Research Papers

Research Paper, Anleihen, Bob Maes, Philippe Dehoux

Sie schauen sich auch gerade die Euro-Swap-Spreads gegenüber US-Swap-Spreads an? Diese beobachten wir ebenfalls genau. Aber um ehrlich zu sein, ist der nebenstehende Chart einer der Letzten, den wir bei der Verwaltung von Aggregate-Euro-Rentenportfolios betrachten. Wenn Sie erfahren möchten worauf wir den Fokus legen, lesen Sie die Seite doch gerne bis zum Schluss.

Research Paper, Alternative Investments, Pieter-Jan Inghelbrecht, Johann Mauchand, Steeve Brument

Rückkehr zur Diversifizierung

Wir haben die Allokation zwischen Aktien und Anleihen kürzlich analysiert und die Frage gestellt, 'Ist 40/30/30 das neue 60/40?' Nun, ja, wir denken schon. Unsere Analyse zeigt eine langfristige Korrelation zwischen Aktien und festverzinslichen Wertpapieren, die beängstigend nahe bei 1,0 liegt. Diese erhöhte Korrelation verändert die Wirksamkeit der traditionellen Portfoliokonstruktion grundlegend.

Olivier Clapt, Asset Allocation, Research Paper

Kapitalmarktannahmen - Langfristige Renditeprognosen

Obwohl das Navigieren nach den Sternen mutig und abenteuerlich erscheinen mag, würden wir es auf den Finanzmärkten nicht empfehlen. Besser mit einem soliden Kompass ausgerüstet sein!

Q&A's

Q&A, Money Market, Pierre Boyer

Geldmarktstrategien: wenn Bares Wahres ist

Geldmarktstrategien sollen den Anlegern eine risikoarme und liquide

Möglichkeit bieten, höhere Renditen als auf traditionellen Sparkonten

zu erzielen. Die Portfoliomanager Pierre Boyer, Elodie Brun und Benjamin

Schoofs berichten über ihre Erfahrungen mit dieser Anlageklasse.

