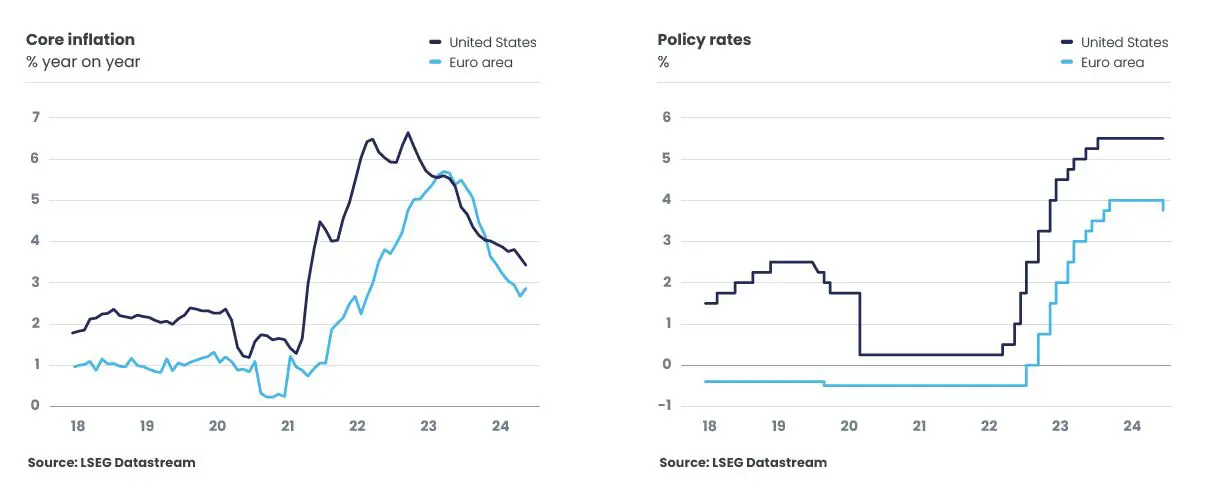

At the start of summer 2024, growth continues, but its pace remains uneven across countries and regions. China is still facing deflationary pressures, the eurozone is making slow progress, while growth in the United States, still close to 2%[1], seems to be slowing a little. Wherever inflationary pressures have been felt, they have continued to abate over the months, paving the way for a cautious easing of monetary policy.

China : growth stalls...

Among the major economies, China is the only one where value-added prices are falling: beginning of 2024, while real GDP was growing by just over 5% year-on-year, nominal growth was barely above 4%, well below the 9% average observed over the second half of the 2010 decade[2] ! The country is no longer able to absorb the enormous mass of savings it generates every year. This "savings glut" had, for a time at least, found its counterpart in a vast infrastructure investment program, largely financed by local authorities. The decline in their revenues, linked in particular to the fall in land sales, is now limiting their ability to finance an ever-increasing number of infrastructure projects. The government is now trying to "channel" excess savings into financing industries of the future (solar panels, batteries, electric vehicles, etc.). The limits of this strategy are likely to become apparent very quickly: as with the photovoltaic industry, and in the absence of sufficient domestic demand, China will be faced with overcapacity and will have to look abroad for an outlet for its production. However, it is likely to encounter strong resistance from its American and European partners. Europe's decision to increase taxes on electric vehicles if no agreement is reached echoes the increase in customs duties decided a few weeks earlier by the United States! Against this backdrop of trade tensions, it is futile to hope that monetary policy will come to the rescue. The current easing of mortgage rates has had little traction on household borrowing: despite mortgage rates having fallen by almost 200 basis points since mid-2022[3], real estate lending is still not responding. As long as households continue to have a high saving rate, and as long as the authorities do not rebalance growth in favor of consumption, and in particular do not make an effort to strengthen the social safety net, growth is likely to remain disappointing.

United States: Fed remains cautious...

In the United States, growth continued at the start of the year, underpinned by still solid consumption. The dynamism of job creation is no stranger to this situation: far from slowing down, job creation has risen, in monthly terms and smoothed over three months, from less than 200,000 in November 2023 to almost 250,000 in May 2024[4]. However, the arrival on the job market of an ever-increasing number of migrant workers has prevented the labor market from tightening up: for several months now, the unemployment rate has been gradually rising. The past tightening of financial conditions should now contribute to slowing growth. Interest rates on consumer credit are high, and credit card defaults have just risen significantly. Still elevated mortgage rates and rising house prices should also weigh on residential investment. As for the support provided by public spending and the implementation of the Inflation Reduction Act, this is gradually fading. Against this backdrop, growth is expected to slow from an average of 2.5 % in 2024 to 1.7 % in 2025[5].

Source : LSEG Datastream

Nevertheless, the Federal Reserve has every reason to remain cautious: inflation in services, even though it eased in May, is still too high in relation to its target. If the easing in the labor market continues, the Federal Reserve should still be able to cut interest rates twice this year, with the first cut in September. Migration policy - J. Biden has just signed an executive order which, if implemented, would reduce the number of adults entering the U.S. illegally by 85,000 per month - and, more generally, the economic policy to be followed after the November 5 elections could, however, significantly alter the trajectories of growth and inflation in 2025 and, with them, that of monetary policy.

Euro zone : towards a sustainable rebound in activity?

