Is your portfolio waterproof enough?

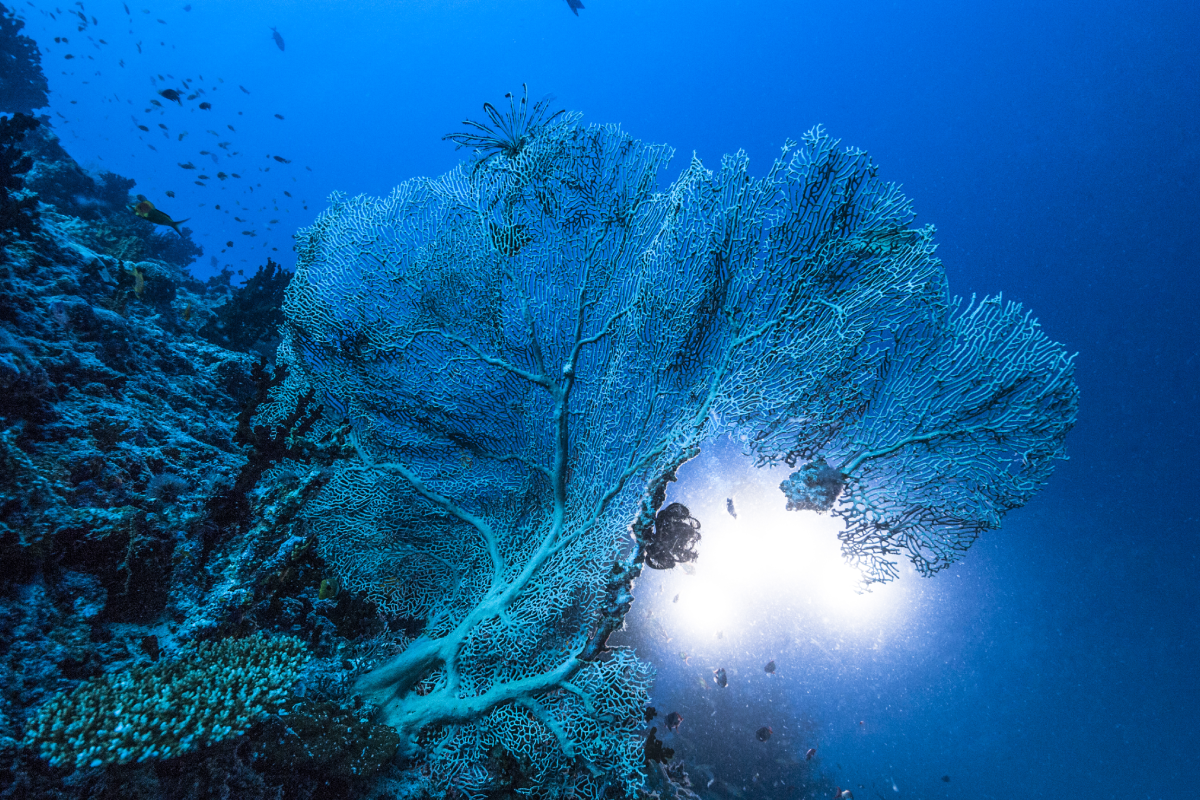

However water is a vital resource for businesses across many sectors, only one-third of companies carry assessments of their water-related risk exposure[1]. In the context of the water crisis that we are facing, it is crucial that companies shift to more water-resilient business models. Water-related risks will have increasing operational and financial impacts, some of which are already materializing.

Companies which integrate water into their long-term business and financial planning could unlock potential opportunities!

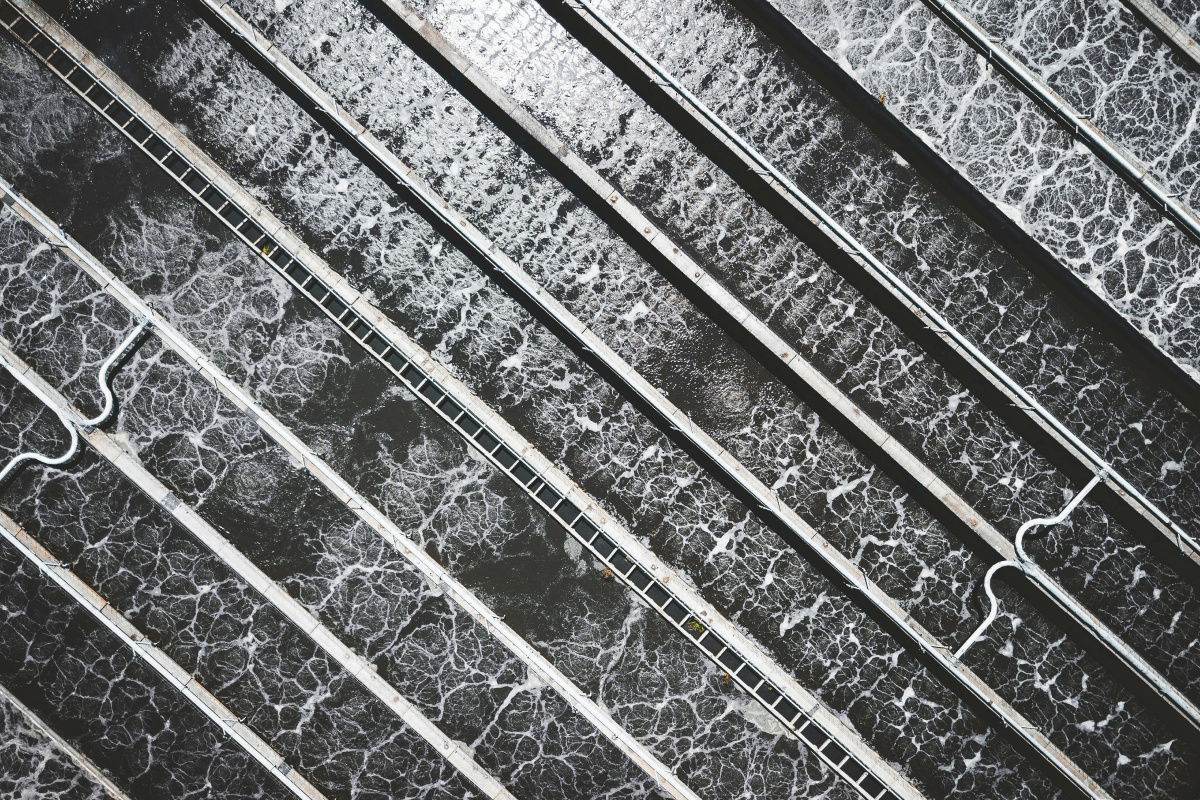

Assessing companies’ water-related risks is key… but how can it be done?

Both companies and investors have a lot to gain from properly assessing water risks. The former can develop strategies to address these risks, the latter can understand the potential impact of water risks on their investments.

Now the complexity starts.

Let’s start building our water resilience now!

;

;