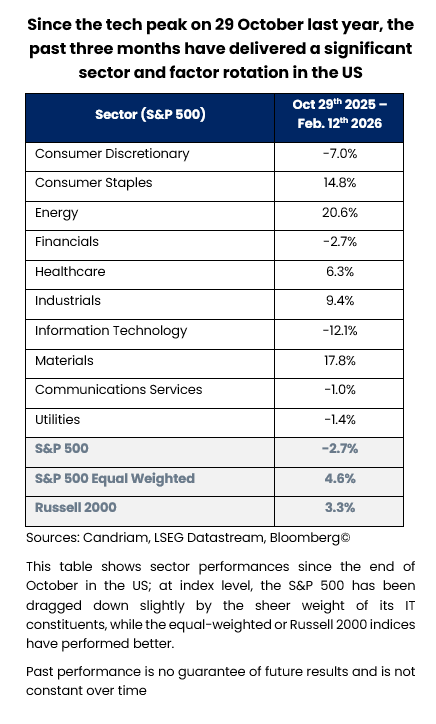

The major US equity indices have gone nowhere. Since the late-October peak in Technology, the S&P 500 has moved sideways, masking what has in fact been a decisive rotation. Energy has rallied more than 20%, Materials close to 20%, and Consumer Staples well into double digits. Technology, by contrast, is down roughly 11% over the same period. The equal-weighted index has quietly advanced and closed at fresh highs. More sectors are rising than falling. The headline tells a story of stasis; beneath the surface, tensions are rising and capital is being redistributed.

What we are witnessing is not a broad market pause. It is a re-pricing of business models. Artificial intelligence is no longer simply a growth narrative; it has become a sorting mechanism. The market is distinguishing between those positioned at the infrastructure layer of the AI stack and those whose margins and pricing power may be structurally challenged by it.

AI: from concentration to polarisation

For much of the past year, AI has been synonymous with mega-cap concentration. That phase is now evolving. Investment in AI infrastructure – semiconductors, memory, data-centre hardware, networking, power equipment – remains robust. Hyperscalers continue to deploy capital aggressively. Hardware and component suppliers are still seeing upward earnings revisions. Capital intensity and return on investment have returned to centre stage.

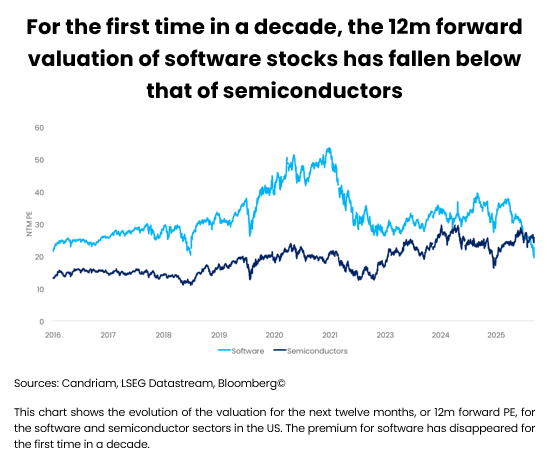

By contrast, parts of the software and Software-as-a-Service (SaaS) universe face a different dynamic. AI-enabled agents and automation tools threaten to compress pricing and erode traditional subscription models. Terminal growth assumptions are being revised. The issue is not demand collapse; it is competitive displacement. Dispersion within Technology has therefore widened materially – we remain constructive on semiconductors and hardware but are more circumspect on software.

This polarisation explains much of the recent rotation. Equal-weight indices outperform because breadth has improved as index heavyweights have corrected. Materials and segments of Energy benefit from the physical footprint of AI – power generation, grid upgrades, cooling, metal inputs.

Regionally, the implications are equally clear. Asia, particularly Korea and Taiwan, remains levered to the hardware and semiconductor cycle. The United States remains central to AI leadership, but no longer in a monolithic way. Europe, often dismissed as a laggard, gains indirectly via industrial supply chains and fiscal spending on infrastructure and defence. AI is not unwinding; it is maturing and dividing.

De-synchronisation: markets moving out of sync

The defining feature of this phase is de-synchronisation. Regions, sectors and currencies are no longer moving in lockstep. Equal-weight indices are diverging from cap-weighted benchmarks. Hardware is outperforming software. Asia’s semiconductor exposure is behaving differently from US platform names. Emerging-market currencies are strengthening even as US rates remain elevated.

As a result, our objective is not to maximise exposure to a single macro outcome, but to align with structural forces that persist across scenarios: AI infrastructure over software platforms, capital intensity over illusory margins, and carry over compression.

In the commodity complex, base metals are supported by converging forces: AI infrastructure, electrification, defence spending and broader capital renewal. Oil remains more exposed to supply dynamics and cyclical demand variability. Precious metals retain a strategic role in multi-asset portfolios, underpinned by declining real yields, reserve diversification and geopolitical risk.

