Elektrizität treibt den menschlichen Fortschritt seit Jahrhunderten an – und dennoch macht sie bis heute nur rund 20 % des globalen Energieverbrauchs aus.[1] Trotz jahrelanger Klimawarnungen hinkt die Elektrifizierung weiterhin hinter dem zurück, was zur Erreichung der Pariser Klimaziele notwendig wäre. Doch nun tritt eine neue Kraft auf den Plan – eine, die von Elektronen lebt und in atemberaubendem Tempo wächst: künstliche Intelligenz.

Kann sie die längst erwartete Revolution der Elektrizität endlich zünden? Oder gefährdet sie am Ende den Übergang zu einer nachhaltigen Energiezukunft?

Vom Fossil zur Elektrizität: eine Transformation in Bewegung

Der Anteil von Strom am weltweiten Energieverbrauch ist seit dem Jahr 2000 von 15 % auf heute etwa 20 % gestiegen; der Strombedarf wuchs im vergangenen Jahrzehnt damit doppelt so schnell wie der Gesamtenergieverbrauch.[2] Ein Fortschritt – aber bei Weitem nicht ausreichend für das Netto-Null-Ziel.

Elektrifizierung ist ein zentraler Baustein der Energiewende, da Strom am einfachsten zu dekarbonisieren ist. Zwar sorgen sinkende Kosten für erneuerbare Energien und unterstützende politische Maßnahmen für zusätzliche Dynamik, doch schwer zu vermeidende Emittenten – etwa Zement-, Stahl- und Glasindustrie – kommen aufgrund technischer und wirtschaftlicher Hürden nur langsam voran.

Im Verkehrssektor ergibt sich ein gemischtes Bild. Pkw elektrifizieren sich rasant: Für 2025 wird erwartet, dass der Verkauf von Elektrofahrzeugen die Marke von 20 Millionen Einheiten überschreitet – rund 25 % der weltweiten Verkäufe.[3] Sollte dieser Trend anhalten, könnten die Pkw-bedingten Emissionen bis 2030 im Einklang mit Netto-Null verlaufen – einer der wenigen Bereiche auf Zielkurs. Doch Luftfahrt, Schifffahrt und Schwerlastverkehr bleiben deutlich zurück.

Erneuerbare Energien sind die treibende Kraft der Elektrifizierung: Ihr Anteil an der weltweiten Stromerzeugung stieg innerhalb weniger als zehn Jahre von 20 % auf 33 %. Die Internationale Energieagentur (IEA) erwartet, dass erneuerbare Energien ihren Anteil am Endenergieverbrauch bis 2030 auf 20 % erhöhen, von heute etwa 15%.[4] Dennoch schreitet die Dekarbonisierung insgesamt nur langsam voran – insbesondere in Industrie und Verkehr, wo geopolitische und wettbewerbsbezogene Sorgen nach wie vor stärker wiegen als Klimaziele.

Während die internationale Klimapolitik an Schwung verliert, tritt ein neuer Unsicherheitsfaktor auf den Plan: künstliche Intelligenz. Ihr rasant wachsender Strombedarf könnte die Energielandschaft grundlegend verändern – und den Übergang zur Nachhaltigkeit entweder beschleunigen oder erschweren.

Wird KI die Stromwende in eine Revolution verwandeln?

Künstliche Intelligenz steckt zwar noch in den Kinderschuhen, doch sie formt bereits heute die weltweiten Stromsysteme grundlegend um. Ihr rasantes Wachstum treibt den Strombedarf in die Höhe – insbesondere durch Rechenzentren – und verändert sowohl die Erzeugung als auch den Verbrauch von Energie. Dieser Nachfrageanstieg stellt die Energiemärkte vor erhebliche Herausforderungen und könnte den Fortschritt hin zu den Klimazielen bremsen. Welche langfristigen Auswirkungen dies haben wird, ist noch weitgehend unklar.

