Research Papers

Research Paper, Fixed Income, Bob Maes, Philippe Dehoux

You want to talk about euro swap spreads versus US swap spreads? We watch that, too. But to be honest, that graph is one of the last things we look at when managing euro fixed income aggregate portfolios. So if you want to see it, you’ll have to read all the rest of this page first.

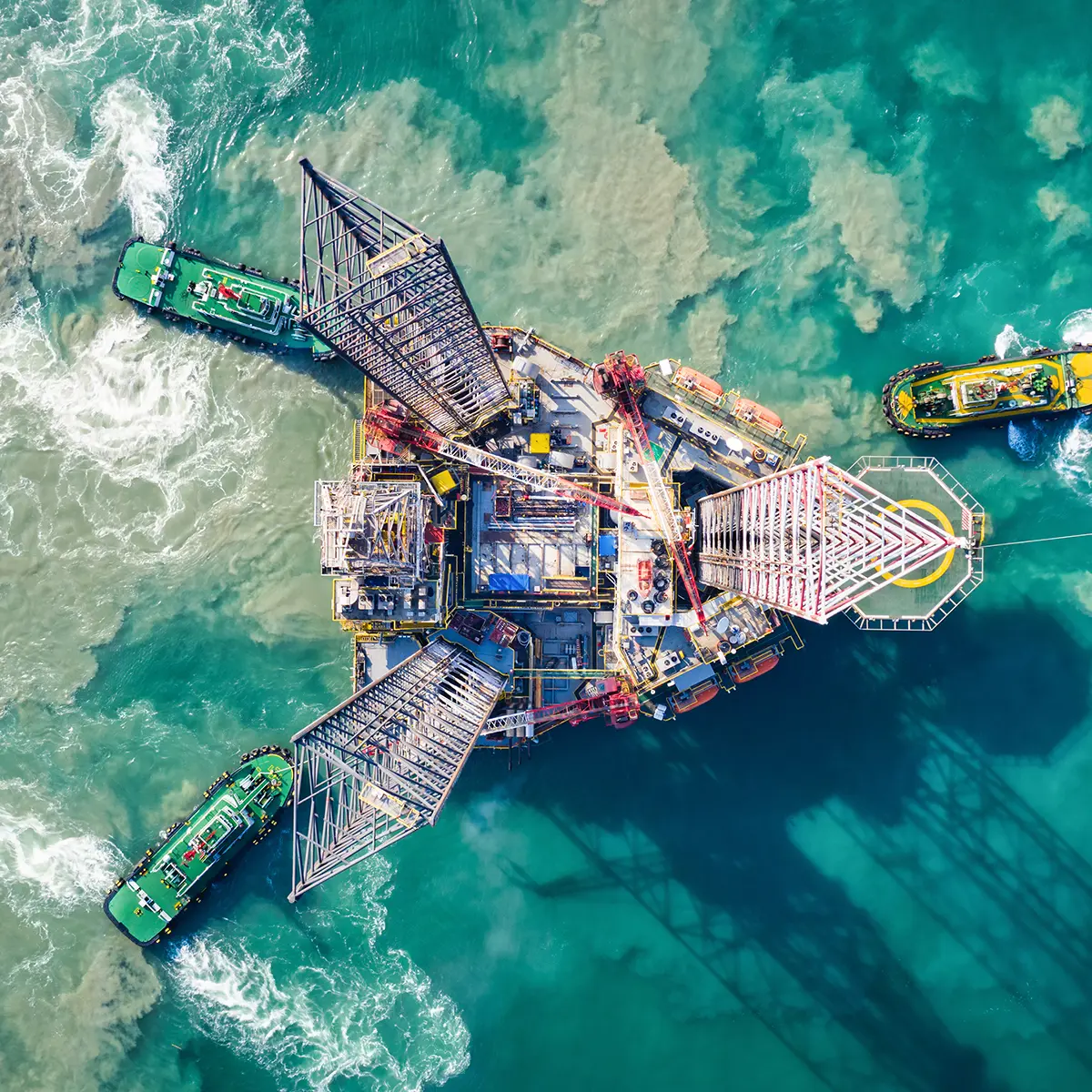

Research Paper, Alternative Investments, Pieter-Jan Inghelbrecht, Johann Mauchand, Steeve Brument

Restoring Diversification

We have previously examined the equity/bond allocation and asked, ‘Is 40/30/30 the new 60/40?’ Well, yes, we think it is. Our work shows a long-term correlation between equities and fixed income that is frighteningly close to 1.0. This increased correlation fundamentally alters the effectiveness of traditional portfolio construction.

Olivier Clapt, Asset Allocation, Research Paper

Capital Market Assumptions – Long-term return forecasts

Although navigating by the stars can seem brave and adventurous, we would not recommend it on financial markets. Better be equipped with a solid compass !

Q&A's

Q&A, Money Market, Pierre Boyer

Money market strategies: when cash is king

Money market strategies aim to offer a low-risk and liquid way for

investors to generate higher returns than traditional savings

accounts. Pierre Boyer, Elodie Brun, and Benjamin Schoofs, portfolio

managers, share their insights on the asset class.

Q&A, Christopher Mey, Emerging Markets, Nikolay Menteshashvili

Unlocking opportunities: a guide to investing in emerging market corporate debt

In a constantly-evolving global environment, emerging markets present distinctive opportunities for investors looking to diversify and enhance their returns. Emerging market corporate bonds represent a $1trln+ asset class, combining robust fundamentals with strong return potential. Nikolay Menteshashvili and Christopher Mey, portfolio managers, explain in detail why this investment strategy deserves investors attention, how it may offer attractive risk-adjusted returns, and the key requirements for successfully navigating this complex yet promising universe.

Q&A, ESG, SRI, Kroum Sourov, Christopher Mey, Emerging Markets

Sustainable: an emerging market for emerging debt

Kroum Sourov and Christopher Mey, portfolio managers of the sustainable emerging market debt strategy, describe the significance this type of analysis can have for a bond portfolio. They explain Candriam’s investment process, with our emphasis on relative value and risk management. This approach is intended to allow the strategy to adapt the ever-changing markets over the course of an economic cycle.

Transparency Code

Please find the Transparency Codes on the Fund pages.

Sustainability Overview

Sustainability, and Responsibility, must be part of the personality and culture of the firm. We need Responsibility to be a part of ourselves in order to translate it into your investments.