of very low interest rates several times in the past. The right part of Chart 2 shows that the coupon is low or close to zero, given that nominal interest rates in Japan are close to zero. On the left side of the chart, we can see a reduced hedging power of Japanese government bonds. In other words, despite very low yields, Japanese government bonds have retained a part of their risk mitigating properties. This ability was partly supported by major central banks, which during the recent crises have been initiating bond purchasing programmes.

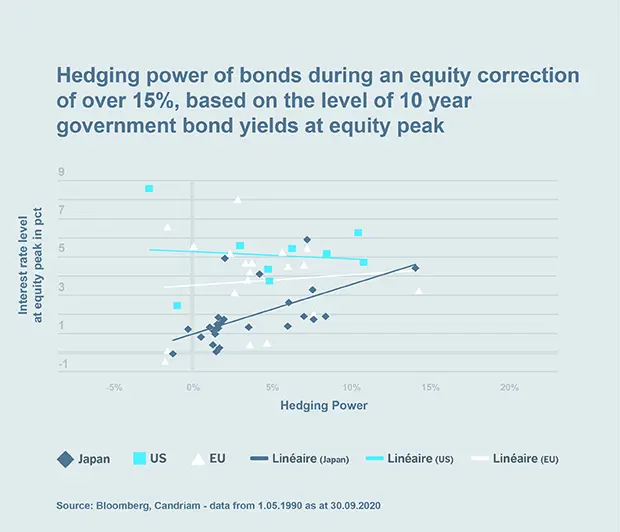

However, as shown in Chart 3, government bonds’ risk mitigation powers are reduced when interest rates fall below 2%. In the chart, every point of equity peak just before a market correction of over 15% is indicated by a spot of a different shape and colour – for Japanese, US and Eurozone equities. The vertical axis shows the 10 Year local government bond yield. The chart illustrates that US and Eurozone government bonds have been providing better risk mitigation abilities given that at equity peak government bonds yields where higher that those of their Japanese peers.

Based on the charts we examined, we can conclude that government bonds can still be used to mitigate risks within diversified portfolios but that they do not fill this function as effectively as in the past. However, there are other approaches available that can also be used for risk mitigation.

Solution 1: Flexible strategy

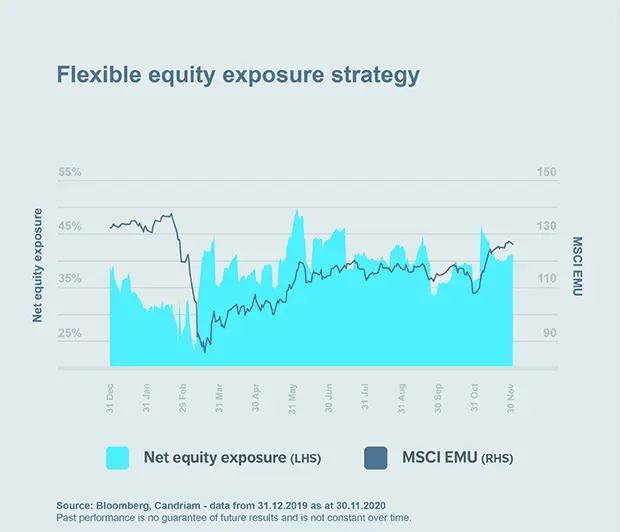

Allocating capital to flexible funds can be a solution for risk mitigation as fund manager can dynamically adjust equity exposure or/and protect portfolio with optional strategies in a timely manner.

Chart 4 shows the performance of the MSCI™ EMU Index (from 31.12.2019 to 30.11.2020) and how being flexible has allowed to reduce the exposure to Eurozone equities (by over a third) during the COVID-19 market shock and to rebuild it as the market recovered later in 2020.

