The " soft landing " scenario is confirmed...

Our allocation strategy for the second half of the year is based on an economic environment that remains favorable for equities, and is improving for bonds.

We anticipate a slowdown in US activity, in line with a " soft landing " scenario (activity decelerating below 2 % annualized from the second half of 2024), a very gradual economic recovery in Europe, and still robust growth in Asia. Global economic growth is expected to be around 3.5%[1] annualized. At the same time, disinflation should continue, with core CPI around 3 % at the end of the year in the United States[2]. This context is positive overall for equities and bonds.

... and is one of the best possible backdrops for action.

While investors' expectations of earnings growth over the next 12 months seem credible for the USA (around 10 %), Europe (5 %) and Japan (6 %)[3], there is greater uncertainty for emerging countries : earnings per share growth is currently expected at 16 %, after downward revisions in 2022 and 2023.

Following the strong performance of equities in the first half of the year, valuations remain reasonable overall : P/E for the next 12 months is below 14[4] in Europe, around 12 in emerging countries, and 15.5 in Japan, in line with 20-year historical averages. Only the United States has a P/E above its long-term average, above 20 - a high level linked to the growing weight of the technology sector and the " Megacaps "[5]. The free cash flow/sales ratio, which takes into account the substantial cash flow generated by these companies, nevertheless indicates valuations in line with the historical average of the last 30 years, and below the level of the TMT bubble of the early 2000s[6].

Equity valuations should also benefit from the start of the central bank rate-cutting cycle. Historically, the Fed's first rate cut is followed in 80% of cases by a positive performance by US markets[7].

In addition, the start of the rate-cutting cycle by the major central banks should redirect investors' allocations towards longer-term assets. After eighteen months of inflows, money market funds are set to lose ground to longer-duration bonds and equities. Investors seem to be rebuilding a stronger exposure to equities after the shock of 2022.

Towards wider participation in the growth of profits ?

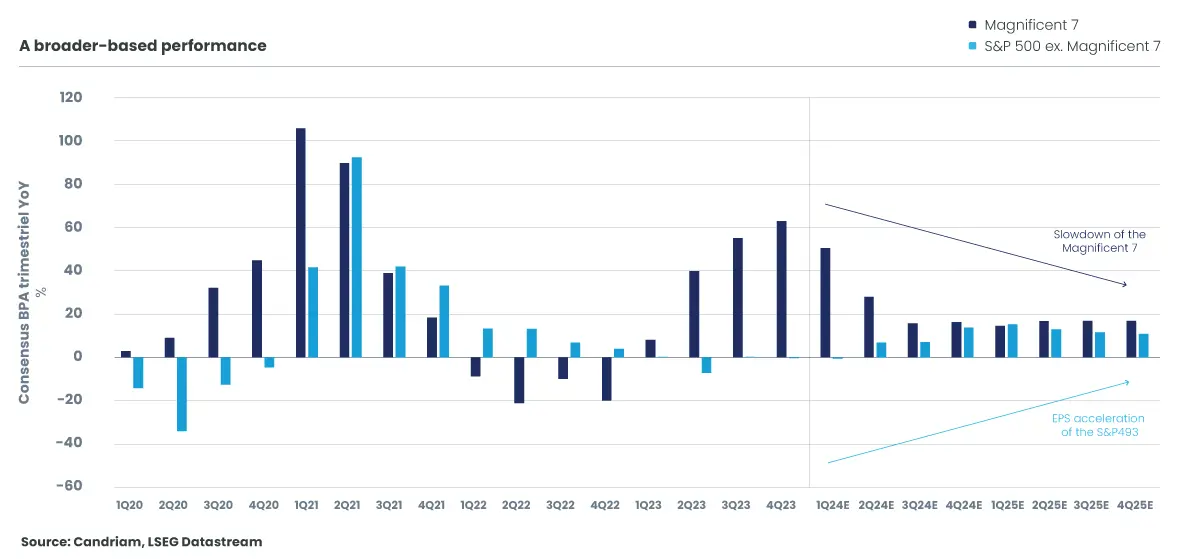

In the US market, we remain positive on the technology sector, which should continue to enjoy strong earnings and cash flow growth. After 4 quarters of dominance by the magnificent 7 (over 40 % increase in earnings, largely driven by Nvidia[8]), the other 493 S&P500 companies are forecast to deliver positive earnings growth and close the gap with the Megacaps. In this hypothesis, the rise in financial markets would be healthier, as it would be driven by the positive performance of a greater number of stocks.

