Simon Martin – Senior Partner and Chief Investment Strategist, Tristan Capital Partners

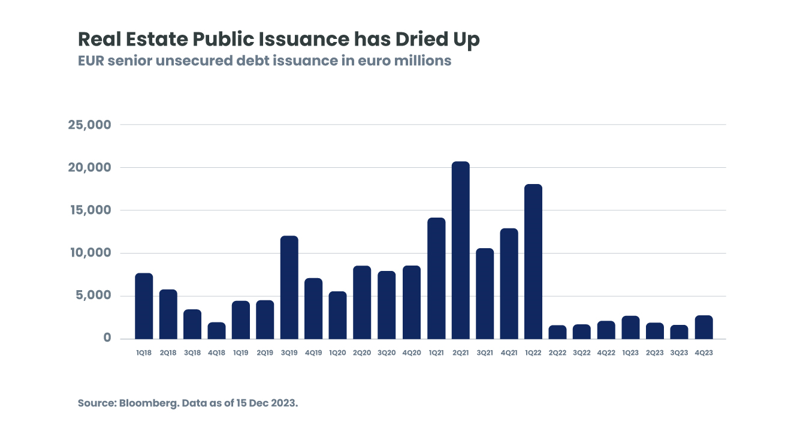

Real estate markets spent most of 2023 in statis, ‘frozen’ for the most part by rising interest rates and uncertainty related to asset valuations. Transaction flows were low by historical standards, similar to the levels seen during the Great Financial Crisis. Real estate credit markets have largely been closed to new issuers and other borrowers.

Prices under Pressure

Over the last 18 months, valuers and appraisers have been forced to base property price estimates on interest rate changes. The scale and volatility of credit costs has meant that in most sectors, capitalisation rates have increased significantly, driving down appraised values and public markets valuations. The magnitude of the mark-downs has been somewhat mitigated by the relative strength of the leasing/rental markets, and by indexation arrangements which have increased net operating income. However, data from Savills suggests that values are 20% to 30% below their 2021 levels.

Refinancing needs Surge

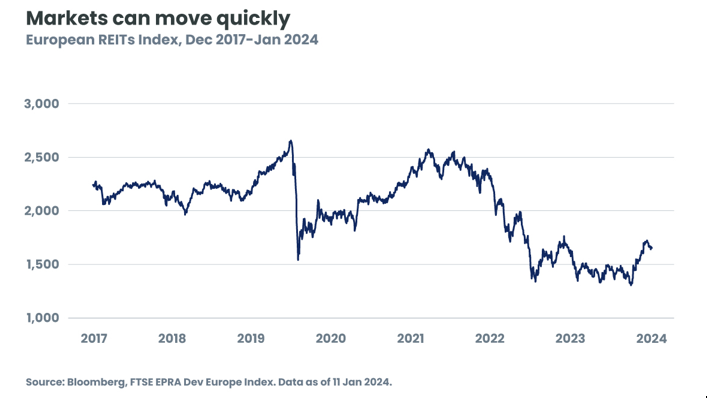

Given these dynamics, the recent shifts in the central bank narratives and interest rate expectations is very welcome. The shift to a ‘pause’ has loosened financial conditions and is likely to spur more commercial real estate (CRE) activity in both refinancing and transactions. In turn, we expect the changed rate environment will motivate many investors to step off the sidelines and begin to look at opportunities to commit incremental capital to the sector. This improvement has been most clearly visible in the public (REIT) markets, where there has been a rally in the final quarter of 2023, particularly in the stocks that were most aggressively leveraged going into 2021.

Past performance is no guarantee of future results and is not constant over time.

In practice, this improvement in market sentiment comes at a time when the demand for capital is high. If financial conditions continue to ease, we may see the real estate market shift into gear quite quickly, particularly in the credit space. With banks and public credit markets largely closed and firmly set in wait and see mode, the refinancing backlog is substantial.

Enter Private Debt

These developments reinforce the case for private credit capital commitments over the next 12-24 months. This surge in refinancing activity increases the demand for credit while the supply of new debt capital remains constrained, so spreads are likely remain elevated and rates remains elevated. Combined the effect of relatively high rates and wider spreads has lifted the potential returns on whole loans and senior secured loans to ‘equity-like’ levels. It is rare for European private debt investors to both be paid this well, and to have such an open playing field available to them. This should be a happy hunting ground for private credit players.

Conclusion

While the real estate market may look like its ground to a halt, our conversations with key participants suggests they are limbering up for a busy 2024. Real estate markets tend to spin on a sixpence and nailing the bottom of the CRE market requires investors to skate to where the puck is going tomorrow, not to where it is today. The sector has repriced to reflect rate increases and we think it could now offer opportunities for risk-aware participants with capital. We believe that capital providers and investors can now make the uncertainty and volatility of the last two years work to their advantage, providing they do their homework and move quickly.

Time to lace up the skates!

This document is provided for information and educational purposes only and may contain Candriam’s opinion and proprietary information, it does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction, except where expressly agreed. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.