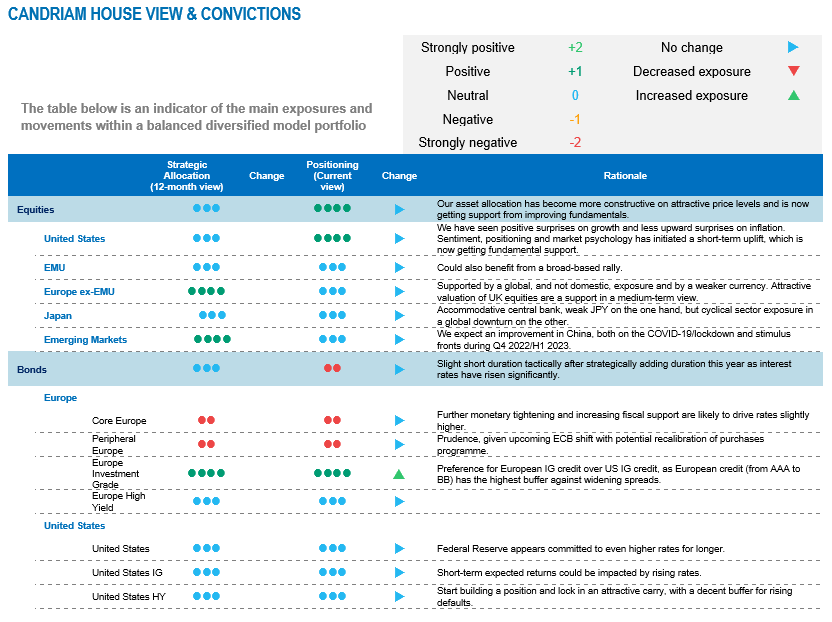

In October, we turned more constructive based on our analysis of the market configuration. This month, fundamental support provides further reasons to maintain this stance. Nevertheless, the level of uncertainty regarding the outlook for the global economy remains high, and downside risk to profits remains and will continue to generate volatility in all asset classes. Against this backdrop, we have decided to keep our tactical overweight on equities via US and emerging markets as well as a preference for credit over government bonds within fixed income.

The starting point: an extreme market configuration

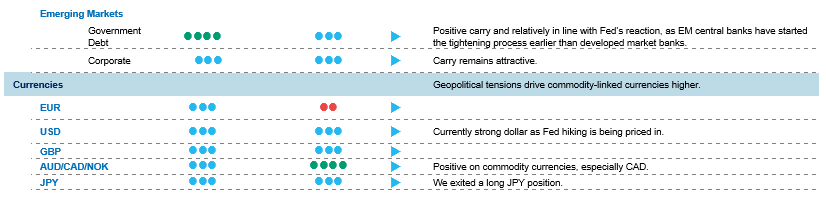

Our analysis on investor sentiment, market psychology and technical set-up pointed to widespread pessimism, and revealed depressed measures in October. This extreme configuration usually represents a buy signal and justifies a short-term market rebound. This led us to become more constructive on risky assets, adding to equities and high yield.

More recently, we have noted a normalisation from this extreme situation, but there is still room for improvement. For example, 91% of investors say that global earnings won’t improve over the next 12 months – hardly a sign of investor exuberance.

Clearly, sentiment and psychology indicators are no longer extreme, but remain quite low from a longer-term perspective.

A slowdown in central bank tightening

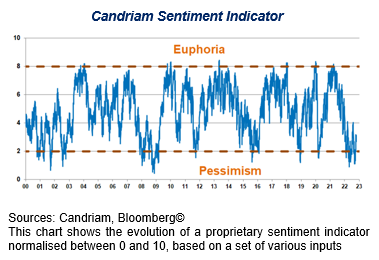

While the initial stage of the recovery in financial markets appears to have been pushed by an extreme market configuration, the next phase of the upward leg needed fundamental support. Fortunately, the reading on central banks’ policy has evolved from “glass half empty” to “glass half full”.

Investors have noted the slowdown in the pace and scale of interest rate hikes delivered by central banks around the globe compared to previous months. Even if the size of the moves may decrease, the latest declarations from ECB members have been hawkish.

Of course, the main question for multi-asset investors is where and when the Federal Reserve will pause its tightening cycle. It is our understanding that trends on the labour market will be key. The Fed will closely watch trends on the labour market, and some measures may indicate less tension. US wages seem to be peaking, and their trend will help to determine at what level the Fed will pause. However, inflation anticipations remain high.

