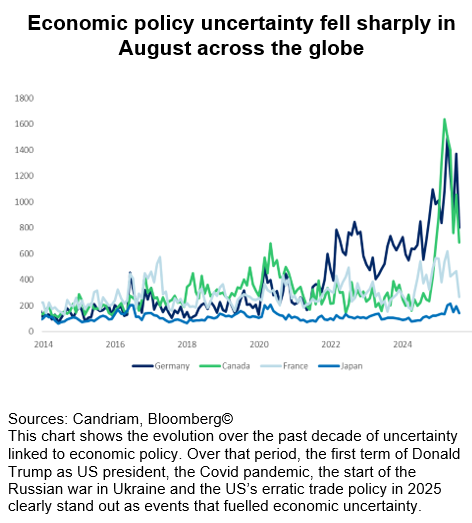

The global economy approaches the final stretch of 2025 at an inflection point. Financial markets, unsettled for much of the year by tariff escalations and a slowing US economy, now find comfort in an accommodative monetary policy path, less uncertainty in trade negotiations and a potential major political shift in the making at the Federal Reserve.

For investors, this alignment is both a relief and a challenge: it creates short-term visibility that supports risk assets, but also longer-term uncertainties that could, along with shifting trade relations, reshape the contours of the global economy. The resumption of cuts in the funds rate by the Federal Reserve is therefore not merely a technical adjustment by central banks, but likely the signal of a broader regime change, where monetary, political and geopolitical forces intersect. As a result, two adjustments in our allocation stand out this month: Japanese equities are upgraded to overweight and emerging market debt is lifted to slight overweight.

Better monetary policy visibility

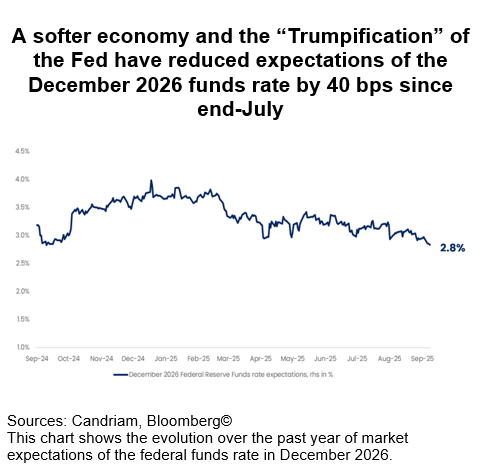

The immediate backdrop is one of easing economic anxiety. US growth has slowed, but the labour market’s softness has not turned into a collapse. We expect a slowdown towards 1-2% growth, but not a recession in 2025-26. Inflation remains under pressure from tariffs on imports, yet voters at the Federal Reserve have indicated their willingness to “look through” these temporary price effects. The result has been a decisive shift in market expectations: investors now see an extended series of rate cuts stretching over several quarters, designed to guard against downside risks to employment rather than to choke off inflation.

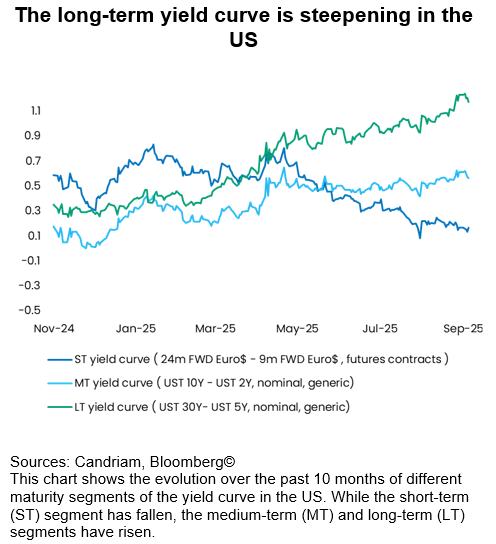

Bond markets started to reflect this new trajectory over the summer. The 2-year US Treasury yield has dropped sharply, the 10-year yield has fallen in tandem towards 4%, and the yield curve has steepened in a classic bull-steepening pattern. In line with historical precedents, we interpret this as a prelude to a sustained easing cycle.

