Since the market has incorporated the fact that there would be fewer rate cuts by the Federal Reserve and they would probably come later than expected at the end of 2023, core equity indices have continued to perform well in Northern America and Western Europe. However, a certain anxiety is building up regarding the fact that the market might be priced for perfection. Some will argue that sectors such as industrials, financials and healthcare have started participating in the upside. Others will point out that AI is leading this narrow market with the main US equities lining up several months of gains. So, “should I stay or should I go”?[1]

Since the market has incorporated the fact that there would be fewer rate cuts by the Federal Reserve and they would probably come later than expected at the end of 2023, core equity indices have continued to perform well in Northern America and Western Europe. However, a certain anxiety is building up regarding the fact that the market might be priced for perfection. Some will argue that sectors such as industrials, financials and healthcare have started participating in the upside. Others will point out that AI is leading this narrow market with the main US equities lining up several months of gains. So, “should I stay or should I go”?[1]

The main equity indices were positive overall during the month, with large cap and quality stocks outperforming small cap indices. Sector-wise, consumer discretionary, industrials and technology outperformed defensive sectors.

Yields of medium- to long-term maturities of European and American sovereign issues continued to climb higher, with rises of between 20 to 40 basis points, as expectations regarding the number of cuts have fallen. Corporate spreads continued to trend down.

The HFRX Global Hedge Fund EUR returned +0.80% over the month.

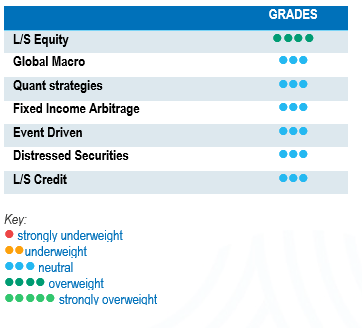

Long-Short Equity

February was overall a good month for Long-Short Equity strategies. On average, strategies with higher levels of directionality outperformed market neutral or flexible net long strategies. There was a fair level of dispersion within each management style. Performances were driven by beta, with equities rallying higher but also by strong alpha generation on long positions. Since the start of the year, alpha generation has been strong on both long and short positions, making it one of the best starts in the last 10 years. Now that the rate hiking cycle has probably reached the end of its course, we expect higher dispersion inter- and intra-sector, which will be beneficial for Long-Short Equity strategies. Furthermore, these strategies have more tools than traditional long only strategies to help navigate market volatility, should the consensus scenario of moderate growth for 2024 hit a road bump.

Global Macro

Average performances for Global Macro strategies were positive during February. Managers benefitted from equity long positions as the rally continued and broadened, with economic data remaining solid. The carry on credit positions tended to contribute positively to performance, while returns generated from trading were more muted. Short positions in energy futures were also additive to performance. We expect the current and foreseeable environment to offer interesting investment opportunities.

Quant strategies

February was strong in terms of performance for Quantitative strategies. Trend-following models outperformed monetising investments in equities, commodities and currencies. Long positions in US, Europe and Japanese equity futures contributed to performance but this was slightly offset by short positions in China/Hong-Kong, which stopped their long downward trend. Long positions in soft commodities and short positions in energy futures were also additive to performance. Multi-Strategy Quantitative programmes lagged Trend Followers, but were positive on average over the month and can show greater performance consistency for the last year.

Fixed Income Arbitrage

Since the beginning of the year, central banks have become more data dependant than ever, and each small piece of economic data could potentially trigger interest rate moves or change yield curve shapes. However, as we speak, volatility has dropped significantly compared to 2023, and the bond price trend is range-bound. The market seems to have adopted a “wait and see” stance, supporting carry strategies but not directional or relative value strategies, while offering a very supportive environment to implementing positively convex positions to take advantage of the next moves.

Risk arbitrage – Event-driven

Performances for Event-Driven strategies were relatively muted in February, with a high level of dispersion. Deal picking was an important factor in performance generation during the month, with several idiosyncratic events negatively impacting performance. Special Situation books contributed positively to performance on average. These strategies tend to have a long equity bias, benefiting from market beta tailwinds and risk-on sentiment. Merger announcements have been relatively muted over the last two years, which is understandable given the market volatility. Nonetheless, the number of new deals has ticked upwards since the start of the year. Some major banks have expressed positive expectations regarding an increase in corporate activity and the progressive normalisation of the number of deals announced. According to strategy specialists, the number of deals announced is more correlated to the level of visibility corporate management has on the state and direction of the economy rather than to the level of the cost of debt itself. As inflation slowly trickles down and interest rates near their peak, we might be at the beginning of a nice cycle for the strategy.

Distressed

Expectations for distressed opportunities have evolved significantly over the last 18 months. Coming into the end of 2022, the red-hot inflation levels and rapid rate hike cycle were indicators of a distressed cycle bonanza not seen since the Great Financial Crisis. These expectations dwindled during 2023 as the economy and job market remained resilient. The opportunity set during the year was opportunistic in nature, taking advantage of specific events such as the banking crisis in the US during the first quarter of 2023 or of idiosyncratic situations. Default levels have now started to increase, although expectations remain contained, given that most corporations opportunistically refinanced their outstanding debt at lower rates during the 2020-2021 period and that consumers’ financial health remains relatively strong. While strategy specialists remain largely on the sidelines focusing on idiosyncratic opportunities, they remain cautious about investing in high-yield issuers and have identified cracks in specific areas such as the loan market. Some market participants have taken on large debt loads through loans, which are usually floating rate issues, without anticipating such a meteoric rise in short-term rates.

Long short credit

The appeal of Long-Short credit strategies seems to be improving. An environment of higher rates for longer could be a tailwind for alpha generation both on long and short positions, as fundamental research becomes more important in portfolio construction. Absolute return or hedged investment approaches have gained more relevance as positions in AT1 issues have generated significant volatility and market losses for the investment community. Yields have widened, again giving fixed income a seat at the asset allocation table. However, as recent events have demonstrated, risk diversification is very important and should be an integral part of the investment allocation process.

[1] “Should I stay or should I go”, song by The Clash.