A decline in economic and political risk premiums

The decline in risk premiums associated with the economic and political outlook constitutes another fundamental support for financial markets.

The contraction in manufacturing is now apparent for most countries in survey data, but the monetary policy tightening already implemented has still to materialise in hard data.

The global manufacturing PMI is below 50 points for the second month in a row, signalling a contraction. Interestingly, the pace of deceleration has improved for the second consecutive month on a global scale, but has further accelerated in the eurozone. This no longer constitutes a surprise for investors.

Growth surprises are back in positive territory, while upside inflation surprises are gradually fading. Regarding future inflation, we continue to emphasise that monetary policy works with long and variable legs, and this should help bring inflation down. US money supply has slowed down sharply, pointing to an upcoming moderation in inflation.

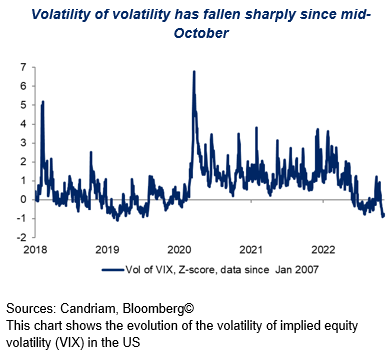

Further, markets have anticipated a decline in uncertainty/volatility regarding geopolitical risks. The volatility of volatility is down to pre-pandemic levels.

The decline in risk premiums has also been accompanied by better news flow out of China, which pointed towards a potential end of the Zero-Covid Strategy (ZCS) in 2023.

While the roadmap remains unclear, preparations are being made. Regarding vaccines, we note that the inhalable vaccine by CanSino was adopted following the Party Congress and could be rolled out. Further, BioNTech’s mRNA has been approved for foreign residents.

While the Zero-Covid Strategy was reiterated recently, investors believe there could be a shift in the spring, after the Lunar new year peak travel rush and next March’s two Party sessions. Financial markets tend to pre-trade reopening and the positive momentum could last two to three months, based on observations in the West.

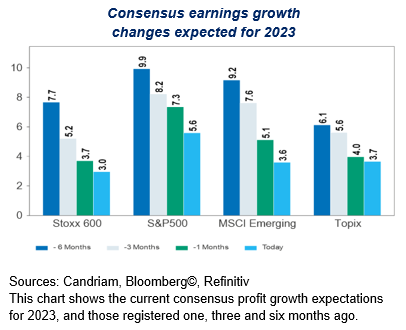

Downwards earnings revisions are on their way

Earnings per share (EPS) growth expected for next year is still positive, but a negative trend is unfolding. The scale of revisions differs across regions and across sectors:

- In the US, negative revisions mainly relate to tech & communications

- In Europe, negative revisions mainly relate to cons. discretionary & materials

- In emerging markets, negative revisions mainly relate to energy and cons. discretionary

- Within emerging markets, country-wise, Korea and Taiwan earnings expectations have been heavily revised down.

As already outlined, we have modelled EPS growth expectations for the US and for Europe, based on global PMIs, the US dollar trade-weighted index, the price of oil and the US 10y yield.

We find that profit growth expectations will have to weaken going forward. US EPS growth could be revised downwards by 2% by the end of this year, while European EPS growth could see a further downwards revision of 8%.

We continue to observe that, in terms of performance, US indices are pricing in more than a soft landing. More specifically, cyclicals with long duration are pricing in a hard landing. In Europe, however, performances are in line with previous soft landings. Last month’s repricing benefited value plays that no longer price in a soft landing.

Assessment of current positioning

To sum up, we currently position our multi-asset portfolios in the following three directions:

- we follow the more positive developing trend on equities but with a controlled risk budget.

- we maintain a slight underweight on duration.

- we remain positive on credit.

Market signals had reached extreme levels in the first half of October. Equities have experienced a strong rebound since October, leading to a rapidly normalising situation with a convincing market rebound.

Central banks have reached their inflection point in their tightening pace, leading to more stable, but still restrictive financial conditions going forward. As a result, investors’ expectations are close to peak expectations given the current economic backdrop.

Performance-wise, the rally may not be over, but it should be more broad-based to continue, i.e. leading value and cyclical sectors have benefitted most, and are starting to be overbought, while the tech sector is lagging.

From a fundamentals perspective, to fuel a sustained market recovery, we need the support of improving news flow, either on the geopolitical front with easing uncertainties (Russia/Ukraine, China reopening, US Mid Terms) or on the economic front (a bottom on PMIs and EPS downgrades in sight).