China A-shares opened a way for international investors to participate in the world’s third largest stock market by market capitalisation (after New York Stock Exchange and Nasdaq) with about 3,800 large, medium-sized and small listed companies[1]. China A-shares are the stock shares of mainland China-based companies, priced in Chinese RMB and traded on the Shanghai (SSE) and Shenzhen (SZSE) Stock Exchanges.

Before A-Shares, non-Chinese investors could invest in H-Shares that gave access only to Hong Kong-listed companies, which included mainly state-owned or private mainland China companies such as China Mobile, China Construction Bank, Tencent and Xiaomi, as well as some very well-known US-listed Chinese ADRs of about 170 Chinese companies, including Alibaba and JD.com. Local China stock markets also offer less active B-shares, which are priced in USD or HKD and listed on SSE and SZSE. A-Shares can offer investors valuable diversification benefits as they give access to a wide range of domestically-oriented Chinese companies which do not depend on overseas revenues for their well-being.

In the past few years, China A-shares were made available to large Western institutional investors through the Qualified Foreign Institutional Investor (QFII) and Renminbi Qualified Foreign Institutional Investor (RQFII) programmes and the Shanghai & Shenzhen-Hong Kong Stock Connect Schemes. The average daily trading volume on A-shares from HKEX (northbound) has grown by over 14 times from HKD 5.9bn in Q1 2017 to HKD 85bn in Q1 2020 (Source: Hong Kong Exchanges and Clearings as at end of March 2020). In June 2019, SSE and London Stock Exchange (LSE) launched Shanghai-London Connect, a collaboration which can potentially attract more foreign capital inflows to China stock markets in the future.

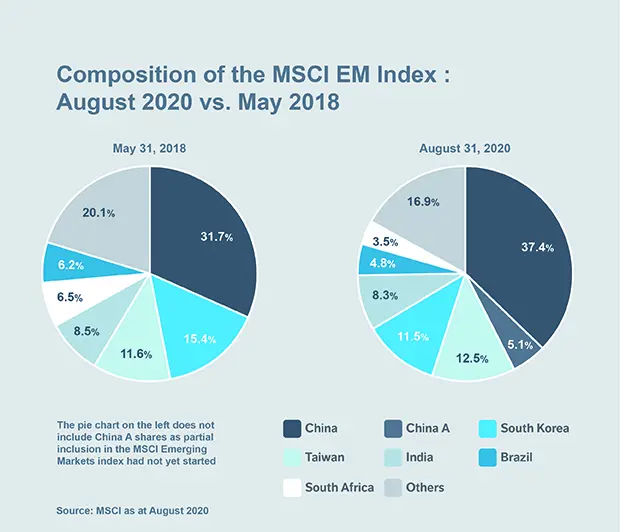

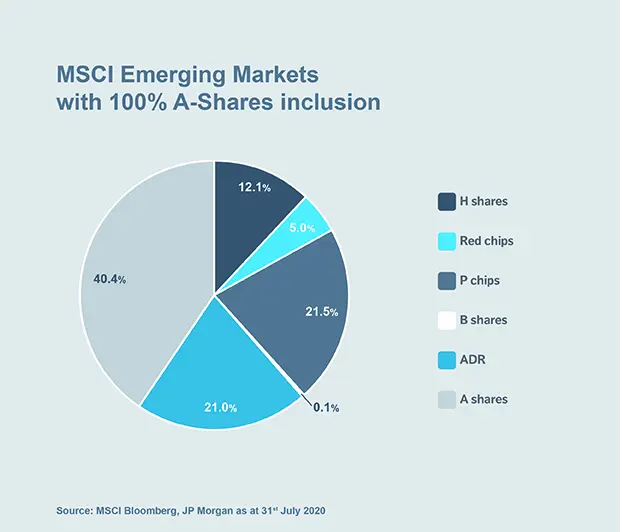

Starting in 2017, the MSCI™ and FTSE™ global indices have began to include China A-Shares. For example, as of August 2020, China A-shares accounted for 5.1% in the MSCI Emerging Markets Index (please see Chart 2) However, as more A-Share companies are included, this proportion will increase (please see Chart 3)

In the MSCI All Cap World Index, China accounts for only 5.6% (Source: MSCI, 30th November 2020[2]), which we believe under-represents its weight in the global economy as the country’s GDP accounted for 16.3% of the world GDP in 2019 (Source: World Bank, 31th Dec 2019[3]).

A market for active managers

While global indices have started to include China A-Shares, mainland Chinese companies do not have to meet the same high governance standards as those listed on the Hong Kong stock exchange. This, as well as the relatively low research coverage of A-Share companies, points in the direction of active management, rather than index-based investing, as the more profitable way of investing in this market.

In addition, there are other features of A-Shares that makes them particularly attractive to stock pickers. Retail investors currently account for about 80% of the A-Share market turnover and, as the result, it is a fairly well-traded market with higher than average level of volatility. The mispricing created by this volatility is another attractive factor for stock pickers, who can spot valuation-based investment opportunities.

Moreover, while the state owns around a quarter of industries and exercises influence and control in many spheres of the economy, when compared to the Hong Kong-listed H-Shares, the market of China A-Shares of mainland companies provides access to a wider selection of private companies in the IT, Technology, Healthcare and Consumer sectors. And this is where most investment opportunities lie. As an article published by the World Economic Forum in May 2019 stated, “The combination of numbers 60/70/80/90 are frequently used to describe the private sector's contribution to the Chinese economy: they contribute 60% of China’s GDP, and are responsible for 70% of innovation, 80% of urban employment and provide 90% of new jobs. Private wealth is also responsible for 70% of investment and 90% of exports[4].”

As a pioneering ESG asset manager, we are also encouraged to see that these factors are becoming increasingly important to mainland Chinese companies. This is particularly true for those industry-leading players which have higher levels of foreign investment, although there is still much room for improvement from both company’s and regulation’s sides. This is being driven by the Paris Agreement carbon-neutral objectives for 2060 and the consequent big push for clean energy and electric vehicles, as well as the recently announced anti-trust measures for the internet and e-commerce sector.

We are confident that A-Shares continue to provide a route to an important and growing market for international investors which will improve in quality while providing valuable diversification benefits.

[1] Source: World Federation of Exchanges, as at May 2020

[2] https://www.msci.com/documents/10199/8d97d244-4685-4200-a24c-3e2942e3adeb

[3] https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=CN-1W

[4] https://www.weforum.org/agenda/2019/05/why-chinas-state-owned-companies-still-have-a-key-role-to-play/