Last week in a nutshell

- At first sight, the US job report for November came out rather solid as the unemployment rate fell from 3.9% to 3.7%. But excluding the strike in the auto sector, Q4 confirms a slowing labour market.

- EU finance ministers gathered in Brussels to continue their discussion on the reform of the stability and growth pact and new EU fiscal rules.

- China’s President Xi Jinping warned EU representatives to avoid “confrontation” and reminded his willingness for economic cooperation during a China-EU summit in Beijing.

- China’s Politburo announced its intention to stimulate the country’s domestic demand and enhance economic recovery.

What’s next?

- The main focus will be on several central banks gathering for their final meeting of the year, notably the Fed, the ECB, the SNB and the BoE. The press conferences should help investors to schedule the start of the monetary easing cycle in 2024.

- In the US and the EU another wave of macroeconomic releases will hit, notably Flash PMI estimates for December.

- China will publish its Industrial Production and Retail Sales data, giving some insights on its economic conditions and the potential size of the upcoming stimulus.

- Venezuela and Guyana will remain under the radar as President Maduro is heading to Moscow before year’s end and his party claimed majorities in favour of a referendum to extend the country’s territory to its neighbour’s oil-and-minerals-rich region, Essequibo.

Investment convictions

Core scenario

- The desynchronisation growth continues. The US economy is growing on a softening trend as well as inflation, backing the last Federal Reserve bank’s decision to pause monetary tightening and keep interest rate high for long.

- Europe remains in the worst fundamental situation, with economic and inflation data coming in below expectations (negative surprises). This does, however, take some of the pressure off the ECB, which should regain its easing capacity more quickly than expected in 2024 if necessary.

- In China, economic activity and the evolution of prices have shown some timid signs of stabilisation while the housing sector remains a drag.

- The perception of a softer bias from developed countries’ central banks has led to a significant downward repricing in bond yields. Meanwhile, China’s likelihood to export deflation to the world is fading only slowly.

- The decline in real rates has been a tailwind for equity valuations since the November FOMC.

Risks

- Risks to the outlook for global growth remain tilted to the downside as geopolitical developments unfold.

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions. Financial stability risks could return.

- US inflation needs a credible Federal Reserve as inflation breakeven anticipations have not decreased yet while the European Central Bank must be mindful of the peripheral countries.

- Oil price, US yields and USD are the key variables to watch – a lot of pressure has been lifted in recent weeks.

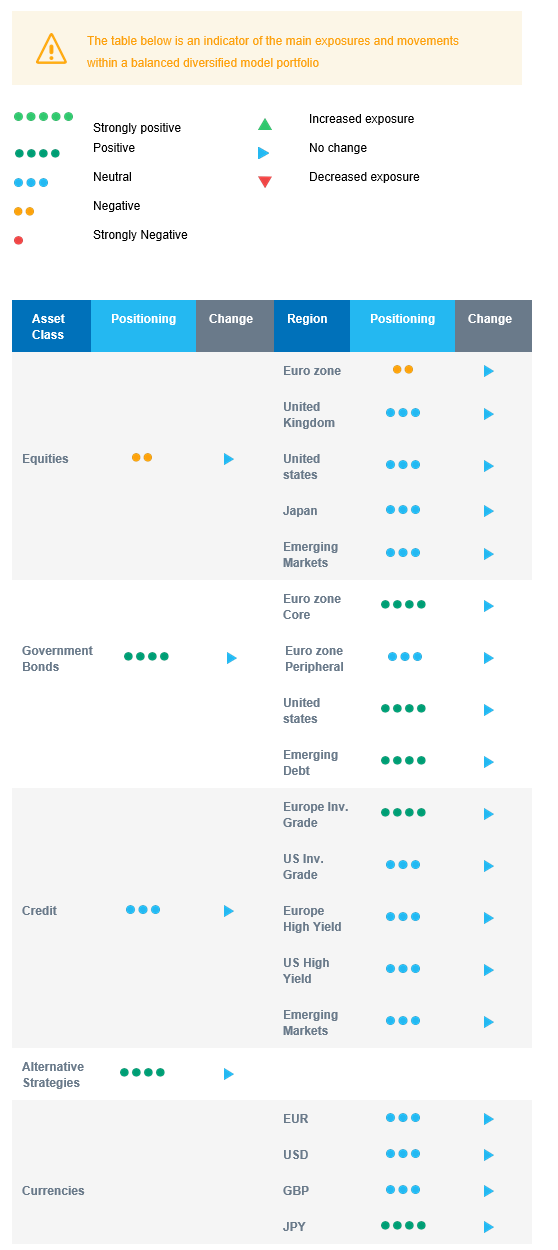

Cross asset strategy

- Our asset allocation shows a relative preference for bonds over equities as the equity risk premium is currently insufficient to encourage investors to reweight the asset class.

- We have the following investment convictions:

- We are overall slightly underweight equities.

- In terms of regional allocation, we are underweight euro zone equities, as Q3 figures confirmed a slight contraction in activity.

- We are neutral US, Japan and Emerging markets.

- We keep a preference for late-cycle sectors. Given our expected gradual decline in bond yields and proven earnings resilience, we have become more constructive on the US Technology sector.

- In the fixed income allocation:

- We focus on high-quality credit as sources of carry.

- We also buy core European and American government bonds with the objective to benefit from the rise in interest rates and bond yields in a context of slowing economic activity and cooling inflation.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets.

Our Positioning

With equities being relatively less attractive, we maintain a slight underweight positioning on equities and a long bond duration. Regionally, we are underweight euro zone and neutral on Japan, Emerging markets, and US equities. In the fixed income bucket, our focus is on credit that brings carry, i.e., investment grade and emerging debt. In terms of sectors, given our expected gradual decline in bond yields and proven earnings resilience, we are constructive on the US Technology sector. Beyond this, we stick to our preference for Health Care and Consumer Staples and take into account that central banks are at the end of their hiking cycle.