Last week in a nutshell

- US PPI and CPI came in hotter than expected mostly due to gas prices, while retail sales rebounded to 0.6% but fell short of expectations.

- The University of Michigan consumer sentiment slightly edged down to 76.5, and below forecasts of 76.9.

- Japanese wage growth negotiations (Rengo) hit 5.28% this year vs. 3.8% putting a tailwind on the BoJ to start monetary policy normalisation.

- The PBOC left its Medium Lending Term Facility rate unchanged but unexpectedly drained net CNY 94bn, for the first time since late 2022.

What’s next?

- Investors will closely monitor the Federal Reserve's decision and communication regarding potential rate cuts, particularly in light of last week's high inflation data.

- Also the Bank of Japan and the Bank of England will hold meetings. While not much is expected from the UK, the BoJ is at the crossroads with some hawkish comments from BoJ officials and inflation and Yield Curve Control data.

- China will share a set of indicators on economic activity, labour, and retail sales providing investors with more insights on the health of its economy.

- Preliminary figures on global manufacturing and services PMI will help investors assess how well the world economy is faring. The euro zone will also release preliminary data on Consumer Confidence.

Investment convictions

Core scenario

- The last leg of the steady path from a 3% to a 2% inflation rate seems to be more bumpy in the US than in the euro zone. Overall, the growth / inflation mix is undeniably returning to “familiar” territory.

- A soft-landing/ongoing disinflation scenario in the United States remains our most likely scenario, implying no rush for the Fed to deliver monetary support. We don’t expect the first monetary easing before the end of the first half.

- 2024 should bring better visibility with a narrowing economic growth gap between countries while most central banks have restored room for manoeuvre.

- In China, economic activity has shown some fragile signs of stabilisation while the evolution of prices remain deflationary.

Risks

- While uncertainty remains on the timing of the start of monetary easing, a downside risk would be too prudent of an approach towards monetary easing by central banks and a disappointed market.

- Geopolitical risks to the outlook for global growth remain tilted to the downside as developments in the Red Sea unfold. An upward reversal in the price of Oil, US yields or the US dollar are key variables to watch.

- A risk would be a stickier inflation path than expected which could force central banks to reverse dovish rhetoric. In our understanding, it would take more than just the bumpy data registered in January.

- Beyond commercial real estate exposures, financial stability risks could return as a result of the steepest monetary tightening of the past four decades.

Cross asset strategy

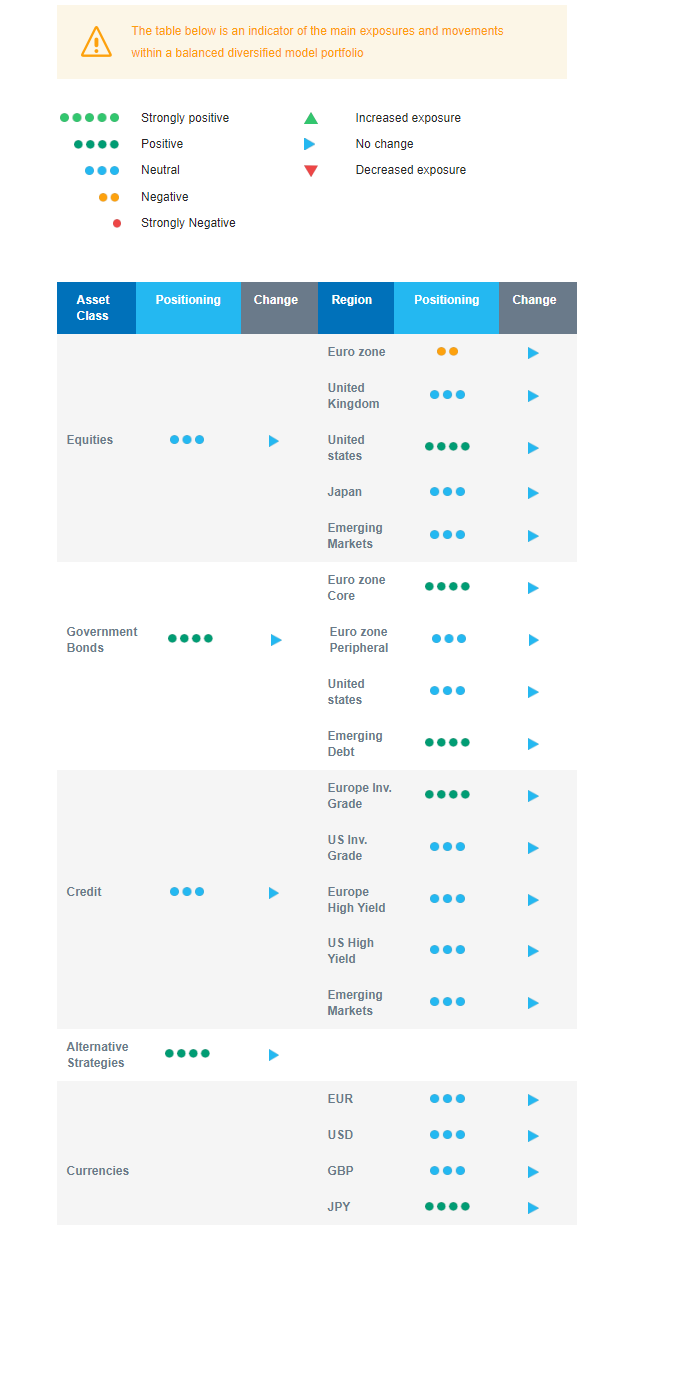

- Our asset allocation is broadly balanced. We acknowledge the current momentum supporting the US equity market, have the weakest conviction on the European market and are neutral Japan and Emerging markets although both seem to have turned a corner.

- We have the additional investment convictions:

- We keep a neutral allocation as sentiment seems stretched and provided the absence of a sell signal in our proprietary analysis.

- We look for specific themes within Equities. As we expect a rangier market for the next couple of months for the broad market and because consensus expectations on the Technology sector may be overly optimistic, we downgrade our views on the US technology sector to a neutral stance. Our long-term outlook remains however strongly positive. We remain buyers of late-cycle sectors like Health Care. We look for opportunities in beaten down stocks in small and mid-caps or within the clean energy segment.

- In the fixed income allocation:

- We focus on high-quality credit as source of a pickup in yields.

- We also buy core European government bonds with the objective to benefit from the carry in a context of cooling inflation.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We maintain a neutral stance on US government bonds, looking for a new, more attractive, entry point as we expect markets to revise their Fed outlook further down the line.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets.

Our Positioning

The US market rally since October is exceptional compared to historical observations and we acknowledge the current momentum although after this atypical number of successive rises, the probability of a short term consolidation has risen. We have a supportive stance on US equities, are more cautious on the European market, neutral on Japan and Emerging markets. Within the fixed income segment, we are open to adding European duration, have less conviction on US duration. We also continue to harvest carry via Investment Grade credit and Emerging Market debt.