Past performance is not a reliable indicator of future performances. Markets could develop very differently in the future.

In Europe, we are increasing our exposure to small- and mid-cap companies in order to benefit from the gradual upturn in business. Indeed, these companies in Europe have underperformed the largest caps by 25 % since 2022[9], and by almost 5 % since the beginning of the year. The performance of small and mid-caps is strongly linked to the progress of leading economic indicators such as PMIs, and should be supported by an improvement in macroeconomic factors over the coming months, as well as by the first rate cuts by the European Central Bank. Over the past 40 years, small and mid-caps have outperformed by 8 % in the 12 months following the first rate cut.

The best possible diversification between asset classes...

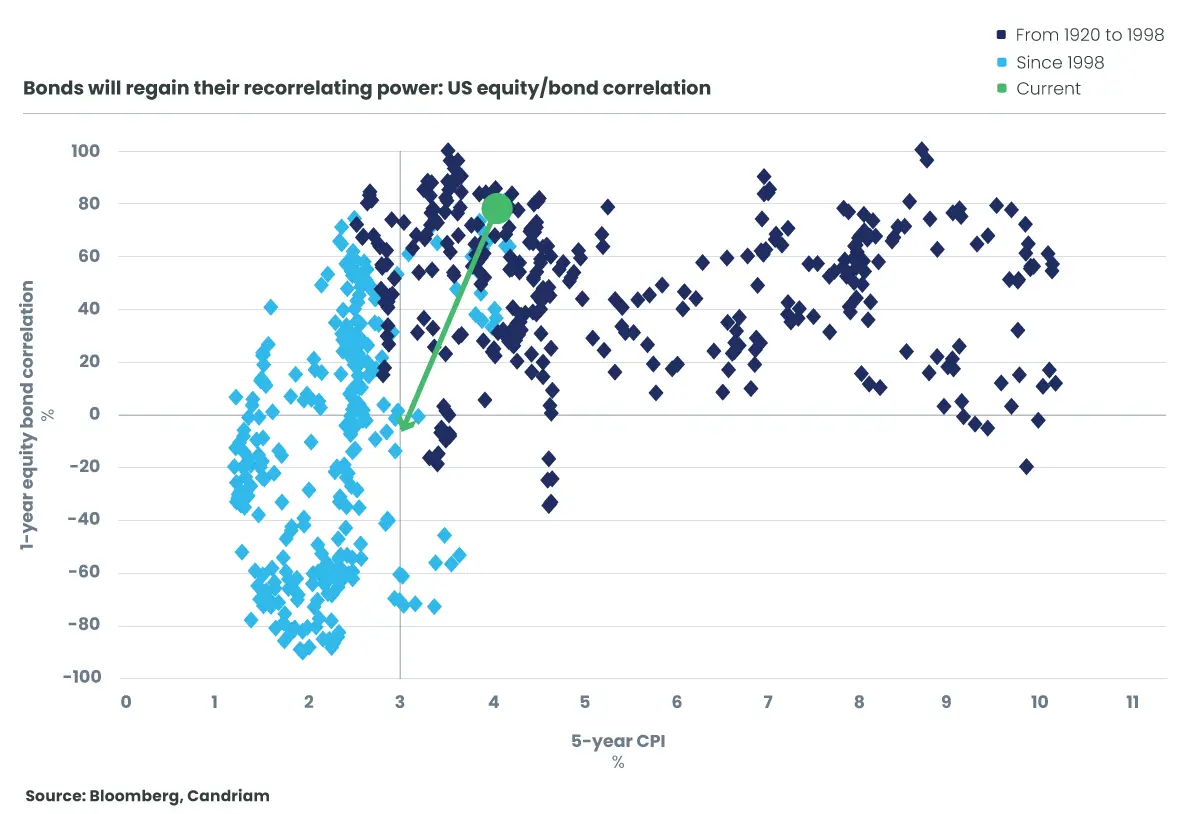

The positive correlation between equities and bonds in recent years has complicated the management of diversified portfolios, with the prices of both major asset classes moving in the same direction. Rate hikes led to declines in equity markets and bond prices, while any easing in long-term rates enabled equity and bond markets to post positive performances. Our quantitative analysis shows that this is historically the case when inflation exceeds 3 %, which has been the case since the end of the Covid. Below this threshold of 3 %, the correlation between equities and bonds can drop and become negative again, allowing effective diversification between equities and bonds. In our economic forecasts, we expect to fall below this 3% level in the United States by 2025.

The presented scenarios are an estimate based on past and/or current market conditions and are not an accurate indicator.

Our allocation is rounded out by exposure to gold, which has outperformed our expectations since the beginning of the year, thanks to strong demand from certain central banks (notably China). We believe that over the next few months, the macroeconomic context should become more favourable once again (possible fall in US real interest rates), while central bank demand for gold should remain strong over the medium term.

...should make the gradual increase in duration more efficient

In addition to a long exposure to equities, we are therefore adding a progressively longer duration exposure to bonds. Our economic forecasts show that, with a " soft landing " in the United States and relatively weak economic growth in Europe, an easing of long rates is possible. In this way, we benefit from both an attractive carry and a cushioning effect in the event of a downturn in equities.

We will be more selective in both government bonds and credit. After the sharp tightening of spreads in the first half of the year[10], the risk/return profile of certain bonds seems less attractive to us. At current spread levels, US high yield bonds implicitly assume a default rate close to 0.

