Last week in a nutshell

- The economic activity in the US continued to expand in early October, with the Composite PMI rising to 51 from 50.2 in September. Both Manufacturing and Services came in higher than analysts' estimates. On the other side of the Atlantic, the euro zone Composite PMI fell to a 35-month low of 46.5, after a contraction in both Manufacturing and Services sectors.

- The US Q3 earnings season keeps going on. On average, companies reporting earnings are 7.7% above expectations, better than the 4.4% one-year average positive surprise rate, but a bit below the five-year average of 8.5%.

- As expected, the ECB left its key interest rate unchanged at 4.00%. If maintained at this level for sufficiently long, the rate will make a substantial contribution to meeting the targeted inflation figure.

- After topping 5%, the 10Y Treasury fell following a raft of mixed fresh US economic data. US GDP grew at a 4.9% annual pace in Q3, better than expected, while weekly jobless claims indicated a possible slowdown.

What’s next?

- Fed’s next rate decision on November 1st will be in the spotlight. The central bank is widely expected to keep rates unchanged, but may be hesitant to indicate if it is done hiking for good after this week’s strong GDP reading.

- Final PMIs from the US and China will be published, giving further insights into economic activity in the regions.

- In Europe a series of data covering flash estimates of the CPI, GDP growth rate and unemployment will be disclosed.

- Also in the US it will be an intense week of macroeconomic releases, especially regarding the housing and job markets.

Investment convictions

Core scenario

- In terms of economic growth, we expect the US to avoid a recession providing that long-term rates do not remain too long at the current level. In Europe, growth is likely to remain lacklustre for most of next year, and the likelihood of a recession is increasing in the region. In China, economic activity and the evolution of prices have shown some timid signs of cyclical stabilisation.

- The resilience in both inflation and labour markets and the persistent hawkish bias of developed countries’ central banks have led to an upward repricing in bond yields. Meanwhile, China’s likelihood to export deflation to the world is fading only slowly.

- The markets’ response of higher long-term bond yields indicates a shift from recent trends: the yield curves do not invert further anymore as investors re-asses upward the premium for holding long-term yields.

- In summary, the increase in real rates is a headwind for equity valuations while the deceleration of economic growth will weigh on profits. Risks to the outlook for global growth remain tilted to the downside as geopolitical developments unfold.

Risks

- A temporary overshoot in longer-dated bond yields present a risk for fixed income holdings and duration-sensitive equities.

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions. Financial stability risks could return.

- A stickier inflation path than already expected could force central banks to hike even more, which implies that the growth outlook is tilted to the downside.

- Besides geopolitical tensions on several fronts, which imply rising uncertainty and vulnerabilities, as well as a potential increase in oil prices, the US elections of November 2024 are looming fast.

