Last week in a nutshell

- The US registered “good news” on the inflation front as core consumer prices cooled to 3.9% YoY, while core producer prices rose just 1.8% YoY in December.

- The euro zone consumer confidence indicator rose to its highest reading since February 2022, beating consensus estimates.

- In the US, the Republican presidential debate in Iowa took place opposing rivals Ron DeSantis and Nikki Haley, while former New Jersey governor Chris Christie’s dropped out of the presidential race.

- Taiwanese voters went to the polls and elected Lai Ching-Te, from the Democratic Progressive Party (DPP) as new president amid increasing tensions with China.

What’s next?

- The Iowa caucuses, which have served as the lead-off voting process in presidential elections since the 1970s, marks the kick off of the US election year.

- China will release a series of economic data including GDP growth and unemployment rate.

- US Preliminary and euro zone final data on inflation, consumer expectations, and current conditions will shed some light on how consumers assess their potential for future spending.

- US real estate data on housing starts and preliminary building permits will give a sense of how much and where future construction activity will take place.

Investment convictions

Core scenario

- We expect somewhat of a slowing US economic activity in 2024 (1.9% vs. 2.5% in 2023). Inflation is showing increasingly encouraging signs (2.6% on average in 2024 vs. 4.1% last year) and wage pressures should finally ease.

- The Fed confirms our soft landing scenario and the impact of the latest communication (3 cuts in 2024 in the median dot plot) is likely to extend the business cycle.

- 2024 should bring better visibility as the inflation/interest rate shock fades and central banks will use their margin of manoeuvre.

- Growth desynchronisation continues. In the euro zone, growth is likely to remain lacklustre for most of 2024 (0.5%) while disinflation accelerates (2% on average in 2024 vs. 5.4% last year). The likelihood of a standstill or mild recession is increasing in the region but the ECB appears to be a step behind the Fed when it comes to rate-cut timing.

- In China, economic activity has shown some fragile signs of stabilisation (4% GDP growth expected in 2024) while the evolution of prices remain deflationary.

Risks

- Geopolitical risks to the outlook for global growth remain tilted to the downside as developments in the Red Sea unfold. An upward reversal in the price of Oil, US yields or the US dollar are key variables to watch.

- A remote risk would be a stickier inflation path than expected which could force central banks to reverse course.

- Similarly, financial stability risks could return as a result of the steepest monetary tightening of the past four decades and the tightening in financial conditions.

- Upside risk would be an earlier exit from central banks’ restrictive monetary policy.

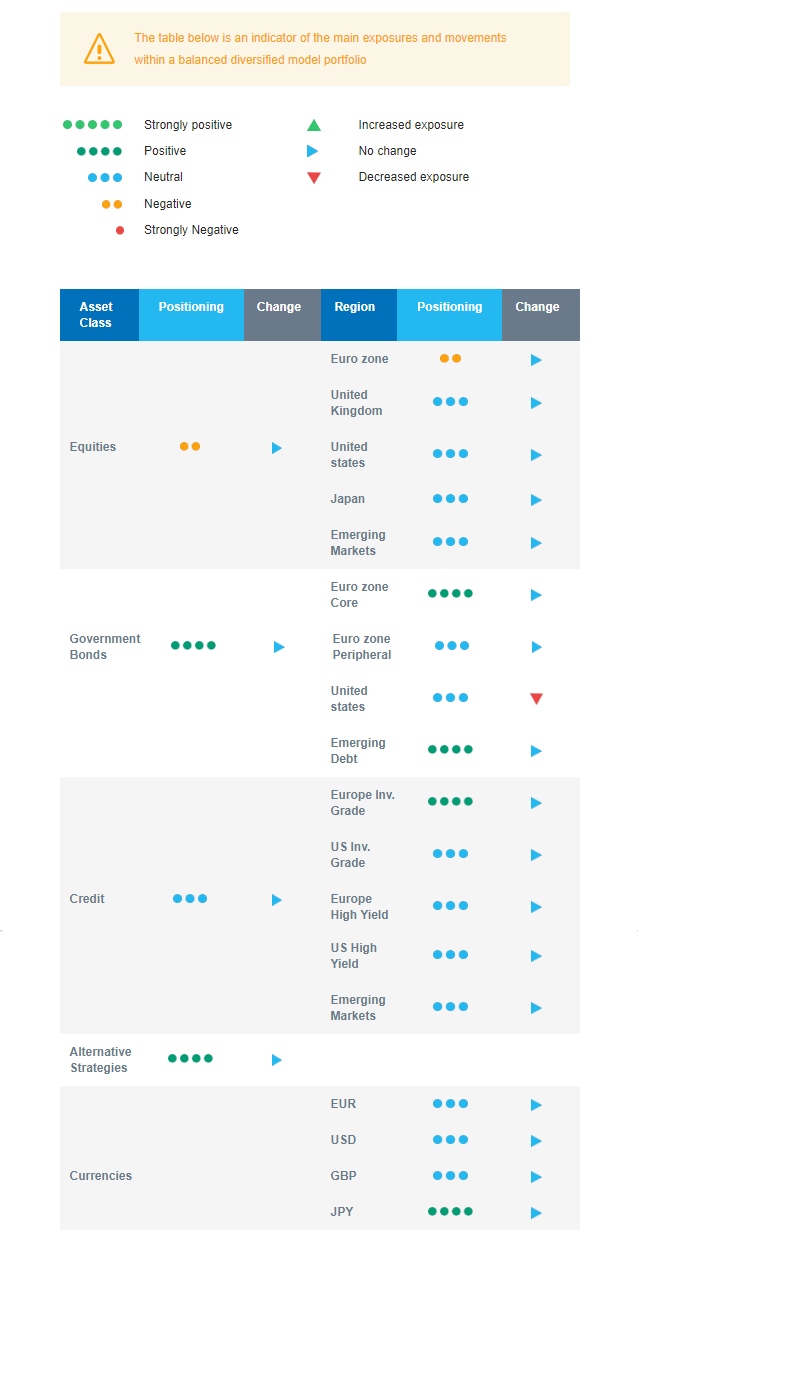

Cross asset strategy

- Our asset allocation shows a relative preference for bonds over equities as the equity risk premium is currently insufficient to encourage investors to reweight the asset class.

- We have the following investment convictions:

- We expect limited equity upside, and are currently slightly underweight on equities pending a better risk/reward and clearer signals on when to increase our exposure. We have a cautious view on euro zone equities and are neutral on other regions.

- We look for specific themes within Equities. Among them, we like Technology / AI and look for opportunities in beaten down stocks in small and mid-caps or within the clean energy segment. We also remain buyers of late-cycle sectors like Health Care and Consumer Staples.

- In the fixed income allocation:

- We focus on high-quality credit as sources of carry.

- We also buy core European government bonds with the objective to benefit from the carry in a context of slowing economic activity and cooling inflation. As US yields have fallen from 5% in mid-October to 3.8% at the end of 2023, we took profit on our long US duration stance, keeping a neutral stance on American government bonds.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets.

Our Positioning

With equities becoming relatively less attractive, we look for specific themes within this asset class and maintain a long bond duration. Regionally, we are underweight euro zone, as the European Central Bank remains more restrictive than its US counterpart. We stay neutral on Japan, Emerging markets, and the US. In the fixed income bucket, our focus is on credit that brings carry, i.e., investment grade and emerging debt. In terms of sectors, given our expected gradual decline in bond yields and proven earnings resilience, we are constructive on the US Technology sector. We are building a barbell strategy with last years’ beaten-down stocks in clean energy and Health Care and Consumer Staples as more defensive counterweight.