Research Papers

Research Paper, Vastrentende effecten, Bob Maes, Philippe Dehoux

Wil je het hebben over euro swapspreads versus Amerikaanse swapspreads? Daar kijken we ook naar. Maar om eerlijk te zijn, is die grafiek een van de laatste dingen waar we naar kijken als we euro vastrentende portefeuilles beheren. Dus als je het wilt zien, moet je eerst de rest van deze pagina lezen.

Research Paper, Alternative Investments, Pieter-Jan Inghelbrecht, Johann Mauchand, Steeve Brument

Diversificatie herstellen

Is de diversificatie van een 60/40 portefeuille gewoon op pauze of heeft deze strategie definitief afgedaan?

Olivier Clapt, Activa-allocatie, Research Paper

Aannames voor de kapitaalmarkt - Rendementsverwachtingen voor de lange termijn

Hoewel navigeren aan de hand van de sterren dapper en avontuurlijk kan lijken, zouden we het niet aanraden op financiële markten. Je kunt maar beter een goed kompas hebben! In een wereld die voortdurend verandert, hebben beleggers begeleiding nodig bij hun beslissingen over activaspreiding. Met deze langetermijnvoorspellingen verrijken we hun gereedschapskist voor portefeuilleconstructie.

Q&A's

Q&A, Money Market, Pierre Boyer

Geldmarktstrategieën: als contant geld koning is

Geldmarktstrategieën zijn bedoeld om beleggers een liquide manier

met een laag risico te bieden om hogere rendementen te genereren dan

met traditionele spaarrekeningen. Pierre Boyer, Elodie Brun en Benjamin

Schoofs, portefeuillebeheerders, delen hun inzichten over de

beleggingsklasse.

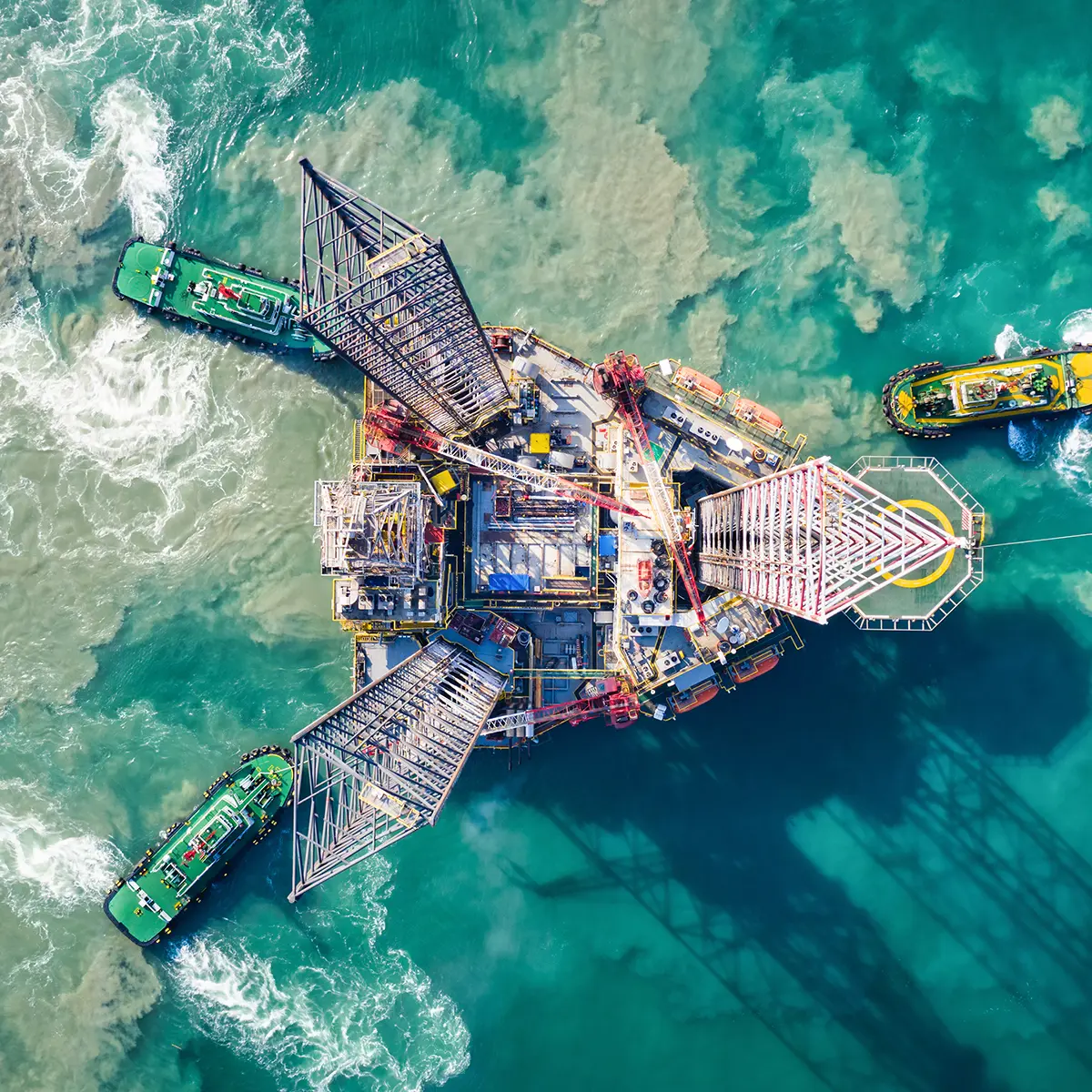

Q&A, Christopher Mey, Emerging Markets, Nikolay Menteshashvili

Kansen ontsluiten: een gids voor beleggen in bedrijfsobligaties van opkomende markten

In een wereldwijde omgeving die voortdurend in beweging is, bieden opkomende markten onderscheidende mogelijkheden voor beleggers die op zoek zijn naar diversificatie en rendementsverbetering. Bedrijfsobligaties van opkomende markten vertegenwoordigen een activaklasse van meer dan $1 triljoen, die robuuste fundamentals combineert met een sterk rendementspotentieel. Nikolay Menteshashvili en Christopher Mey, portefeuillebeheerders, leggen in detail uit waarom deze beleggingsstrategie de aandacht van beleggers verdient, hoe ze aantrekkelijke, voor risico gecorrigeerde rendementen kan bieden en wat de belangrijkste vereisten zijn om met succes door dit complexe maar veelbelovende universum te navigeren.

Q&A, ESG, SRI, Kroum Sourov, Christopher Mey, Emerging Markets

Duurzaam: een opkomende markt voor opkomende schulden

Kroum Sourov en Christopher Mey, portefeuillebeheerders van de duurzame obligatiestrategie voor opkomende markten, beschrijven het belang dat dit type analyse kan hebben voor een obligatieportefeuille. Ze leggen het beleggingsproces van Candriam uit, met onze nadruk op relatieve waarde en risicobeheer. Deze aanpak is bedoeld om de strategie aan te passen aan de steeds veranderende markten in de loop van een conomische cyclus.

Transparency Code

U vindt de Transparency Codes op de pagina's van de fondsen.

Duurzaamheidsoverzicht

Duurzaamheid en verantwoordelijkheid moeten deel uitmaken van de persoonlijkheid en de cultuur van de onderneming. We hebben Verantwoordelijkheid nodig om het te vertalen naar uw beleggingen.