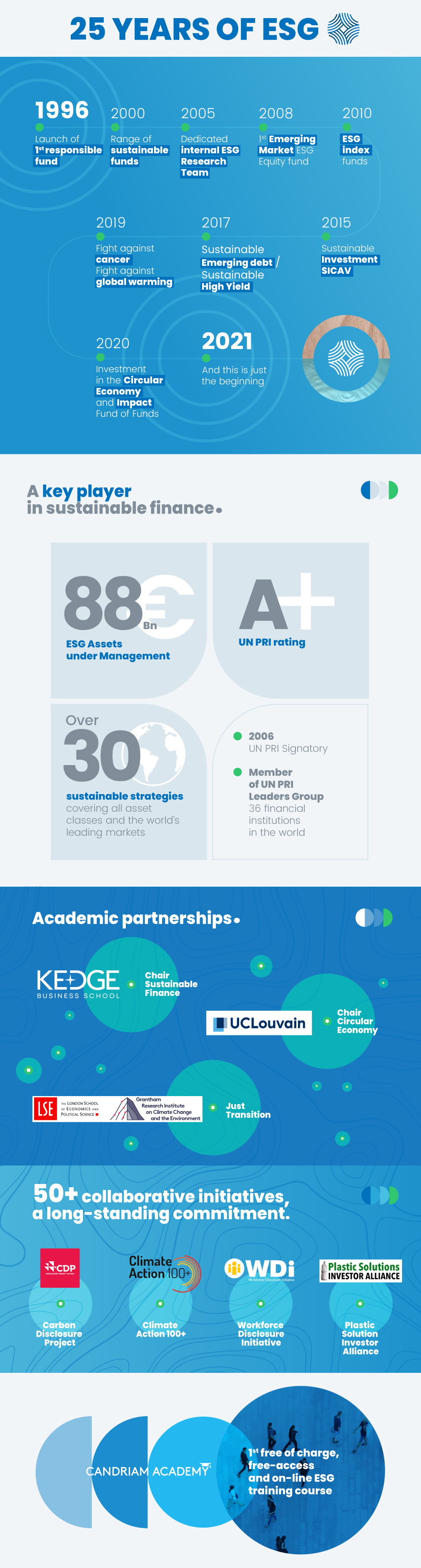

Most investors now require companies to act responsibly in their efforts to meet current and future environmental, social and governance challenges. At Candriam, this goes beyond the words embedded in our name – Conviction AND Responsibility in Asset Management. They are values to which we have strictly adhered for the past 25 years already.

What were you doing in 1996?

At Candriam, we were busy launching our first responsible fund.

GET INVOLVED

To leave a fitting legacy for future generations, each individual’s actions have to consider the greater good. What is now needed, more than ever, is collective action to lead society towards a sustainable future. And we, who have the requisite tools, expertise, creativity and commitment, know how to achieve virtuous growth..

And this is just the beginning!

SHAKE THINGS UP

We’ll say it again: Responsible Investment is a source of added value. In our view, finance starts to make sense again when investment becomes sustainable. We see our role in the industry as that of Sustainable Investment ambassador.

“No conviction-based investment company can compile credible SRI strategies and ESG integration without quality-based research."”

Alix Chosson, Lead ESG Analyst

LET ACTIONS SPEAK LOUDER THAN WORDS

Committed to Sustainable Investment for over 25 years now, we currently manage the biggest range of ESG funds in Continental Europe. Almost one third of our AuM is invested in sustainable strategies. Strong, independent research is one of the cornerstones of our pertinent and innovative sustainable investment approach. Our voting policy encourages virtuous corporate behaviour. 10% of the management fees earned from our sustainable investment SICAV is donated to impact projects in education and social inclusion. We launched Candriam Academy to awaken the financial community’s awareness of sustainable investing. Our internal culture and CSR policy overlap. Honesty, however, for us, is the best policy.

“In the future, engagement will be even more collaborative, targeted and proactive”

Sophie Deleuze, Lead ESG Analyst, Stewardship

OPTING FOR SUSTAINABLE INVESTMENT MEANS …

Reconciling your investment with your values. Spotting opportunities and more accurately assessing the risks involved in integrating extra-financial criteria. Prioritising a sustainable performance that takes a "holistic" approach to analysing a company. Having access to thematics with a strong ESG impact. Meeting the latest regulatory demands.

Acting together for a sustainable future.

“What’s unique about the Candriam approach to sustainability is its ability to stand the test of time, which can be put down to the innovatory nature of our ESG approach.”

Wim Van Hyfte

IF OUR FIRST FUND COULD TALK, THIS IS WHAT IT WOULD SAY ABOUT 25 YEARS OF ESG AT CANDRIAM