In Europe, a similar though less forceful pattern has emerged: Bund yields have stopped rising at around 2.75%, while the ECB is keeping its options open if the fallout from higher US tariffs pulls activity downwards. Inflation expectations remain low, giving policymakers space to act if needed. That said, political uncertainty in France lingers in the background. While it has not yet spilled over into wider spreads in the region, the potential for renewed instability and little consolidation in public finances could unsettle the OAT-Bund spread.

The immediate implication is a reduction in risk premia across asset classes. Credit spreads have tightened over the period, equities have risen, and the US dollar has softened. Real yields have declined, creating conditions that once again favour duration and risk assets alike. This is the first take-away of the current environment: short-term monetary policy visibility has replaced the ambiguity of the summer months with a roadmap that markets can anchor to.

The “Trumpification” of the Fed

However, the larger story lies beyond this short-term relief. Under political pressure, the Federal Reserve is undergoing a profound transformation. President Trump has signalled his intent to reshape the institution, not only by appointing new governors, but by challenging the independence of regional Fed presidents. Earlier this month, US Secretary of the Treasury Scott Bessent called for big changes at Fed. The replacement of Fed Chair Jerome Powell next year, combined with new appointees more supportive of the administration’s goals, could cement a majority aligned with Donald Trump’s economic vision.

This “Trumpification” of the Fed has two key implications. The first is on the central banks’ reaction function. A Trump-influenced Fed would likely adopt a more activist stance:

- Prioritising employment over inflation stability.

- Looking through tariff-induced price increases.

- Moving more quickly towards cuts when labour market weakness emerges.

- Lowering estimates of the neutral rate and NAIRU (the Non-Accelerating Inflation Rate of Unemployment, referring to the lowest rate of unemployment that an economy can sustain without causing inflation to rise).

This would represent a sharp departure from the gradualist, data-dependent approach of recent years. It implies a tilt towards a politically sensitive, growth-biased central bank.

The second implication is on the economy and markets. In the short term, such a Fed would support nominal GDP growth through lower financing costs, weaker real yields and higher nominal earnings. Equities, particularly in sectors sensitive to domestic demand, would likely benefit. Gold and other real assets would also thrive, as investors hedge against the erosion of monetary discipline and rising inflation. The US dollar, meanwhile, would remain under pressure, in line with the US administration’s goal.

But the medium-term risks are significant. If markets perceive the Fed as sacrificing its independence, the credibility of US monetary policy could erode. This could trigger a bond market sell-off, raising long-term yields and undermining equity valuations. In such a scenario, quantitative easing or so-called Yield Curve Control might return not as a cyclical tool, but as a political necessity.

The “Trumpification” of the Fed therefore encapsulates the complexity of the current environment: attractive in the short term for risk assets, but potentially destabilising over time. We have both horizons in mind and accordingly refrain from adopting an outright bullish stance.

Better trade visibility

The third axis of improvement in recent weeks is trade. After months of tariff escalations and uncertainty, negotiations have yielded clearer contours. While frictions remain – particularly with China, India and, closer to us, Switzerland – progress with other trade partners has reduced tail risks. The result is greater visibility for exporters and supply chains, which had been operating under constant threat of disruption.

For the United States, the near-term costs of tariffs remain. Import prices have risen, and households face a squeeze on disposable incomes. Yet the international picture is less threatening: exporters in Europe and Japan now operate in a somewhat more predictable environment, and emerging markets most exposed to US demand have gained clarity.

This improved trade backdrop interacts positively with monetary policy. A dovish Fed and clearer trade conditions reduce volatility and encourage capital flows into regions previously shunned. We have noted that the VIX volatility index fell below 15 points on five consecutive days following the central bankers’ gathering at the Economic Policy Symposium in Jackson Hole. It has printed only 12 days below that level in 2025, nine of them in August.