The risks identified for the second half of the year are primarily political in nature.

The French parliamentary elections are an unexpected first step that could lead to further political instability in France. Their triggering had a direct impact on the spread of French debt, which, at a level close to 80 bp (compared with German rates), quickly incorporated part of this risk. French and European equities were also penalized, especially certain companies and sectors such as French banks and utilities. The challenge for our overall asset allocation will be to understand, after the elections, to what extent this instability may accentuate the rise in risk premiums (on French debt, on certain equities) and possibly alter our fundamental vision. Pending the results, we have partially reduced our allocation to European equities and cut our exposure to French debt. Nevertheless, we believe that the risks of contagion to other European countries are limited, and that the ECB has the means to limit these effects if necessary.

In the United States, the presidential election will also be a key milestone for the financial markets. Historically, equity markets move sideways in the three months preceding the presidential election, with increased volatility. One of the most unfavorable outcomes of the election would be the 100% implementation of Donald Trump's inflationary and growth-destroying program. In this scenario, with the risk of " stagflation ", exposure to the US dollar and certain commodities such as gold could limit the portfolio's downside risk. In the event of a more nuanced and reasonable outcome, financial markets should return to fundamentals, which we consider to be rather good for equities and bonds.

In any case, and despite this generally positive environment, the second half of 2024 is likely to continue to be fraught with uncertainty for investors, a source of volatility often favorable to dynamic, active portfolio management.

This document is provided for information and educational purposes only and may contain Candriam’s opinion and proprietary information, it does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval. Information disclosed is subject to change without notice.

[1] Source: Candriam estimate

[2] Source: Candriam

[3] Source : Ibes Datastream, MSCI indices, June 2024

[4] Source: Ibes Datastream, MSCI indices, June 2024

[5] The weight of technology stocks and " megacaps " has risen from 20% of the index in 2004 to 42% today (S&P500).

[6] The S&P500 as a whole has seen its Free Cash Flow/Sales ratio double from 6% to 12% between 2004 and today (source: UBS). In the early 2000s, the P/FCF was between 30 and 40, whereas it is now 25.

[7] Source: Candriam

[8] Source: Candriam, LSEG Datastream

[9] Source: Bloomberg

[10] Bloomberg – ICE Bof1 – Spread reduction YTD: -46 bps Euro/HY / -18 bps Euro IG, 27/06/2024