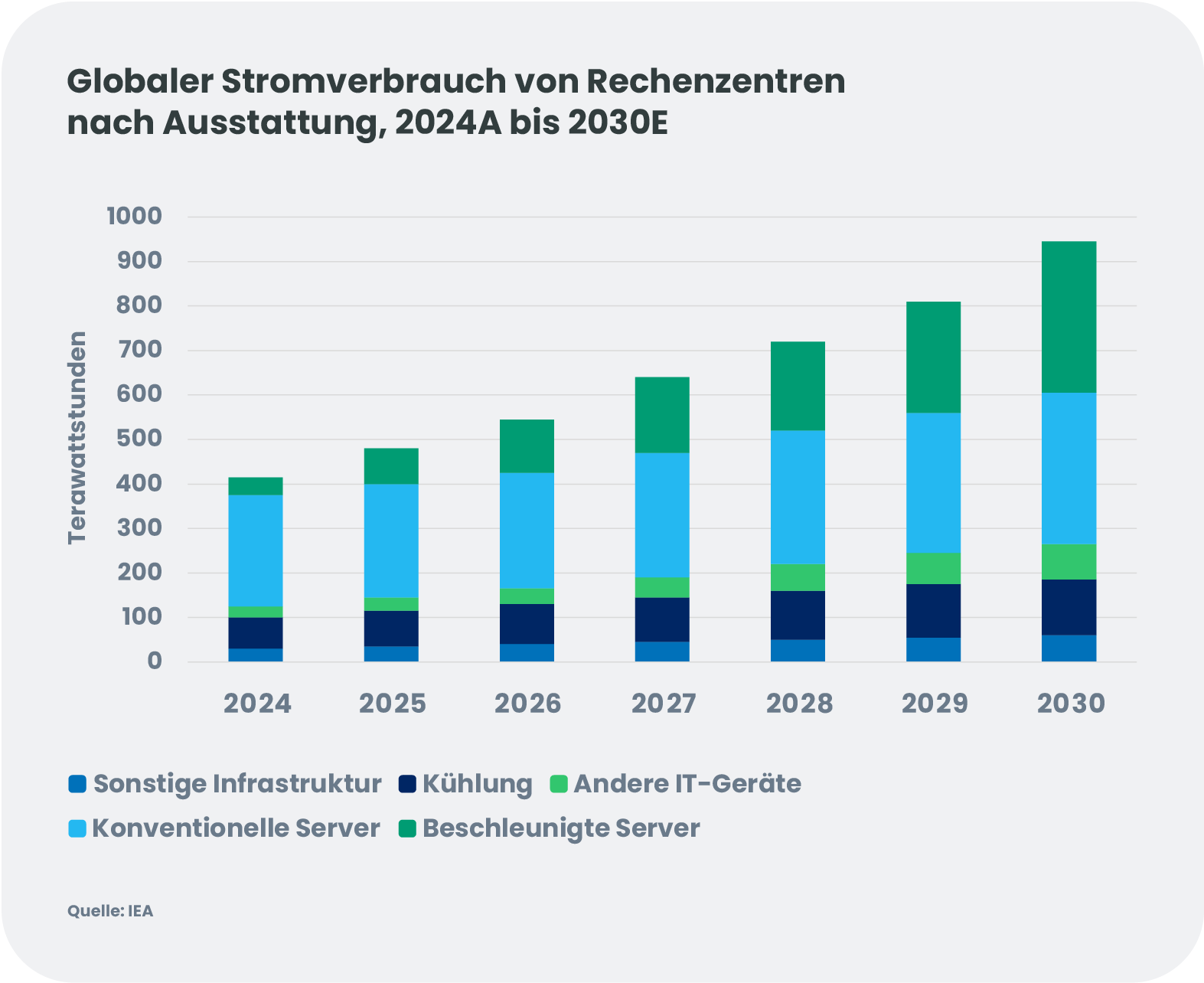

Im Jahr 2024 verbrauchten Rechenzentren rund 415 Terawattstunden (TWh) Strom – etwa 1,5 % des globalen Verbrauchs.[5] Die Internationale Energieagentur (IEA) rechnet damit, dass dieser Bedarf bis 2030 auf 945 TWh mehr als doppelt so hoch ausfallen wird – und selbst diese Prognose gilt als eher konservativ im Vergleich zu anderen Einschätzungen. Langfristige Szenarien gehen davon aus, dass der Strombedarf von Rechenzentren bis 2050 auf bis zu 3.500 TWh steigen könnte, vergleichbar mit dem heutigen Gesamtverbrauch von Indien und dem Nahen Osten zusammen.

Der Trend ist eindeutig: KI wird im frühen 21. Jahrhundert zum mit Abstand stärksten Wachstumstreiber der globalen Stromnachfrage.

Die rasante Expansion der KI treibt einen beispiellosen Anstieg der weltweiten Stromnachfrage voran. Dies erfordert gewaltige und beschleunigte Investitionen – nicht nur in neue Stromerzeugung, sondern ebenso in Netzausbau und Energiespeicher, um die Stabilität und Flexibilität des Systems zu sichern. Anders als in den vergangenen zwei Jahrzehnten, in denen das Nachfragewachstum vor allem aus Schwellenländern kam, sorgt der KI-getriebene Bau von Rechenzentren nun für einen starken Nachfrageschub in entwickelten Volkswirtschaften – allen voran in den USA. Die IEA erwartet, dass die weltweite Stromnachfrage für den Rest dieses Jahrzehnts jährlich um mehr als 3 % wachsen wird.

Dieser Wandel transformiert die Strommärkte. Mit wachsendem Anteil erneuerbarer Energien verschiebt sich das System von einem preisbildenden Mechanismus, der vor allem durch Brennstoffkosten bestimmt war, hin zu Modellen, die hohe Anfangsinvestitionen widerspiegeln. Damit rückt der Bedarf an