;

;

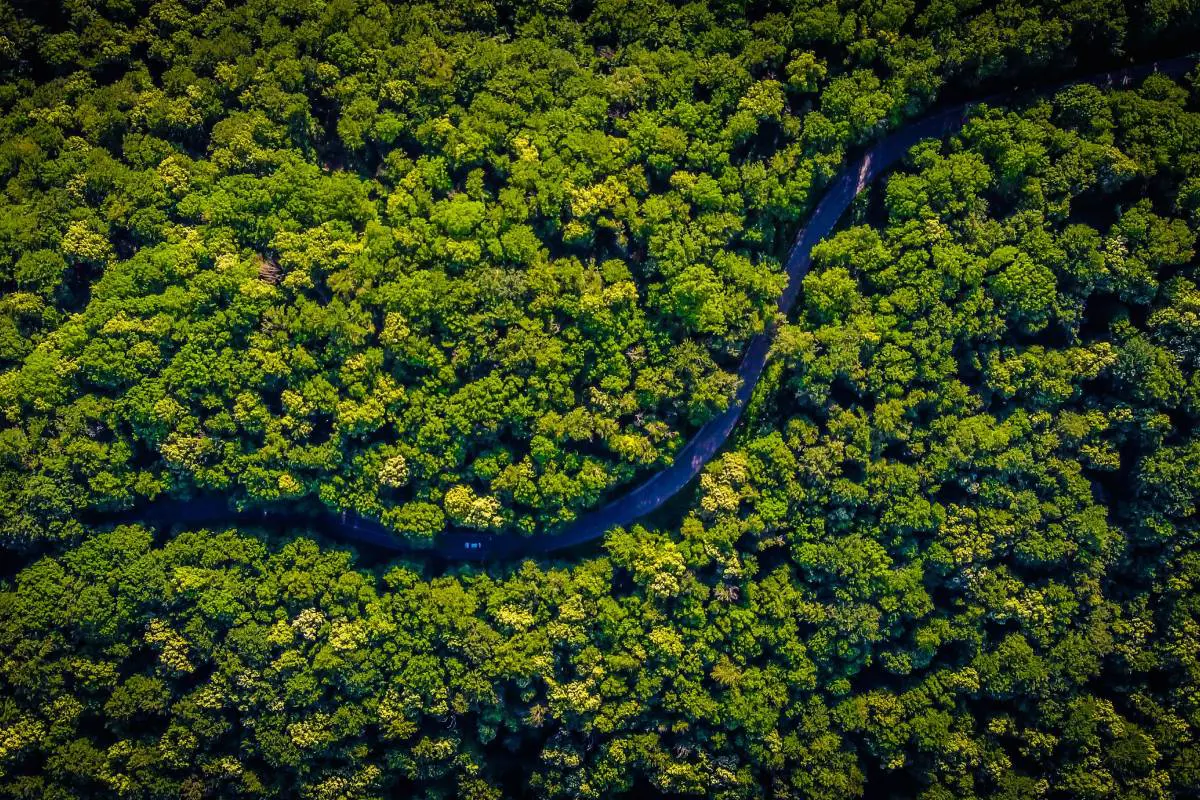

Biodiversity: Candriam in motion

Mounting risks call for immediate action, and we should get our priorities right

In the past 50 years, the Earth has lost 69% of wildlife, according to WWF’s Living Planet Report. Our ecosystems being sustained by an intricate web of interdependencies, any imbalance endangers a multitude of species, animals and plants.

Once lost, ecosystems are extremely difficult to recreate. This is why, before aiming for ambitious nature restoration projects, our primary focus should be on avoiding any negative impact on biodiversity. To properly assess physical risks, a comprehensive analysis of companies’ impacts and dependencies on biodiversity is necessary.

8 to 12 |

97% |

82% |

|

Source: Our World in Data |

plunge in the number of tigers over the last century Source: WWF |

Decline of the global biomass of wild mammals since prehistory Source: IPBES |

;

;

”It is imperative to protect biodiversity to ensure the survival of all life forms on Earth. At Candriam, we have consistently incorporated biodiversity considerations into our investment strategies.

Tackling new risks to uncover new opportunities

Each step of our sustainable journey brings another level of difficulty. The biodiversity topic has emerged with its lot of specific obstacles. Which indicators? Which investment solutions? Physical risks are becoming relatively clear, but with very few regulations in place as of now, what about transition risks?

We have updated our ESG framework to account for biodiversity-specific issues, notably the fact that biodiversity is a highly local subject that requires local corporate data at asset-level. Indeed, the impacts and dependencies will not be the same whether the company is located close to a forest or in a desert. Our three-dimension framework, relying on Carbon4Finance data supplemented by sophisticated tools that were developed internally, is a key strength in our ESG framework.

An ambitious commitment at corporate level

We have committed to address biodiversity through various channels, among which exclusions, biodiversity footprint, stewardship and transparent reporting. Our holistic approach and the differentiating aspects of our biodiversity model are explained at length in our Biodiversity Strategy.

Hear Elouan Heurard, our ESG analyst on Biodiversity

explain the challenges of biodiversity analysis and the specificities of our approach

For a deep dive in our biodiversity model and our commitments as an investor

Are you up to speed on the key concepts of Biodiversity? Take on our training module!

Double materiality, Ecosystem services, Life Cycle Analysis – how comfortable are you with the concepts? Not quite? We have your back !

Our free on-line training module on Biodiversity will help you raise your game !

Join our 15,000 members and take the Biodiversity course with the Candriam Academy.

Chaire 2030 Investir Demain

Candriam is part of the Think Tank “2030 Investir Demain”, together with French newspapers AGEFI and ID L’info durable.

All along the coming year, workshops gathering experts from diverse backgrounds will focus on various aspects on Biodiversity, leading to the publication of a guide for investors.

Stay tuned !

COP 16, the first Biodiversity COP

after the adoption of the Global Biodiversity Framework in 2022

The 16th meeting of the Conference of the Parties to the United Nations Convention on Biological Diversity (CBD COP16) will be held in Cali, Colombia, from October 21st to November 1st.

COP16: too little, too late.

Two years after the adoption of the Kunming-Montreal Agreement, the progress on global biodiversity goals remains mixed. Despite commitments, a limited number of countries (44 out of 196) have submitted their National Biodiversity Strategies and Action Plans. The parties have agreed to submit their plans as soon as possible, with a global review scheduled for COP17 and COP19.

How to invest? Discover our Water strategy!

Biodiversity-rich ecosystems are water sinks as much as carbon sinks – notably forests. Preserving and restoring these ecosystems is key to maintaining freshwater availability, thereby contributing to mitigating the water crisis. Conversely, freshwater supply is an essential ecosystem service that sustains the wellbeing of all species. We need to preserve water, one of our most precious resources.

Our Water investment strategy aims to capture the opportunities by investing in companies that offer innovative solutions to the challenges of water management, either by improving our water supply, or using this resource more efficiently. Want to know more?