Market neutral strategies involve taking both long and short positions on assets, aiming to exploit relative value or price inefficiencies. They target a low net exposure to the equity market, and a low to moderate level of volatility. We have identified two distinct market areas where we strive to extract value while offering regular returns:

- Market events linked to the growth of passive investments and

- Quantitative multifactor investing with an ESG framework.

Taking advantage from a structural trend: The growth of passive investing

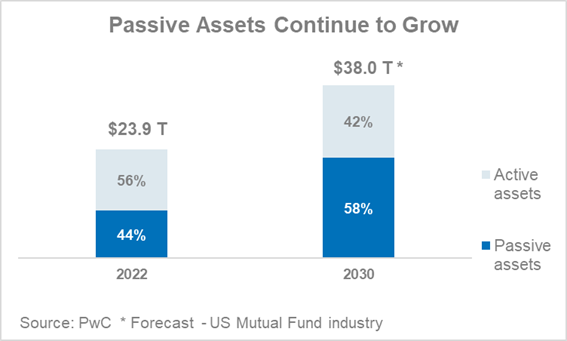

Over the past decades, the financial industry has been profoundly shaped by the steady growth of passive investing. PwC expects that by 2030, passive funds may represent 58% of total US mutual fund/ ETF industry assets[1]. The pricing distortions generated by this phenomenon can be transformed into investment opportunities.

First, index rebalancing events trigger large in- and outflows that may result in temporary price spreads. Our investment team closely monitors these events in the aim to generate returns through a combination of long and short positions on listed stocks.

Secondly, investment flows into passive strategies create opportunities by amplifying pricing discrepancies between securities, depending on whether they are included in an index or not. The relative value trades implemented by our team aim to exploit these mispricings. The opportunity set is substantial, as passive investment keeps rising globally.

Multifactor quantitative equity: Aiming to drive consistent alpha by combining quantitative financial and ESG analysis

Our ESG market neutral strategy aims to combine long positions in fundamentally sound companies with strong environmental, social and governance (ESG) credentials, with short positions in companies with weaker financials and poor ESG scores. By balancing these positions, we aim to capture the return spread between the two groups, which we expect to be positive over time and largely uncorrelated with traditional asset classes. Our systematic investment process enables us to seamlessly integrate both ESG and financial metrics, with the goal of generating long-term value - an approach we believe is both original and compelling.

While index rebalancing and index-related relative value strategies are usually implemented by multi-strategy funds or proprietary trading houses, we have packaged them through a UCITS fund format with daily liquidity.

Our market neutral strategies come with distinct expected volatility levels to accommodate various investor needs.

Equity long/short strategies can help stabilise portfolio performance when combined with other asset classes such as equities and bonds. Indeed, their historical low correlation with most traditional asset classes, including in downside movements, has a smoothing effect on the portfolio’s fluctuations. They can also help reduce portfolio risk.

Figures are worth a thousand words.

- € 740 million Assets under Management

- 3 Levels of risk

- 15 Investment professionals dedicated to these strategies

- 26 ESG experts

Want to explore our experts’research

Do you want to know more about our alternative funds?

Main risks associated with the strategies

- Risk of loss of capital

- Equity risk

- Derivative risk

- Counterparty Risk

- Arbitrage risk

- Sustainability risk