Reservekapazitäten, Netzstabilisierung sowie marktgestützten Instrumenten wie Kapazitätszahlungen stärker in den Fokus. Diese Maßnahmen – kombiniert mit Netzengpässen und notwendiger Infrastrukturmodernisierung – werden die Strompreise für Verbraucher voraussichtlich erhöhen und zugleich die wirtschaftliche Attraktivität von Batteriespeichern steigern.

Der Wettlauf der Hyperscaler, sich über langfristige Stromabnahmeverträge (PPAs) enorme Strommengen zu sichern, treibt die Preise weiter nach oben und beschleunigt den Ausbau erneuerbarer Energien. Bis 2035 dürfte rund die Hälfte der zusätzlichen Kraftwerkskapazitäten, die für Hyperscaler benötigt werden, aus erneuerbaren Quellen stammen.[6] Diese Investitionen bleiben nicht ohne Kostenfolgen: Während politische Entscheidungen maßgeblich bestimmen werden, wie stark Haushalte belastet werden, warnt der IWF, dass bei unzureichendem Ausbau erneuerbarer Energien und Stromnetze die US-Strompreise bis 2030 um bis zu 8,6 % steigen könnten.[7]

Nun zur Billionen-Dollar – und Billionen-Watt! – Frage: Wird KI die Energiewende beschleunigen oder weiter ausbremsen?

Unbestritten ist: KI wird die Stromnachfrage erhöhen und bestehende Systeme belasten – und damit umfangreiche Modernisierungen notwendig machen. Die zusätzliche Nachfrage von 700 bis nahezu 1.000 TWh bis 2030 hat einen erheblichen CO₂-Preis, abhängig davon, wie emissionsintensiv die zugrunde liegende Stromerzeugung ist. Gleichzeitig kann KI jedoch Effizienzgewinne ermöglichen und den gesamten Energieverbrauch reduzieren – ein Effekt, der jedoch durch mögliche Rebound-Effekte (Jevons-Paradoxon) teilweise wieder aufgehoben werden könnte, wenn höhere Effizienz zu weiter steigendem Verbrauch führt.

