Last week in a nutshell

- The FOMC kept its funds rate unchanged at 5.25% to 5.5%. Fed members now expect cutting rates by 75bp in 2024 while Chair Jerome Powell adopted a dovish stance.

- In Europe, the ECB left its key interest rate unchanged at a record high 4%, signalling it has no plan to cut interest rate anytime soon. The BoE and SNB sticked to current policy rates as well while Norges Bank hiked by 25 basis point to 4.5%.

- In the euro zone, December PMI flash estimates came up short of market estimations, further highlighting the economic standstill in the region.

- In China, retail sales did not live up to investors’ expectations, though slightly compensated by improving industrial production.

What’s next?

- 2024 should bring better visibility for investors as the inflation/interest rate shock fades away and central banks will likely use the room for manoeuvre to reduce rates.

- Japan is not in synch as the BoJ is setting the stage for rate hikes in 2024.

- With the start of the holiday season, little market moving data are expected. We look forward to the first week of January with PMIs and the US job report.

- On the geopolitical front we look forward to a major election year ahead as countries that are home to more than half the global population will head to the polls. The kick off will be the Taiwan presidential elections, on January 13th, 2024

Investment convictions

Core scenario

- We expect somewhat of a slowing US economic activity in 2024 (1.9% vs. 2.5% in 2023). Inflation is showing increasingly encouraging signs (2.7% on average next year vs. 4.1% now) and wage pressures finally seem to be easing.

- The Fed confirms our soft landing scenario and the impact of the latest communication (from one incremental hike in 2023 to 3 cuts in 2024 in the median dot plot) is likely to extend the business cycle.

- The Fed’s announcement on December 13th confirms that 2024 should bring better visibility as the inflation/interest rate shock fades and central banks will use their margin of manoeuvre.

- Growth desynchronisation continues. In the euro zone, growth is likely to remain lacklustre for most of 2024 (0.5%) while disinflation accelerates (2% on average next year vs. 5.4% now). The likelihood of a mild recession is increasing in the region but the ECB appears to be a step behind the Fed when it comes to rate-cut timing.

- In China, economic activity has shown some fragile signs of stabilisation (4% GDP growth expected in 2024) while the evolution of prices remain deflationary.

Risks

- Geopolitical risks to the outlook for global growth remain tilted to the downside as developments unfold. An upward reversal in the price of Oil, US yields or the US dollar are key variables to watch.

- A remote risk would be a stickier inflation path than expected which could force central banks to reverse course.

- Similarly, financial stability risks could return as a result of the steepest monetary tightening of the past four decades and the tightening in financial conditions.

- Upside risk would be an earlier exit from central banks’ restrictive monetary policy.

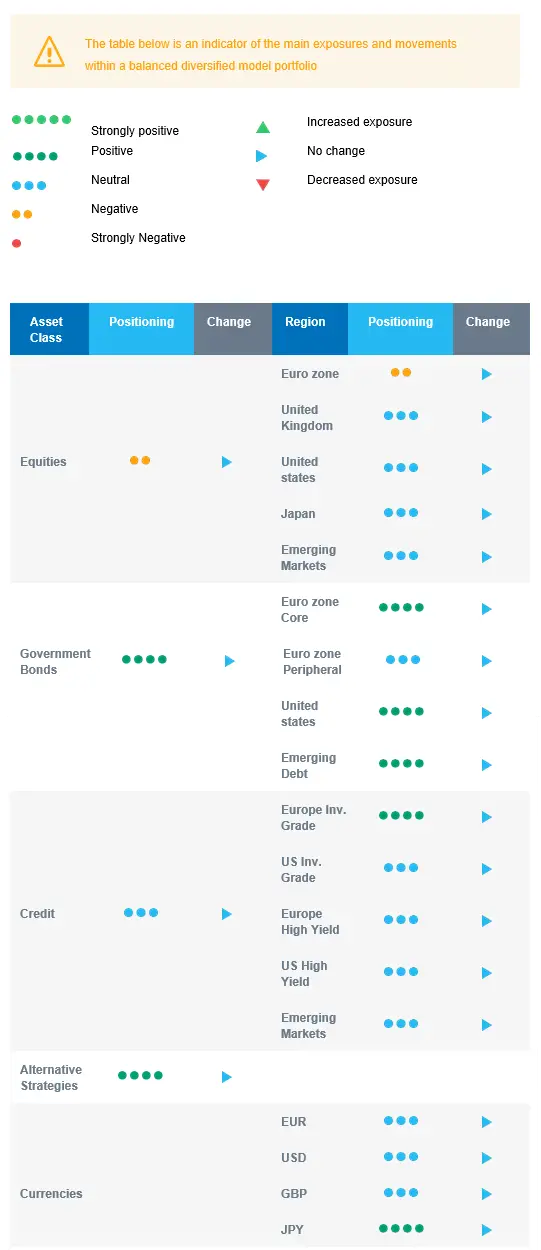

Cross asset strategy

- Our asset allocation shows a relative preference for bonds over equities as the equity risk premium is currently insufficient to encourage investors to reweight the asset class.

- We have the following investment convictions:

- We expect limited equity upside, and are currently slightly underweight on equities, via a negative view on euro zone equities and neutral on other regions.

- We look for specific themes within Equities. Among them, we like Technology / AI and look for opportunities in beaten down stocks in small and mid-caps or within the clean energy segment. We also remain buyers of late-cycle sectors like Health Care and Consumer Staples.

- In the fixed income allocation:

- We focus on high-quality credit as sources of carry.

- We also buy core European and American government bonds with the objective to benefit from the rise in interest rates and bond yields in a context of slowing economic activity and cooling inflation.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets.

Our Positioning

With equities becoming relatively less attractive, we look for specific themes within this asset class and maintain and a long bond duration. Regionally, we are underweight euro zone and neutral on Japan, Emerging markets, and US equities. In the fixed income bucket, our focus is on credit that brings carry, i.e., investment grade and emerging debt. In terms of sectors, given our expected gradual decline in bond yields and proven earnings resilience, we are constructive on the US Technology sector. Beyond this, we stick to our preference for Health Care and Consumer Staples and take into account that central banks are at the end of their hiking cycle, starting to look for opportunities in beaten down stocks in small and mid-caps or within the clean energy segment.