Sustainable Bonds are chic!

Green investing is all the fashion, and the growth and diversity in Green Bonds has been phenomenal. Is this a fad? With the European Central Bank discussing the possible inclusion of climate risk to its systemic risk assessment, we could instead be at an inflection point.

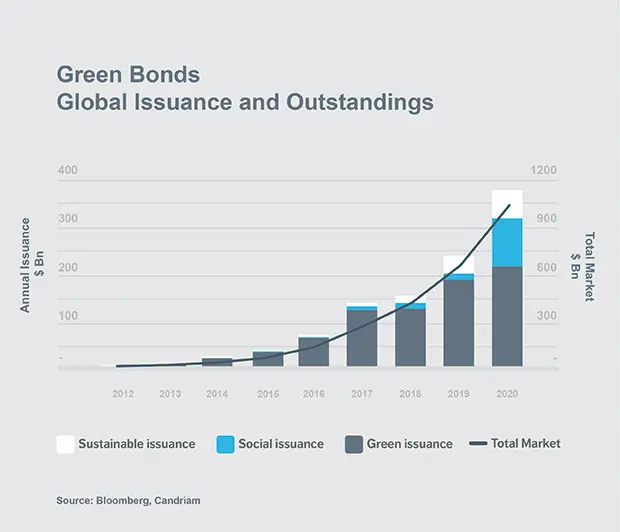

The global market for Sustainable Bonds has risen from $50 billion to over $1 trillion in less than five years. More than half of this is denominated in Euros. In 2021, Candriam forecasts $500 billion in new issuance, mostly in European programs, but with US corporations expanding their issuances as well.

Investors seem to eager to help finance societal projects with environmental or social benefits. Is this in addition to the yield – or in lieu of some of the financial return?

Do investors pay a ‘Green’ Premium for being in fashion?

Spoiler alert: Our research shows no 'Greenium'.

With the wave of Green Bond issuance over the last five years, research has intensified from both financial firms and academics – with conflicting results.

Candriam sought to answer the question with a focus on our own investors and on our portfolios. Our Fixed Income Quantitative Team and Global Bonds Management Teams has tailored our research and econometric model to the needs and interests of our particular investing community.

More precisely, we focused on European Sustainable Bonds for two reasons. First, European investors and investments are in the forefront of the green wave, and are some years ahead of the enormous US markets. With sustainable fixed income products accelerating in volume and becoming rapidly more sophisticated, combining a large but younger stock of assets could produce a less-meaningful 'average'. Second, the medium-term supply is likely to still skew towards European issuers.

Our sophisticated econometric model tests the yield differences in European 'sustainable' bonds – green, social, and sustainable, as defined by Bloomberg -- versus European 'brown' or traditional bonds. We control for other factors which may affect yields – duration, liquidity (bid-ask), coupon, emerging vs developed markets, credit rating, maturity, industry sector, and others.

Go for the Green!

We find essentially no 'Greenium', or yield give-up, for investing in sustainable bonds – while as expected, we find significant yield differences among duration, subordination, credit rating and other factors in the model.

Therefore, investors in Sustainable bonds can enjoy both market returns, and the satisfaction of helping finance a social or environmental benefit.

Look out for our full 2020 results and research paper on European Green Bonds and the 'Greenium' in early 2021.