Letztlich wird die Gesamtwirkung entscheidend davon abhängen, welche politischen Entscheidungen getroffen werden, welche regulatorischen Rahmenbedingungen gelten und wie schnell die notwendige Infrastruktur entsteht.

Aufgeladen in die Zukunft: Wie können Energieversorger in der Stromrevolution richtig durchstarten?

Versorgungsunternehmen wandeln sich vom traditionellen Stromlieferanten zum zentralen Koordinator der elektrifizierten Wirtschaft. Sie erzeugen nicht nur Energie, sondern bauen Netze aus, betreiben sie und sorgen kurz- wie langfristig für ein Gleichgewicht zwischen Angebot und Nachfrage. Lange Zeit an den Aktienmärkten eher übersehen, gilt der Versorgersektor heute als tragende Säule der KI-Wachstumsstory – und hat spürbar vom KI-Boom profitiert. Doch hält die Erfolgsphase an?

Steigende Stromnachfrage – insbesondere durch Rechenzentren und KI – stützt den Sektor insgesamt, doch profitieren nicht alle Teilbereiche gleichermaßen.

Während Aktien europäischer Versorger mit hoher Strompreis-Exponierung durch die Euphorie rund um den Rechenzentrumsboom deutlich gestiegen sind, wird ihre Fähigkeit, weiter zu profitieren, stark von ihrer Positionierung in der

Wertschöpfungskette und ihrer regionalen Ausrichtung abhängen. Europa wird voraussichtlich nicht mit den gleichen Engpässen konfrontiert sein wie die USA, könnte jedoch an Belastungsgrenzen bei Spitzenlast stoßen. Dies würde die Nachfrage nach flexibler Erzeugung (einschließlich Gas) und nach Energiespeicherlösungen weiter erhöhen. Wir sehen im Sektor bis 2030 anhaltendes Potenzial für solide Ertrags- und Dividendenausschüttungen. Das Wachstum kommt – und wird weiterhin kommen – vor allem von regulierten Versorgern (sowie integrierten Unternehmen, getrieben von ihren regulierten Netzaktivitäten), angeführt von Netzbetreibern, die nun die Früchte eines vor Jahren gestarteten Investitionsbooms ernten.

Wir sehen weiterhin drei zentrale Säulen der Energiewende:

- Erneuerbare Energien bleiben aus unserer Sicht der zentrale Treiber der Energiewende, angeführt von China – denn sie sind die schnellste und kostengünstigste Möglichkeit, neue Kapazitäten ins Netz zu bringen. Die weltweiten Clean-Tech-Investitionen erreichten 2024 rund 2,2 Billionen US-Dollar – doppelt so viel wie die Investitionen in fossile Energien. Im Jahr 2024 wurden global 585 Gigawatt (GW) erneuerbare Kapazitäten installiert, davon 64 % in China.[8] Die IEA erwartet zwischen 2025 und 2030 weitere 4.600 GW – doppelt so viel wie zwischen 2019 und 2024 – wobei rund 80 % auf Solarenergie (Utility + dezentrale PV) entfallen, erneut überwiegend aus China. Europa hält an seinem Ziel fest, den Anteil erneuerbarer Energien bis 2030 auf 42,5 % zu steigern; die IEA prognostiziert einen Kapazitätsanstieg von heute 849 GW auf 1.600 GW im Jahr 2030. Trotz Rückschritten bei der Inflation Reduction Act in den USA bleibt der PPA-Markt robust und unterstützt den Ausbau erneuerbarer Energien.

