;

;

At Candriam, we are active owners and debtholders. We exercise our rights when we believe action can enhance long-term value for our clients and ultimate beneficiaries. We prefer to be partners and accompany issuers in their journey as they continue to improve environmental, social, and governance transparency and practice.

Occasionally, we may feel the need to divest a holding. More often, we remain invested and engage for action, because we believe in the capacity of our investees to achieve sustainable performance. The middle-of-the-pack issuers are frequently the ones who are open to investor requests, open to learning new practices, and offer a reasonable chance of improvement. You can find more in the Foreword to this year’s report.

This means holding to our principles, but constantly adapting to an ever-changing world. For example, in 2023 we began to pre-declare a greater number of our voting intentions to provide transparency to stakeholders, and in some instances, as a means of escalation.

The core tenets of our voting policy are shareholder rights, equal treatment of shareholders, board accountability, and transparency and integrity of financial statements. We have held to these central principles since we established them in 2003. Yet, we have updated our public voting policy every year since then.

Our 2023 Annual Engagement and Voting Report describes four prevalent engagement themes– Governance, Climate, Biodiversity, and the ongoing need for Human Rights. With a history of active investing, we have long worked to establish consistency among our engagement efforts, voting decisions, ESG analysis, and investment strategies.

;

;

”Engagement for us includes investees, as well as entities which, through their competence or authority, are able to initiate or influence change

Strong Governance, the foundation of sustainability

Accurate and robust governance is a necessary condition outlining and implementing strong strategy and policies. It may come last in the acronym ESG, but we believe governance must be first for any investor wishing to generate financial returns and understand the risks of the issuers whose securities they hold, corporate or sovereign, equity or debt.

It therefore follows that Board composition is our most frequently-voted topic. Is the Board diverse? Does it include enough external representation to balance the company executives? And increasingly, has the company ‘Onboarded’ the necessary expertise for future change?

Governance is not limited to corporates. Both directly and via collaborative engagements, we are increasingly active with sovereign issuers.

Relentless on climate

In the most recent World Economic Forum annual global risks report,[1] two-thirds of the survey respondents ranked extreme weather as the risk most likely to present a material crisis on a global scale this year.

A long-term theme for us, but illustrative of the continual need to constantly adapt tactics. From zero in 2019, by 2021 there was an explosion in management-sponsored Say-on-Climate resolutions. These require reading the fine print. Are the reporting metrics relevant? Are they strong enough? The risk is that once a weak policy is established, it will be more difficult for owners to introduce and vote in a strong and relevant set of expectations. In 2023, we supported 71% of the resolutions put forth by managements, but supported less than 30% of the eleven climate resolutions proposed by managements.

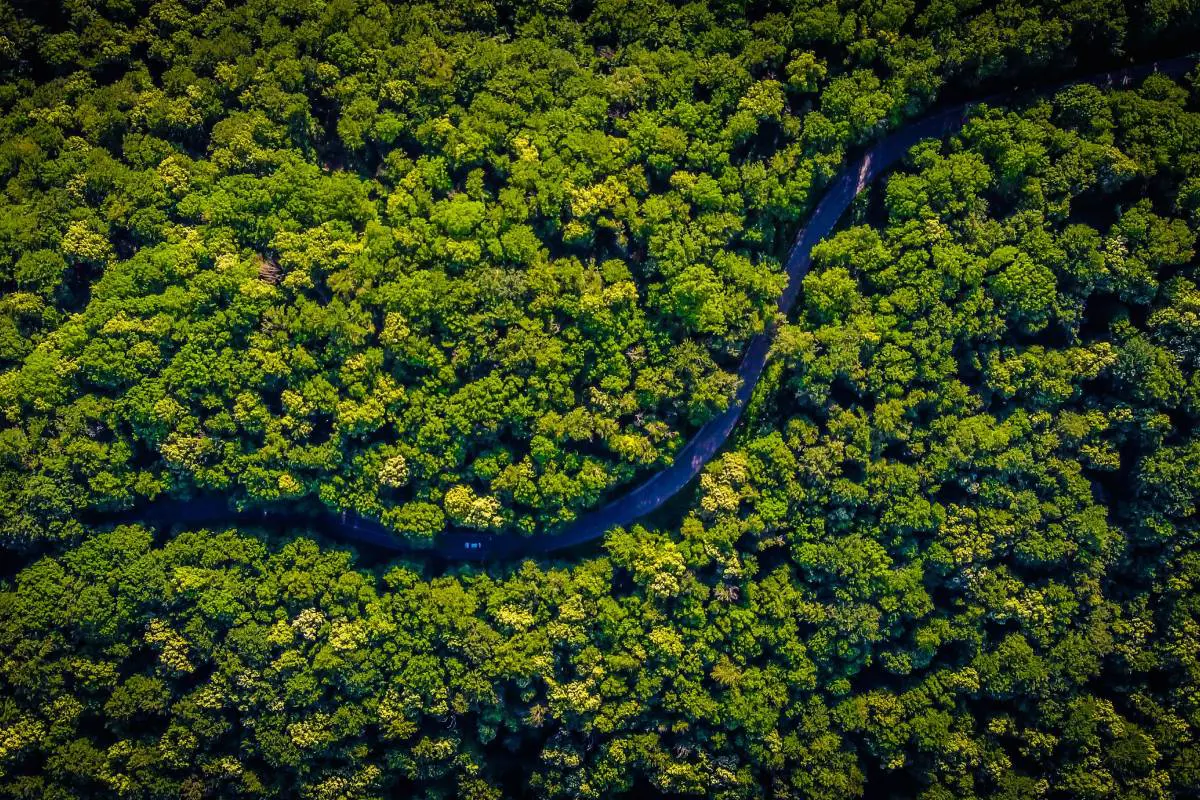

Biodiversity on the rise

Listening to the voices of the investment community overall, one might say that 2023 was the year of biodiversity in finance. We supported all eleven of the shareholder-sponsored nature-related shareholder resolutions presented for our vote. In line with our biodiversity approach, we are joining hands with other investors for engaging with sovereigns and corporates, such as the Plastic Solutions Investor Alliance.

Human rights: permanently on our agenda

Candriam took our human rights priorities a step further by formalising our Human Rights Policy in 2023. The topics are wide – difficult-to-identify labour abuses in supply chains, rising geopolitical instability, and the need for guardrails to protect human rights in important and potentially beneficial new technologies, such as facial recognition and artificial intelligence.

Can investors analyse human rights risks in supply chains?

Reporting since 2009

Just engagement or also voting?

Transparency and sustainability are improving. Stakeholders – not just shareholders, but employees, communities, customers, regulators, and others – are more aware, more involved, and are demanding more information and action. Change is in the air.

That means greater demands on issuers, investment managers, and others. There has been an exponential increase in collaborative initiatives. These sometimes overlap, multiplying work for both issuers and investors.

As responsible investors, we must be careful to choose those initiatives which are likely to be well-organized and efficient – perhaps a large group recognized by an experienced and respected entity, or perhaps a small group where all the parties are well-known to each other.

At Candriam, we act on our Convictions.

The year at a glance

Main themes

- Strong corporate Governance

- Climate change

- Biodiversity

- Human Rights

314

corporates engaged directly

36%

of our AUM[2]

734

corporate issuers engaged collaboratively

256

dialogues led or actively supported by Candriam

9.365

corporate issuers engaged through large initiatives