Download the pdf summary

EN | FR | DE | ES | IT | NL

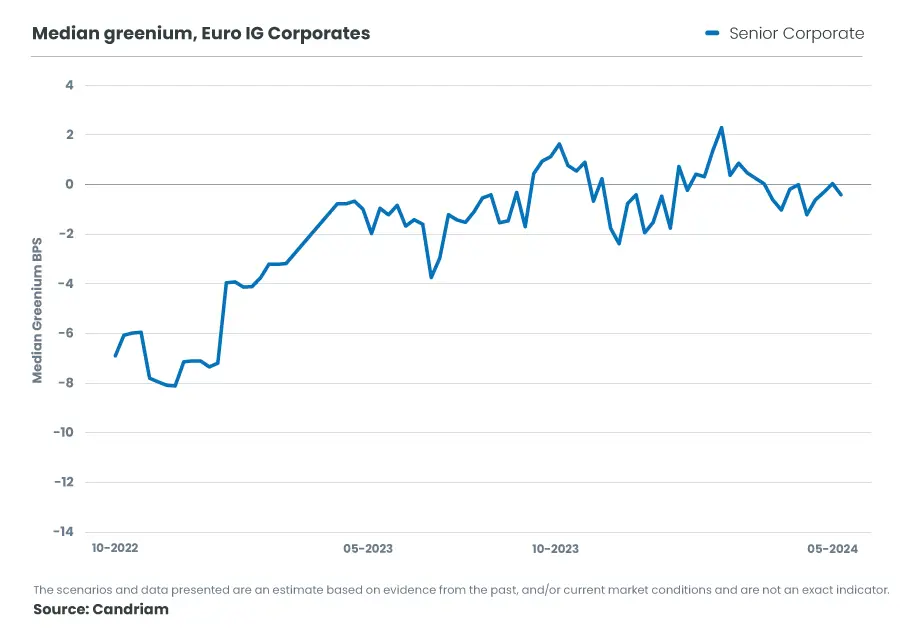

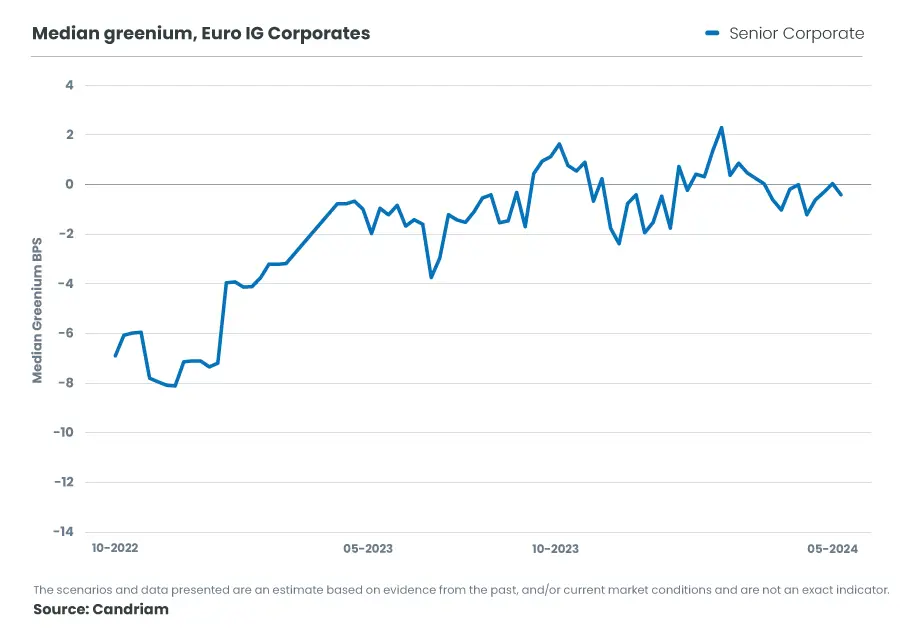

Greeniums are merely a few basis points

The ‘greenium’, or premium afforded to a green bond, is modest. We think part of the reason is that the increased information supplied by companies issuing green bonds is allowing investors a chance to better evaluate the overall sustainability of these issuers. This is particularly true for the newer ‘sustainability-linked’ bonds, where the issuer pays a lower coupon for meeting pre-declared corporate sustainability targets. Clearly all bondholders (and all stakeholders) benefit from well-defined and clearly-reported targets.

Sustainable Performance

We use extra-financial factors as an aid in preventing credit accidents in all our credit analysis, not merely our sustainable strategies. With the greenium so narrow, we see no reason for a sustainable universe to underperform a wider bond benchmark.

It is our Conviction that both financial and sustainability performance will soon be co-equal in Euro IG portfolios. We’re ready to be judged on both.

;

;