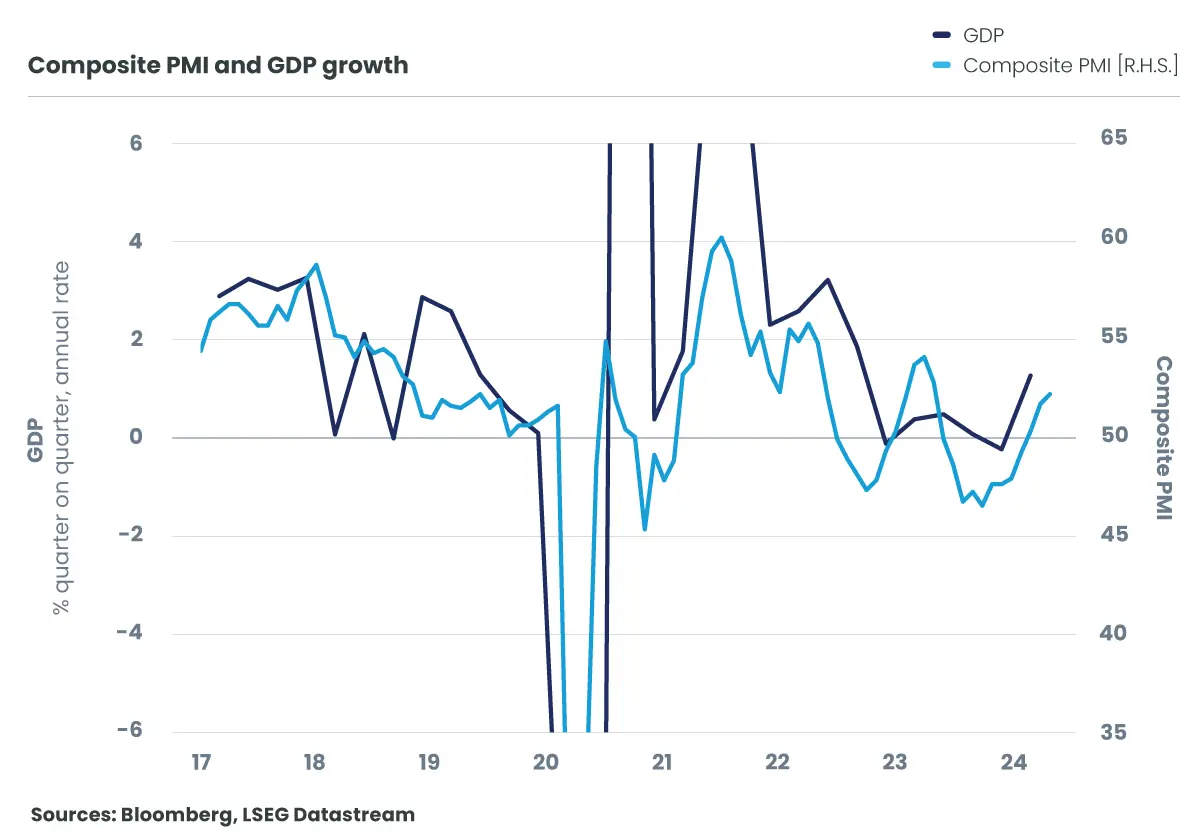

After two years of high inflation and stagnant activity, the euro area economy is showing signs of improvement. GDP grew at an annual rate of 1.3% in the first quarter[6] and PMI surveys point to an ongoing recovery. The increase in household purchasing power should ultimately support consumption and thus the upturn in activity: after 0.6 % in 2023, growth should gradually accelerate to 0.8% in 2024 and slightly above 1% in 2025[7].

Above all, inflation fell sharply to 2.6% year-on-year in May[8]. With this improvement, the European Central Bank decided in early June to cut rates for the first time since... 2019! Indeed, the decrease in inflation is not due solely to the fall in energy prices. Core inflation (excluding energy and food) also fell significantly. This is particularly true of goods whose prices had risen sharply as a result of the severe disruption to supply chains in the wake of the pandemic. Their return to a more normal functioning put an end to this rise. Within services, progress has been more tentative. Certainly for those with a low labor content, inflation has returned to a pace almost in line with the ECB's expectations. But this is still not the case in services where labor represent a high proportion of production costs. For the disinflation process to continue as the central bank hopes, a slowdown in wages is now necessary... but not sufficient. Productivity gains, at a standstill since 2017, also need to recover. Over the next few quarters, the acceleration in activity should help, especially as companies have been hoarding labor since the pandemic. Beyond that, however, without a revival in productivity gains, the central bank may find it difficult to continue cutting rates. Like the Federal Reserve, the European Central Bank has every reason to remain cautious !

This document is provided for information and educational purposes only and may contain Candriam opinions and proprietary information. It does not constitute an offer to buy or sell financial instruments, nor does it constitute investment advice, nor does it confirm any transaction, unless expressly agreed otherwise. Although Candriam carefully selects the data and sources it uses, errors and omissions cannot be ruled out. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval. Information disclosed is subject to change without notice.

[1] Source : BEA

[2] Source : NBS

[3] Source : Bloomberg

[4] Source : BLS, Candriam calculation

[5] Candriam estimates

[6] Source: Eurostat

[7] Candriam estimates

[8] Source: Eurostat