Trending positively, but still underperforming the US

European equities were slightly higher in August but continue to underperform US equities. European macro data were mixed, with PMIs improving in manufacturing but weakening in services. Across the region, Spain and Italy outperformed, while Germany and France lagged. Germany was hit by sectoral exposure, with Industrials, Construction & Materials and Defence all closing down on the month, while France sold off on political developments.

European equities were slightly higher in August but continue to underperform US equities. European macro data were mixed, with PMIs improving in manufacturing but weakening in services. Across the region, Spain and Italy outperformed, while Germany and France lagged. Germany was hit by sectoral exposure, with Industrials, Construction & Materials and Defence all closing down on the month, while France sold off on political developments.

Growth large caps in the spotlight

Since our last Committee in August, European markets have risen slightly, with large caps clearly outperforming mid and small caps for the first time in several months. Within large caps, Growth stocks outperformed Value stocks.

There was no performance dispersion between cyclicals and defensives.

Among cyclicals, the best-performing sectors were Consumer Discretionary (benefiting from better visibility after the US/EU trade agreement signed at the end of July) and Materials, followed by Financials and Industrials, while Real Estate was the only cyclical sector to decline.

Among defensives, Healthcare and Consumer Staples outperformed. Meanwhile, Energy remained broadly stable and Utilities were in red territory, after a strong performance since the beginning of the year.

Lastly, the IT sector rebounded, notably driven by ASML, which more than offset the sell-off seen in the software segment, while Communication Services declined due to mixed Q2 results.

Earnings expectations & valuations

Following the disappointing Q2 earnings season in Europe, EPS growth expectations in Europe for 2025 have been cut again, to +0.3% (vs +1.7% four weeks ago). Consensus still expects 2025 EPS growth to be driven by Real Estate (+12%) and Healthcare (+9%), while several sectors are suffering as a result of negative earnings growth expectations (Consumer Discretionary, Energy, Materials, Communication Services and Consumer Staples).

Since the last Equity Committee, European valuation multiples have increased, with 12-month forward P/E now at 14.7x (vs 14.1x), at the high end of their historical range. IT and Industrials remain the most expensive sectors (24.3x and 20.4x respectively), while Energy is still the cheapest (10.0x).

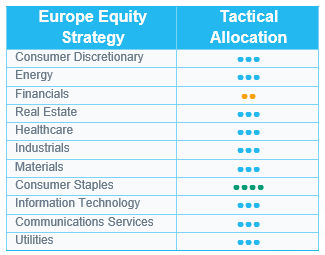

No change to sector grades

We have not made any structural changes to our sector allocation in recent weeks.

We have maintained our positive grade (+1) on Consumer Staples (which should be resilient in a more challenging environment) and our negative grade (-1) on Financials (due to stretched valuations), while remaining neutral on all other sectors.

US equities: Supportive interest rates and earnings reports

US equity markets continued their rally over the past few weeks, supported by a strong earnings season and rising expectations of interest rate cuts by the Federal Reserve. Investors are now pricing in at least two rate cuts towards the end of the year, providing a relative boost to small-cap stocks.

Risk appetite increased

US equity markets have performed strongly over the past few weeks, with investors’ risk appetite increasing over a robust earnings season and growing expectations of Federal Reserve rate cuts. Small-cap stocks outpaced large caps, benefiting from lower rates.

At sector level, Utilities was the only sector to post a negative performance, weighed down by relatively high valuations despite lower rates. Consumer Discretionary and Communication Services strongly outperformed the broader market, followed by Materials and Healthcare, which benefited from positive news flow and attractive valuations. Information Technology underperformed, despite reporting strong earnings.

Strong earnings

Second-quarter earnings in the US came in better than expected. Over 80% of S&P 500 companies reported a positive earnings surprise, driving blended year-over-year earnings growth of 12% (the third consecutive quarter of double-digit growth). The largest surprises came from Financials, Communication Services, Information Technology and Consumer Discretionary. Only three sectors saw earnings declines, with Energy performing the weakest.

During this reporting season, companies delivering positive surprises were rewarded less than usual, while those missing estimates faced stronger-than-average market punishment. Looking ahead, the expected 12-month earnings growth rate remains around 12%. Against this backdrop, the S&P 500’s 12-month forward price-to-earnings ratio stands at 22.4, above both its 5-year and 10-year averages, but not yet excessively high.

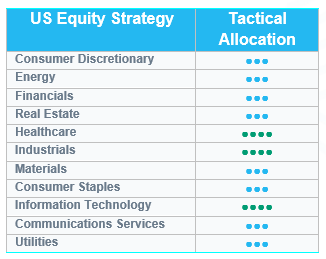

Healthcare upgraded to +1

We are turning more positive on the Healthcare sector, supported by a combination of favourable factors.

- The slowing US economy, weakening employment and potential benefits from lower interest rates make defensive sectors like Healthcare increasingly attractive.

- The regulatory environment is improving, with the FDA highly functional and year-to-date approvals of new drugs running above the 10-year average, providing a supportive backdrop for innovation.

- Trade risks remain manageable, as EU/US tariffs are limited and manufacturing can be shifted or on-shored to the US if needed.

- Academic funding is stabilising, with the worst-case scenario avoided, while valuations are near a 35-year low, offering an appealing entry point.

- Additionally, M&A activity is picking up, adding further upside potential.

While some uncertainty remains around drug pricing policies and vaccines, these factors are manageable and the overall environment points to a favourable opportunity to increase exposure to the Healthcare sector.

