Last week in a nutshell

- The ECB held interest rates steady and confirmed its intention to a June cut, independent from upcoming Fed decisions.

- A cooler-than-expected US producer price index quickly alleviated the short-term pain of the hotter-than-expected consumer price index.

- China’s CPI and PPI decreased further. Cost of means of production and persistently weak demand keep fuelling the deflationary trend.

- Big US banks kicked off the Q1 earnings season with solid financial results, amid robust activity and a mixed outlook.

What’s next?

- Preliminary number of US building permits, existing home sales, and mortgage applications will be published, shedding some light on the strength of the real estate market.

- Final inflation readings for March, PPI and CPI in Europe, Canada and Japan will complete a picture of price trends while the US, UK and China’s retail sales will likely confirm a further expansion.

- The US Federal reserve bank’s Beige Book will be released and the IMF World bank will gather for its Spring Meeting. Its managing director already warned against the height of debt and depleted fiscal buffers.

- Netflix, Procter & Gamble, Johnson & Johnson and American Express will release their Q1 2024 financial results as we get into the thick of the season

Investment convictions

Core scenario

- 2024 comes with more visibility as the economic uncertainties decline in the US and in Europe, where the energy crisis was avoided. Uncertainties remain elevated, nonetheless in Germany. In addition, developed Central Banks have rebuilt room for manoeuvre.

- The goldilocks environment characterised by positive growth surprises and negative inflation surprises is spilling into the euro zone. Growth surprises are positive in all major regions while inflation surprises upwards only in the US.

- In China, economic activity has shown some fragile signs of stabilisation while the evolution of prices remain deflationary.

Risks

- Bond yields are to be monitored especially given the diverging paths taken by the strong US economy and its stabilizing European counterpart, which triggers an increasing spread in yields.

- Geopolitical risks to the outlook for global growth remain tilted to the downside as developments in the Red Sea unfold and the war in Ukraine continues. An overshooting in the price of oil, US yields or the US dollar are key variables to watch.

- A risk would be a stickier inflation path than expected which could force the Federal reserve bank to reverse course. In our understanding, it would take more than just the bumpy data registered since the start of the year.

- Beyond commercial real estate exposures, financial stability risks could return as a result of the steepest monetary tightening of the past four decades.

Cross asset strategy

- Our strategy increasingly reflects the latest development on the euro zone: economic surprises are positive as sentiment and flows may have turned a corner. Investor interest seems to be on the mend, and with a broadly attractive risk premium, the potential for a catch up by laggards is increasing. We are adding some beta and cyclicity to the strategy to benefit from increasingly supportive central banks rhetoric on pending rate cuts.

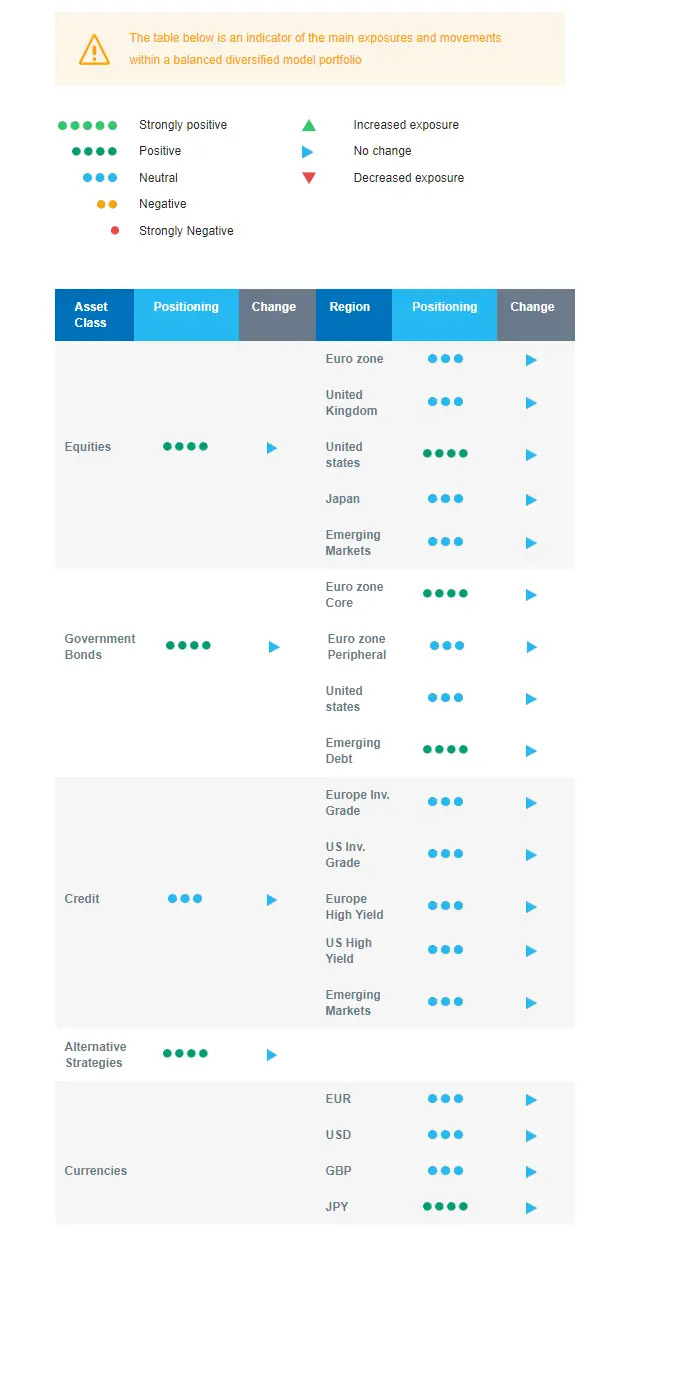

- We have the following investment convictions:

- Our equity allocation has become slightly overweight, via a more constructive view on the euro zone equity market.

- We have been looking for opportunities in beaten down stocks in small and mid-caps and are now starting to add in this segment.

- In the fixed income allocation:

- We have a positive stance on European duration and aim for the carry in a context of cooling inflation.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We maintain a neutral stance on US government bonds, looking for a new, more attractive, entry point.

- We have a newly reduced neutral stance on European Investment Grade credit.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets.

Our Positioning

With the addition of cyclicity to the portfolio, the strategy benefits from a broadening of the goldilocks environment. In Europe in particular, economic surprises are positive, leading to improving sentiment and flows. Investors’ interest is returning, and with the risk premium attractive overall, laggards could perform better in a context of economic improvement and catch up. Beyond the dataflow, we were reassured by the recent central bank meetings and think that the expected upcoming central bank rate cuts are an additional element which should act as support while capping long-term bond yields, underpinning our positive view on duration. We keep a supportive stance on US equities amid a positive EPS momentum and are neutral on Europe, Japan and Emerging markets. We also continue to harvest carry via Emerging Market debt.