Beyond the immediate consequences for equities and commodities, our FX positioning reflects these dynamics. We maintain a constructive stance on emerging-market currencies versus the US dollar. The relative preference for base metals over oil translates into a positive view on the Australian dollar against the Canadian dollar. A tactical long Japanese yen position provides diversification in an environment where uncertainty persists.

Geopolitical tensions – Ukraine, the Middle East, Iran and Venezuela – remain a structural feature of the environment. Elections across major economies add another layer of unpredictability. For investors, this reshapes opportunity rather than eliminating it; but it demands discipline within a clear framework.

Growth: stable, but secondary

Macro conditions remain supportive, but in the current context they are no longer the dominant driver of market leadership. US growth continues to rest on private domestic demand, with investment – especially AI-related capex – playing a larger role than consumption. Manufacturing has stabilised and even rebounded to a four-year high in January. Recession risks remain contained. Yet this is not a broad re-acceleration; it is an environment characterised by narrower, more selective surprises.

The eurozone presents a modest but improving picture. Domestic demand is gradually responding to lower mortgage rates and easing inflation. Fiscal policy – most visibly in Germany – should provide incremental support, and implementation, though gradual, has now begun: industrial orders for November and December 2025 increased sharply, at a pace not seen since Reunification in 1990. Consensus expectations had been sufficiently low that even moderate data have surprised positively. This is a stabilisation of growth, not a boom.

China remains structurally constrained. Policy support is present, but property adjustment, subdued corporate incentives and persistent deflationary forces continue to weigh on internal momentum. External trade cannot fully compensate in a world defined by strategic rivalry. The result is asymmetry: stabilisation without a clear engine of acceleration.

Global growth, in short, is not deteriorating. It is simply not decisive for investors at this stage. Sectoral and thematic dynamics are doing the heavier lifting.

No inflation debate, but policy optionality

Disinflation has progressed across developed economies. The debate has shifted from price pressures to the limits of monetary easing. In the United States, inflation is converging towards target, supported by moderating wages and lower energy prices. Further policy easing is expected, but the path is contested – not because inflation credibility is in doubt, but because institutional credibility has entered the conversation.

Tensions between the administration and the Federal Reserve, alongside an upcoming change of Chair from Jerome Powell to Kevin Warsh, have reintroduced central-bank independence as a market variable. Investors are not pricing a renewed inflation shock. They are pricing higher term premia. Long-dated yields remain elevated – though below recent highs – even as policy rates are expected to fall, reflecting fiscal dominance concerns and political uncertainty.

In the eurozone, the ECB has signalled confidence in its policy stance. Inflation is near target and core pressures are easing. A prolonged pause remains our base case. Monetary policy is neither a tailwind nor a headwind. Japan stands apart, with more entrenched inflation and gradual normalisation underway following the landslide parliamentary victory of Sanae Takaichi.

Government bonds continue to serve as diversification tools in our portfolios, but they are no longer a simple duration call. Returns depend increasingly on fiscal credibility and political stability, not solely on inflation and growth trajectories. Accordingly, we maintain a slight long duration bias via German Bunds.

Credit and EM: carry in a compressed world

Credit markets reflect a different tension. Spreads are tight, risk appetite remains elevated, and compression has largely run its course. In developed markets, return potential lies primarily in carry rather than further spread tightening. Selective capital-structure opportunities – such as within bank subordinated instruments – offer relative value, but the margin for error is thinner than a year ago.

Emerging-market debt remains our strongest fixed-income conviction. The backdrop is constructive: a softer US dollar bias, ongoing central-bank easing across parts of the emerging universe, resilient commodity demand and improving fund flows. Compared with developed credit, EM debt still offers a more attractive balance of yield and fundamentals. This sleeve represents a carry allocation in a world where spreads are compressed.

The surface may appear calm. Beneath it, markets are rotating, repricing and reallocating capital. Understanding that redistribution and positioning accordingly is the task for the months ahead.

Candriam House View & Convictions

Legend

-

Strongly Positive

-

Positive

-

Neutral

-

Negative

- Strongly Negative

- No Change

- Decreased Exposure

- Increased Exposure

| Current view | Change | |

|---|---|---|

| Global Equities |

|

|

| United States |

|

|

| EMU |

|

|

| Europe ex-EMU |

|

|

| Japan |

|

|

| Emerging Markets |

|

|

| Bonds |

|

|

| Europe |

|

|

| Core Europe |

|

|

| Peripheral Europe |

|

|

| Europe Investment Grade |

|

|

| Europe High Yield |

|

|

| United States |

|

|

| United States |

|

|

| United States IG |

|

|

| United States HY |

|

|

| Emerging Markets |

|

|

| Government Debt HC |

|

|

| Government Debt LC |

|

|

| Currencies |

|

|

| EUR |

|

|

| USD |

|

|

| GBP |

|

|

| AUD/CAD/NOK |

|

|

| JPY |

|