Solution 2: Risk mitigation strategies

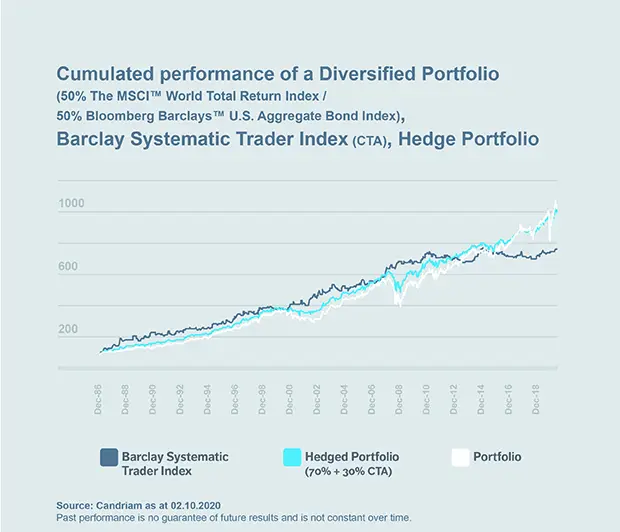

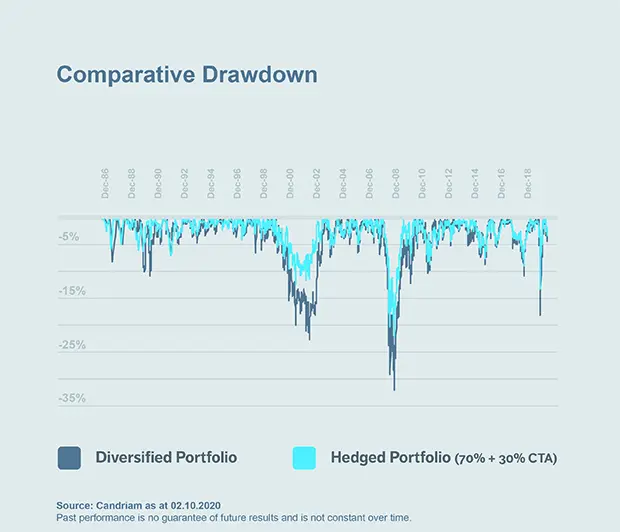

In addition of providing uncorrelated performance, risk mitigating strategies such as CTA (Commodity Trading Advisor), Global Macro and Risk Premia can have the ability to deliver Alpha (i.e. outperformance) during the times of market stress.

Chart 5 shows how adding an allocation to CTA wich focuses on following market trends can reduce drawdown and volatility of a diversified portfolio.

Taking a CTA strategy as a separate example, Chart 6 shows how an allocation to this instrument can help mitigate market drawdowns.

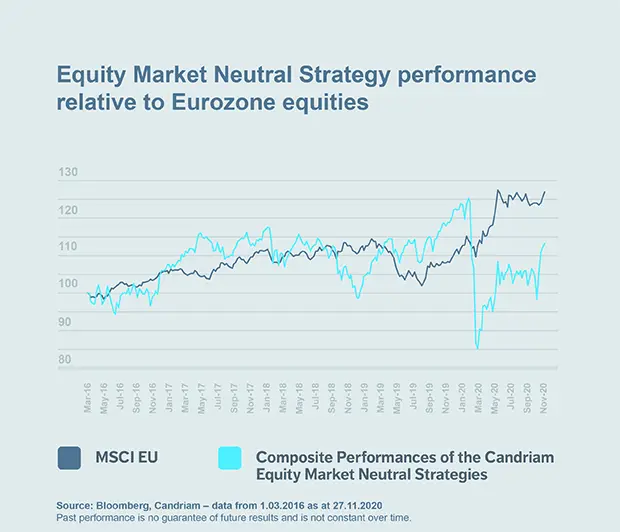

Solution 3: True diversifying Strategies: an Equity Market Neutral approach

While the previous two options typically have some correlation to the wider market, equity market neutral strategies aim to neutralise portfolio exposure to the wider market and deliver uncorrelated returns. This is another option to effectively mitigate risk in low interest rate environment. Chart 7 presents the example of how our market neutral strategies performed relative to Eurozone equities since 2016. For reasons of simplification, the data presented in Chart 7 is that of composites managed by Candriam’s investment teams.

In a low interest rate market environment, government bonds can still provide a degree of risk mitigation for diversified portfolios, partly due to the ongoing quantitative easing by central banks during the COVID-19 crisis. However, this mitigation is less effective than in the past.

Integrating other strategies listed below into a diversified portfolio, to complement the added value of your bond manager, could reduce the overall risk of the portfolio.

- either actively monitore the equity exposure through the use of derivatives,

- or have developed tools to analyse and detect market movements in order to position long in the event of an uptrend or short when a downtrend is identified,

- or are supported by tools to detect market inefficiencies in order to set up combinations of complementary arbitrage strategies.

The performance of investments in equities, bonds and alternative strategies are not guaranteed and there is a risk of capital loss.

The risk profile of strategies depends on different underlying risks among the followings: equity risk, interest rate risk, credit risk, foreign exchange risk, risk arising from discretionary management, risk associated with derivative financial instruments, volatility risk.