Download the pdf summary

EN | FR | IT | NL

Nature: as fragile as it is complex

Initially defined as the sum of all forms of life, biodiversity is now recognized to be much more complex than this, as it also encapsulates all the interactions among its different parts. It is also now broadly known that environmental damages and biodiversity loss are threatening our survival as human beings.

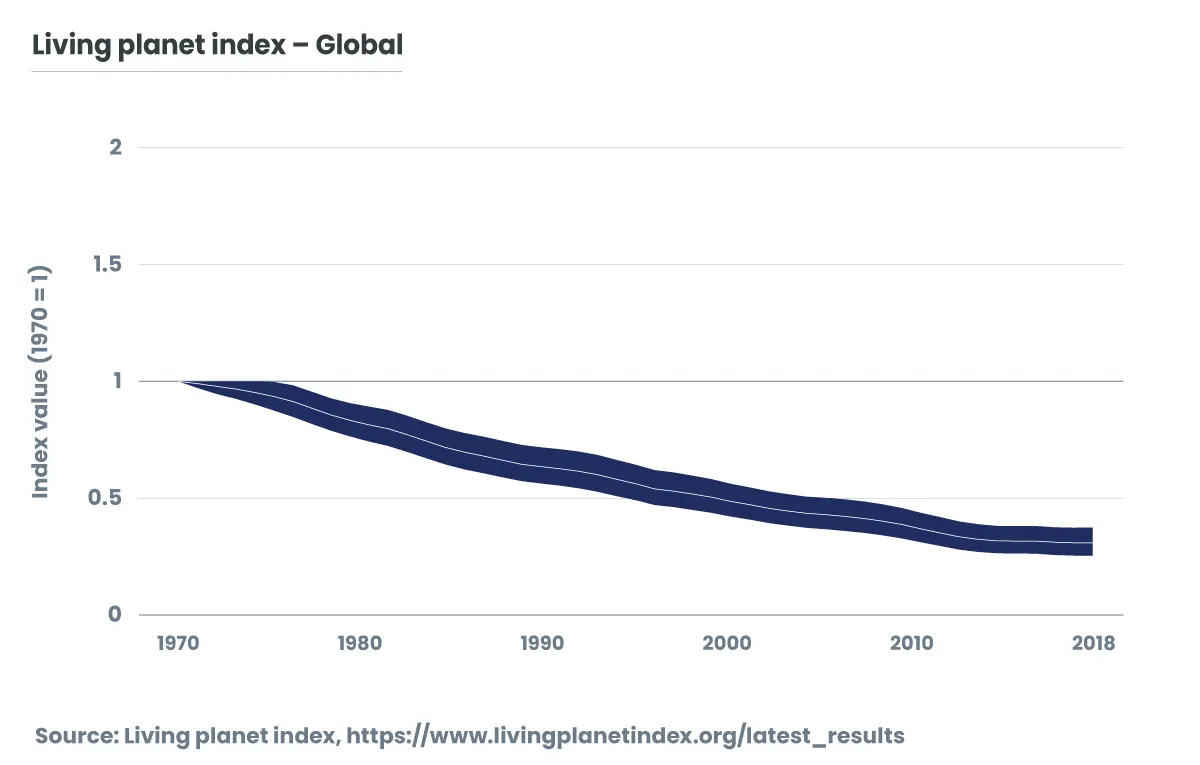

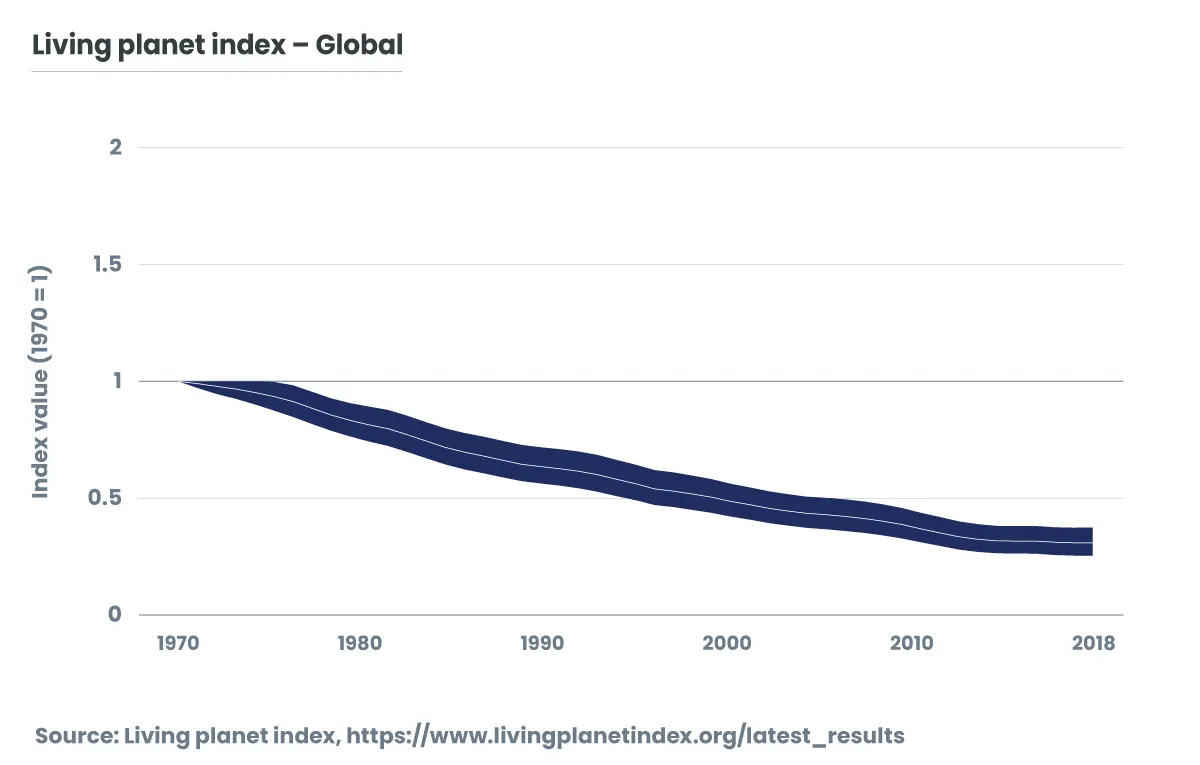

69%

|

Over 50%

|

|

Global biodiversity loss between 1970 and 2018*

*Living planet index

|

of the world’s total GDP is moderately or highly dependent on nature and its services and, as a result, exposed to risks from nature loss*

* World Economic Forum

|

Problem: Protecting biodiversity is highly complex. However willing sustainable investors are to be part of the solution, they may struggle to integrate biodiversity in their investment framework. Understanding double materiality is an important first step but does not provide instructions for use !

How can investors integrate biodiversity in their investments ?

Candriam’s biodiversity model: adding the “Where” to the “What” and the “How”

Unlike climate, which can be analysed using aggregated indicators such as kilograms of C02, biodiversity cannot be reduced to a limited set of indicators. It encompasses numerous dimensions that must be understood separately in their specificities, and particularly at the local level within a specific ecological context. Indeed, a company’s biodiversity impacts and dependencies will differ whether its operations are located close to a tropical forest or in an arid plain. Biodiversity analysis requires to compile the locations of an issuer's operations (mines, industrial sites, offices...) with local biodiversity data (water stress, protected areas, species density). And suddenly, companies’ ESG analysis becomes much more fun !

This is why our proprietary biodiversity model adds a third axis to our ESG approach. On top of the “What” (Business Activity) and the “How” (Stakeholder), we also analyse the “Where”.

;

;