Cross asset strategy

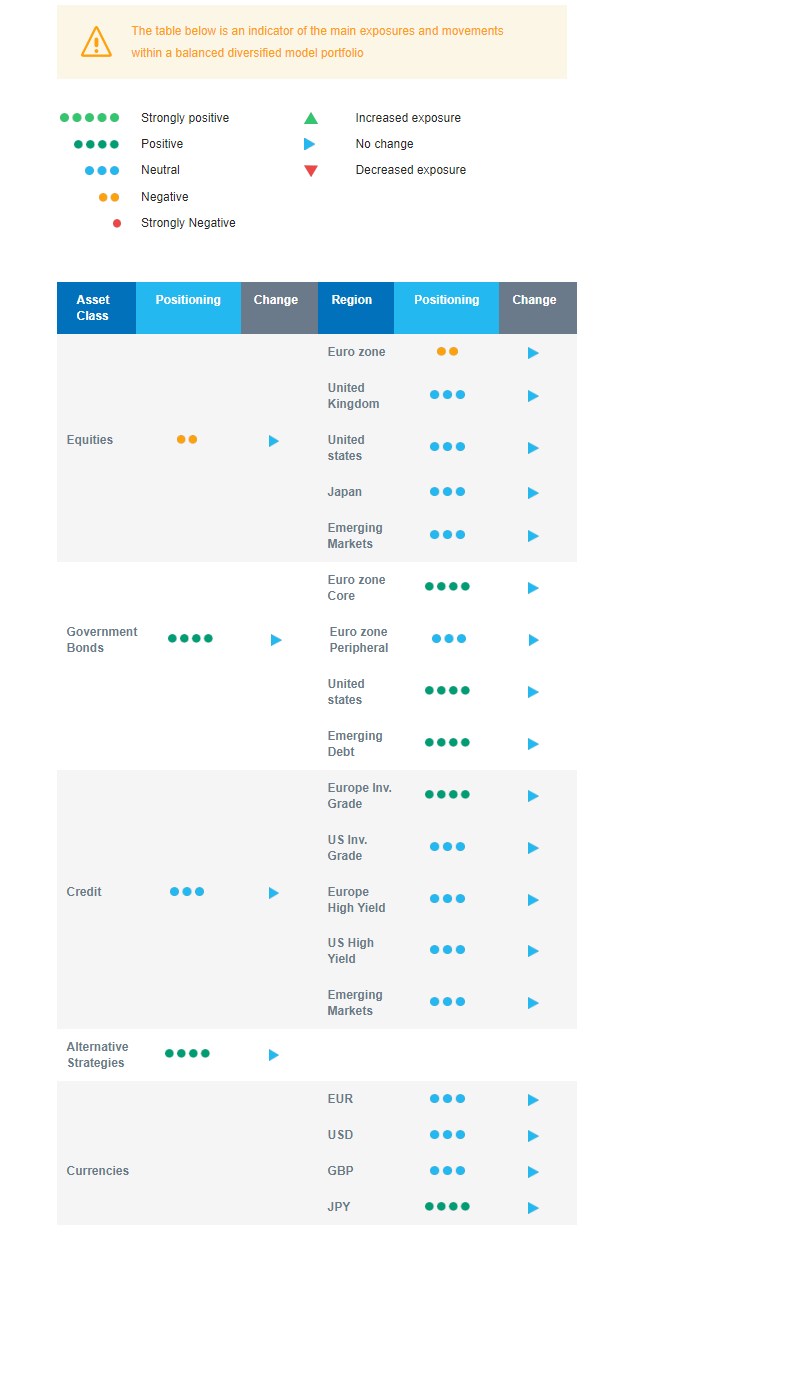

- Our asset allocation has turned more cautious as several risks have started to materialise. We expect a deceleration of economic growth which will weigh on corporate profits amid restrictive monetary policies in most of the developed countries.

- We have the following investment convictions:

- We are overall underweight equities and while market sentiment is less stretched, it is too early to buy back equities.

- We are underweight euro zone equities, as the likelihood of a contraction in activity has increased.

- We are neutral US, Japan and Emerging markets. The latter are vulnerable to the increasing pressure from US rates and the headwind of the USD.

- We keep a preference for defensive, late-cycle, sectors.

- In the fixed income allocation:

- We focus on high-quality credit as sources of carry.

- We also buy core European and American government bonds. The commitment on price stability via a hawkish ECB policy has driven long-term yields to attractive buying levels while the growth/inflation couple (i.e. nominal growth) eases.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they have some decorrelation from traditional assets.

Our Positioning

Our positioning has turned more cautious as several risks have started to materialise. The increase in real rates is a headwind for equities while the deceleration of economic growth will weigh on profits, leading us to adopt a defensive allocation, including an underweight positioning on equities and a long bond duration. We are underweight euro zone equity. We are neutral on Japan, Emerging markets, and the US. In terms of sectors, our “late cycle” asset allocation strategy is axed around defensive sectors. In the fixed income bucket, our focus is on credit that brings carry, i.e., investment grade and emerging debt while being more cautious on high yield. Global growth should remain sluggish in 2024 but the risk appears tilted to the downside as geopolitical developments unfold.