Investment implications

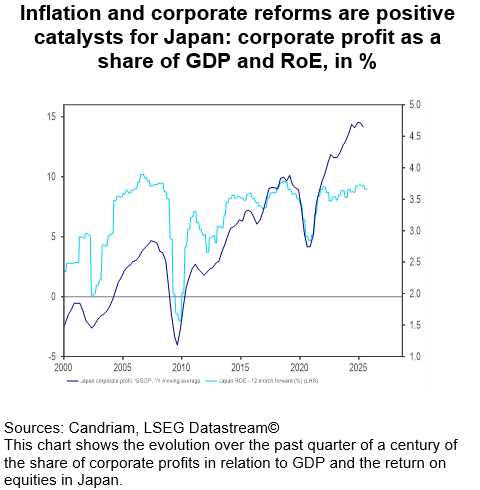

The autumn of 2025 marks the beginning of a new easing phase in global monetary policy. Better short-term visibility, the reshaping of the Fed and progress on trade negotiations have reduced immediate tail risks and created an improved environment for select investment calls. In our view, two stand out as immediate portfolio upgrades: Japanese equities and emerging market debt emerge as the clearest beneficiaries, each underpinned by structural and cyclical forces.

We upgrade Japanese equities to overweight

Among developed markets, Japan is the prime beneficiary of better trade visibility. With global supply chains less threatened, Japanese exporters can enjoy renewed stability. Domestically, the upcoming election campaign is likely to catalyse pro-growth policies, adding to already improving corporate governance standards and shareholder returns. Structural tailwinds – from automation to capital efficiency – are finally materialising in earnings.

We remain alert to new uncertainties that could resurface, from political interference at the Fed to latent instability in Europe. Outside Japan, we remain comfortable with a balanced and well-diversified positioning, with some tilts towards mid-caps in the US and in Germany, while continuing to favour resilient themes such as Technology & AI, European Industrials and adding to Healthcare.

We upgrade emerging market debt to slight overweight

In fixed income, we upgrade emerging market debt to slight overweight. We have become increasingly constructive in recent months. Several factors are converging: tariff relief improves the external outlook for many emerging markets economies. Dovish US monetary policy lowers funding costs and reduces the risk of sudden capital flight. Attractive yield levels provide a compelling risk-reward relative to developed market bonds, even though the spread levels have already tightened significantly. Last but not least, we note improved investor appetite for emerging market debt, a welcome change from the past several years.

Elsewhere, we remain constructive on core European duration. We remain neutral on US Treasuries and prefer European IG over HY.

In currencies, we favour the Japanese yen and maintain selective long positions in EM currencies where real rates and fundamentals align. We remain underweight on the US dollar.

Precious metals, alternatives and market-neutral strategies: gold and silver represent a strong hedge in a world of geopolitical complexity, real rate volatility and a more dovish Fed. We also maintain our allocation to alternative strategies.

Candriam House View & Convictions

Legend

-

Strongly Positive

-

Positive

-

Neutral

-

Negative

- Strongly Negative

- No Change

- Decreased Exposure

- Increased Exposure

| Current view | Change | |

|---|---|---|

| Global Equities |

|

|

| United States |

|

|

| EMU |

|

|

| Europe ex-EMU |

|

|

| Japan |

|

|

| Emerging Markets |

|

|

| Bonds |

|

|

| Europe |

|

|

| Core Europe |

|

|

| Peripheral Europe |

|

|

| Europe Investment Grade |

|

|

| Europe High Yield |

|

|

| United States |

|

|

| United States |

|

|

| United States IG |

|

|

| United States HY |

|

|

| Emerging Markets |

|

|

| Government Debt HC |

|

|

| Government Debt LC |

|

|

| Currencies |

|

|

| EUR |

|

|

| USD |

|

|

| GBP |

|

|

| AUD/CAD/NOK |

|

|

| JPY |

|