Last week in a nutshell

- The Federal Reserve Bank confirmed being on course to cut rates “at some point this year”, most likely by an aggregate 75bp in 2024.

- The Bank of Japan raised rates for the first time in 17 years while the Swiss National Bank cut rates bolstering the case for an ECB cut in June.

- China’s retail sales and factory output exceeded forecasts, providing a boost to economic stabilisation and offering policymakers hope of maintaining growth.

- Preliminary figures on global manufacturing and services PMI surprised positively in the US and stabilised in the Euro Area as price pressure seems to have eased.

What’s next?

- In the US, final numbers on GDP growth, jobless claims, core PCE prices, home sales and sentiment will contribute to giving a fuller picture of the Goldilocks environment.

- Consumer and business confidence surveys are due in the Euro Area, and fresh inflation numbers for France, Spain and Italy will give early insights into price trends in March.

- The UK will release its final Q4 GDP figures, current account and business investment growth, after figures showed inflation fell to its lowest level in almost two and half years.

- The Bank of Japan will publish the minutes from its last meeting and summary of opinions.

Investment convictions

Core scenario

- The last leg of the steady path from a 3% to a 2% inflation rate seems to be more bumpy in the US than in the euro zone. Overall, the growth / inflation mix is undeniably returning to “familiar” territory.

- A soft-landing/ongoing disinflation scenario in the United States remains our most likely scenario, implying no rush for the Fed to deliver monetary support. We expect the first monetary easing in June.

- 2024 should bring better visibility with a narrowing economic growth gap between countries while most central banks have restored room for manoeuvre.

- In China, economic activity has shown some fragile signs of stabilisation while the evolution of prices remain deflationary.

Risks

- Geopolitical risks to the outlook for global growth remain tilted to the downside as developments in the Red Sea unfold and the war in Ukraine continues. An upward reversal in the price of Oil, US yields or the US dollar are key variables to watch.

- A risk would be a stickier inflation path than expected which could force central banks to reverse dovish rhetoric. In our understanding, it would take more than just the bumpy data registered at the start of the year.

- Beyond commercial real estate exposures, financial stability risks could return as a result of the steepest monetary tightening of the past four decades.

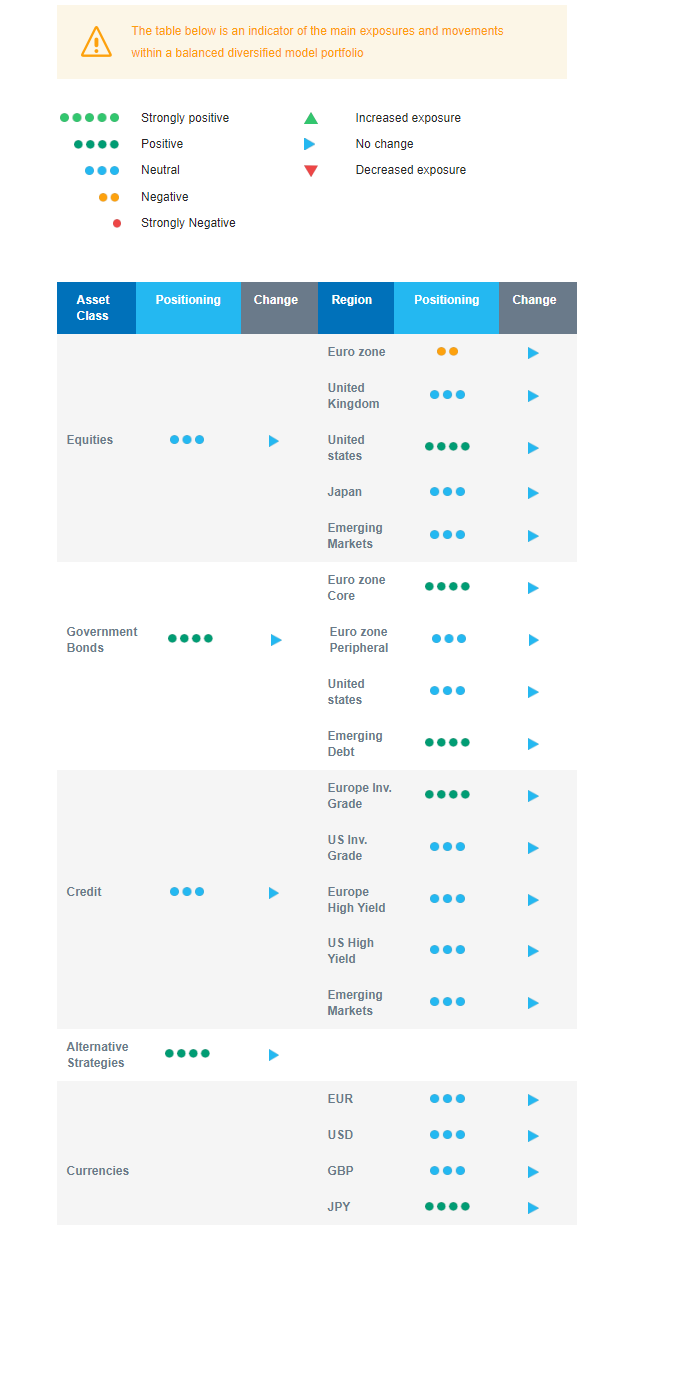

Cross asset strategy

- Our asset allocation is broadly balanced. We acknowledge the current momentum supporting the US equity market, have the weakest conviction on the European market and are neutral Japan and Emerging markets although both seem to have turned a corner.

- We have the additional investment convictions:

- We keep a neutral allocation as sentiment seems stretched and provided the absence of a sell signal in our proprietary analysis.

- We look for specific themes within Equities. As we expect a rangier market for the next couple of months for the broad market and because consensus expectations on the Technology sector may be overly optimistic, we downgrade our views on the US technology sector to a neutral stance. Our long-term outlook remains however strongly positive. We remain buyers of late-cycle sectors like Health Care. We look for opportunities in beaten down stocks in small and mid-caps or within the clean energy segment.

- In the fixed income allocation:

- We focus on high-quality credit as source of a pickup in yields.

- We also buy core European government bonds with the objective to benefit from the carry in a context of cooling inflation.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We maintain a neutral stance on US government bonds, looking for a new, more attractive, entry point.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets.

Our Positioning

The US market rally since October is exceptional compared to historical observations and we acknowledge the current momentum although after this atypical number of successive rises, the probability of a short term consolidation has risen. We have a supportive stance on US equities, are more cautious on the European market, neutral on Japan and Emerging markets. Within the fixed income segment, we are open to adding European duration, have less conviction on US duration. We also continue to harvest carry via Investment Grade credit and Emerging Market debt.