Emerging equities: China’s market sentiment remains resilient

Emerging markets sustained their upward momentum in August. The MSCI EM NR© Index rose by 1.2% (in USD), but lagged behind the MSCI World NR© (+2.5%). The month was defined less by exuberance than by a tug-of-war between political headwinds and bursts of local resilience.

China (+4.9%), long weighed down by policy uncertainty, staged a revival. A 90-day extension of US tariff suspensions buoyed sentiment. Liquidity shifted from bonds and housing into equities. Retail activity returned, volumes surged, and the government’s “anti-involution” stance lent further support. India (-2.4%) was attacked by Trump’s new tariff threats. He accused India of buying large quantities of Russian oil.

Latin America (+7.5%) gained notably. Brazil (+9.2%) shrugged off fresh US tariffs and domestic political noise, and was aided by disinflationary signals and hopes of earlier monetary easing. Colombia (+12.0%) and Chile (+11.2%) surged by double digits. Their equity markets were buoyed by strong domestic demand.

Currencies mirrored the pattern of selective strength. The dollar weakened further, following Jerome Powell’s Jackson Hole speech and rising bets on imminent Fed cuts. For the commodity segments, Brent slumped (-6.1%) on supply concerns and faltering global demand, while copper (+3.8%) advanced and precious metals soared, with gold (4.8%) reaching yet another all-time high. US yields ended the month at 4.23%.

Outlook and drivers

Jerome Powell’s Jackson Hole speech confirmed a dovish tilt, highlighting the Fed’s readiness for a “fine-tuning” rate cut in September, should labour market risks rise. He framed potential easing as “insurance-style,” downplaying tariff-driven inflation as temporary to avoid unnecessary labour market slack. This signals US policy rates have likely peaked, with real yields already eroding as easing expectations grow. Global growth implications are constructive: resilient capex tied to the AI cycle and slower tariff implementation have kept financial conditions loose, supporting growth upgrades. Meanwhile, a weaker dollar narrative has been strengthening as capital flows shift toward economies outside the US with improving relative prospects.

China’s market sentiment remains resilient, underpinned by abundant liquidity and steady policy support. Onshore markets have strengthened significantly, reflecting improved domestic confidence, though valuations now look fair rather than cheap as risk premiums have normalised. Earnings expectations show signs of stabilising, with revisions turning positive in key sectors such as tech hardware, food and entertainment. Combined with policy momentum and improving sentiment, this underpins a constructive outlook for Chinese equities into late 2025.

Metals are extending their solid uptrend. Gold climbed to a historic high, supported by resilient central bank purchases that continue to anchor demand. Copper advanced sharply, propelled by new US tariffs on select copper-based products. Its long-term support is underpinned by persistent structural demand from global grid upgrades. The dynamics not only strengthen the case for the metal itself, but also create tailwinds for a broader set of EM companies positioned along the electrification and infrastructure value chain.

Positioning Update

There is no change to regional ratings. China showed continued signs of improvement. Taiwan recovered on positive news in the technology sector.

There is no change to sector ratings. We prefer names related to metals in Materials, and defence in Capital Goods. Chinese large caps in the consumption space are supported by their investments in AI.

Regions

China

We remain overweight in Chinese equities, though with tempered conviction. Valuations have come in above historical averages after a resilient domestic sentiment. The usual premium shown in H-shares against A-shares reversed and reached a historic high. Regarding tariffs, the US extended its suspension of tariffs on China for another 90 days. Negotiations are ongoing between the US and China, and China sent a delegation to the US in early September for a new round of talks. China’s domestic economy remains weak. The government launched an “anti-involution” campaign which aims at curbing excessive corporate competition to prevent further erosion in profitability across sectors. Stimulus measures have been targeted at consumers but remain incremental in scale, insufficient to offset broader headwinds. The picture remains mixed for large consumer names (Alibaba, Meituan, PDD, JD.com). Their stock performance is more supported by engagement in AI investments than fundamentals. Investor positioning is still light in China.

Taiwan

We remain overweight in Taiwan equities, with the market continuing to benefit from positive momentum in the AI and semiconductor space. Sentiment was lifted by the US decision to allow exports of NVIDIA’s H20 chips to China, a move that underpinned optimism across the supply chain. However, this was followed in early September by a reversal, as Washington imposing stricter rules on TSMC (as well as SK Hynix and Samsung) for their sales to China. Earnings remain robust, particularly within tech hardware, where companies have rallied on the favourable long-term outlook for AI adoption and semiconductor demand. Nonetheless, volatility persists, with US policy shifts in mid-August triggering rotation and profit-taking across Taiwanese technology stocks. Despite these fluctuations, the structural drivers of growth in AI and advanced hardware continue to support the overweight stance.

Sectors

Materials

Gold maintained its strong upward trajectory throughout August into early September. Its rise was underpinned by persistent expectations of US interest rate cuts, concerns over central bank independence and sustained central bank purchases—particularly from emerging markets seeking dollar alternatives. Copper is growing increasingly into a strategic resource in a geopolitical context.

Industrials – Capital goods

In the sector, we prefer defence names, which continue to grow amid rising demand for European autonomy. Emerging country partners, such as South Korea, benefit from strong expertise and advanced production capabilities, positioning them to capture significant potential. Additionally, several robotics companies are also found within the sector, leveraging technological development to deliver innovation and performance.

Technology

The US allowing the export of Nvidia’s H20 chip to China was positive news in August. The geopolitical context still dominates sentiment in the sector, while company fundamentals remain solid across Asia. Chinese names are additionally supported by domestic sentiment, which is looking for technological independence away from the US.