- Die Netzinfrastruktur ist unerlässlich, um die Elektrifizierung und die zunehmende Verbreitung erneuerbarer Energien zu unterstützen. Massive Investitionen sind erforderlich, um die Netze zu erweitern, zu modernisieren, zu digitalisieren und zu optimieren. Die Faustregel, dass 1 US-Dollar für erneuerbare Energien 1 US-Dollar für die Netze erfordert, ist heute noch längst nicht erfüllt. Die Erwartung eines „Netzwerk-Superzyklus“ mit langer Laufzeit hat die Bewertungen netzorientierter Versorger, insbesondere in Europa, in die Höhe getrieben. Unterstützt durch solide Bilanzen und günstige Regulierungen erhöhen Versorger ihre Netzinvestitionen deutlich, mit 8 bis 10% CAGR-Wachstumsrate in regulierten Anlagen bis 2030. Dies dürfte das CAGR-Wachstum der regulierten Gewinne von 2025 bis 2030E von ihrem historisch einstelligen Niveau auf zweistellige Werte beschleunigen.[9]

- Die Märkte für Energiespeicher erreichen im Jahr 2025 neue Rekorde, angetrieben von der steigenden Nachfrage aus Rechenzentren und der Industrie. Speichertechnologie ist für die Integration erneuerbarer Energien, die Netzstabilität und die Flexibilität der Nachfrage- und Reaktionsfähigkeit von entscheidender Bedeutung. Rasante Fortschritte in Langzeitspeichern machen Netzspeicher zunehmend wirtschaftlich, und ihre Bereitstellung dürfte sich beschleunigen. Durchbrüche bei Superkondensatoren könnten Hybridsysteme ab 2030 ermöglichen und Speicherung als wichtigen Katalysator für das nächste Jahrzehnt der Energiewende positionieren. Wie Unternehmen ihre Flexibilität mithilfe verlässlicher Speichertechnologien managen, wird die wahren Unterschiede innerhalb des Sektors aufzeigen. Integrierte Versorger, einst auf Pumpspeicher beschränkt, sehen Energiespeicher heute als aussichtsreiches mittel- bis langfristiges Wachstumsfeld.

Ein Schlüsselmoment für die Energiewende?

Der rasante Aufstieg künstlicher Intelligenz und der beschleunigte Ausbau erneuerbarer Energien markieren einen entscheidenden Moment in der globalen Energiewende. Gemeinsam besitzen sie das Potenzial, die Elektrifizierung von einem langsam voranschreitenden Strukturtrend zu einer echten industriellen Revolution zu machen – angetrieben von beispielloser Nachfrage, enormem Infrastrukturbedarf und rasanter technologischer Entwicklung. Doch dieses Potenzial lässt sich nur ausschöpfen, wenn zentrale Engpässe überwunden werden: von überlasteten Netzen über Fragen der Energiesicherheit bis hin zur Finanzierung. Zu den dringendsten Herausforderungen zählt die gesicherte Versorgung mit kritischen Rohstoffen – unerlässlich sowohl für KI-Hardware als auch für erneuerbare Energietechnologien. Ihre Verfügbarkeit wird weiterhin geopolitische Spannungen prägen und industrielle Strategien weltweit verändern. Letztlich wird der Erfolg der Stromrevolution – und ihre Fähigkeit, wirtschaftlichen Fortschritt mit Klimazielen in Einklang zu bringen – davon abhängen, ob Regierungen in der Lage sind, eine langfristige industrielle Vision zu entwickeln und die KI-Revolution zum Wohle der Gesellschaft zu lenken.

[1] World Energy Outlook 2025 – Analysis - IEA

[2] World Energy Outlook 2025 – Analysis - IEA

[3] World Energy Outlook 2025 – Analysis - IEA

[4] Solarenergie, Geothermie usw. sind Teil der Verbrauchszahlen, aber nicht Teil der Erzeugungszahlen.

[5] Energy and AI – Analysis - IEA

[6] Energy and AI – Analysis - IEA

[7] Power Hungry: How AI Will Drive Energy Demand

[8] Statistiken zur erneuerbaren Kapazität 2025, IEA.

[9] Zahlen von Bloomberg NEF. Die Netzinvestitionen werden 2024-2025 voraussichtlich weltweit um 15-16 % steigen und bis 2030 jährlich um mehr als 10 % zunehmen.