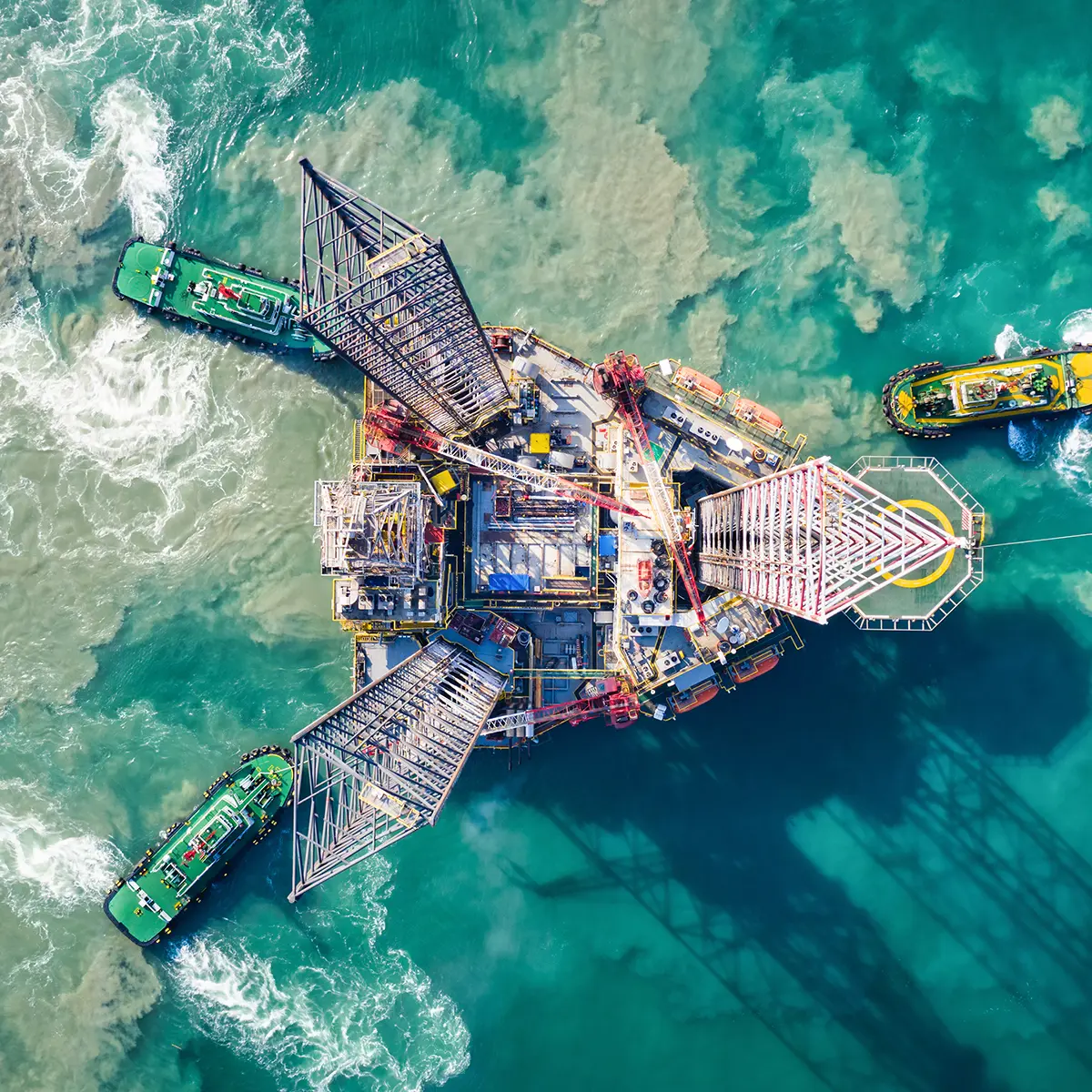

Q&A, Christopher Mey, Emerging Markets, Nikolay Menteshashvili

Chancen freisetzen: ein Leitfaden für Investments in Unternehmensanleihen aus Schwellenländern

In einem sich ständig weiterentwickelnden globalen Umfeld bieten die Schwellenländer Anlegern, die ihre Erträge diversifizieren und steigern wollen, besondere Chancen. Unternehmensanleihen aus Schwellenländern stellen eine Anlageklasse mit einem Volumen von über 1 Billion Dollar dar, die robuste Fundamentaldaten mit einem hohen Renditepotenzial verbindet. Die Portfoliomanager Nikolay Menteshashvili und Christopher Mey erläutern im Detail, warum diese Anlagestrategie die Aufmerksamkeit der Anleger verdient, wie sie attraktive risikobereinigte Renditen bieten kann und welche Voraussetzungen erfüllt sein müssen, um sich in diesem komplexen, aber vielversprechenden Universum erfolgreich zu bewegen.

Q&A, ESG, SRI, Kroum Sourov, Christopher Mey, Emerging Markets

Nachhaltigkeit: ein wachsender Markt für Emerging Debt

Kroum Sourov und Christopher Mey, Portfoliomanager der Strategie Sustainable Emerging Market Debt, erläutern, welche Bedeutung diese Art der Analyse für ein Rentenportfolio haben kann. Sie beschreiben den Investmentprozess von Candriam, bei dem der Fokus auf Relativ Value und Risikomanagement liegt. Dieser Ansatz soll es ermöglichen, die Strategie an die sich ständig verändernden Märkte im Laufe eines Wirtschaftszyklus anzupassen.

Transparency Code

Die Transparenzkodizes finden Sie auf den Seiten des Fonds.

Überblick zur Nachhaltigkeit

Nachhaltigkeit und Verantwortung müssen Teil der Persönlichkeit und Kultur des Unternehmens sein. Wir müssen die Verantwortung in uns tragen, um dies auch in unsere Anlagen übertragen zu können.