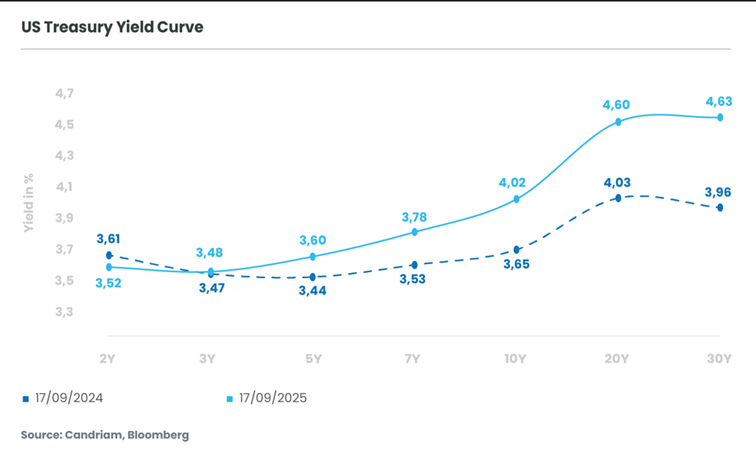

The global rates landscape is entering a decisive new phase as the long-standing flatness of yield curves gives way to steepness that has not been seen since 2011. The term premium, the additional interest by bondholders investing in longer-dated bonds versus short-term bonds, is back after an absence of many years. In both the US and Europe, the interplay of politics, policy, and structural forces is narrowing the room for monetary discretion while amplifying market volatility. Tariffs and de-globalisation are increasing structural price pressures, giving central banks less amplitude for accommodative monetary policy.

Central banks are no longer buyers of bonds, leaving long-term yields relatively unconstrained by either conventional and unconventional monetary policy. More than changes in policy rates and quantitative easing, it’s the long-term credibility of central banks to keep inflation in line with targets that matters.

Fed maneuverability is increasingly cornered between inflation risks and political constraints, while the ECB faces subdued inflation but rising long-end pressures. Against this backdrop, the restoration of the slope is not merely a technical adjustment but a signal of shifting macroeconomic regimes. For investors, it opens a window of opportunity — and a test of positioning discipline — across both rates and credit markets.

The Fed’s Narrow Corridor

The case for curve steepening in the United States is growing increasingly compelling. Inflation remains the pivotal variable, yet the Fed finds itself cornered regardless of the direction of travel. Should inflation edge higher, any attempt to reaffirm credibility with even a mildly hawkish signal would risk provoking a political backlash — if not direct rebukes — from a White House laser-focused on growth and investment ahead of the 2026 midterm elections. Conversely, if tariff costs are absorbed via margin compression and weaker corporate investment, the ensuing drag on GDP will become clear. In that case, corporate guidance is likely to flag earnings downgrades, equity valuations priced for resilience will be repriced, and volatility could re-emerge from its historically depressed levels. Such a scenario would only intensify pressure on the Fed to deliver deeper cuts. Either path — inflation forcing credibility restoration or growth weakness forcing accommodation — results in a steeper yield curve. Even an attempt by the Fed to remain inert and preserve optionality could backfire, with markets becoming more volatile and driving a repricing along the curve.

Tariffs, Trade, and Tension

All considered, the probability of steepening has increased markedly. Tariff rates, though somewhat lower than feared in April, are now being implemented and will likely exert a structural drag on corporate margins and global trade flows. The US economy must now traverse a narrow corridor between resilient growth and contained inflation if the Fed is to be shielded from political interference, and equity markets to avoid instability. Additional progress on the China trade front, following recent deals with Japan and the EU, could bolster global growth expectations and rekindle inflationary pressures. Such a scenario would add upward pressure on long yields precisely when the Fed’s policy options remain one-sided. The structural imbalance between fiscal expansion and constrained monetary flexibility argues strongly for a steeper US curve.

Europe’s Anchored Front-End and Pressured Long-End

In Europe, the trajectory is shaped less by political pressure and more by fundamentals. Inflation dynamics are decisively downward: weak demand conditions across much of the region, compounded by China’s disinflationary impulse, have anchored expectations. Even Germany’s fiscal stimulus is unlikely to trigger sustained price pressures. With growth prospects subdued, demand-driven inflation is improbable, meaning the ECB is unlikely to tighten. Instead, it is poised either to hold or to ease further, ensuring the short end remains well-anchored, if not lower. Yet, pressures are building at the long end. Sovereign debt issuance continues to rise across core European markets. Technical factors are also involved: regulatory changes which provide incentives for Dutch pension funds to reduce duration exposure are generating structural outflows from the long end of the curve. The combination of subdued short-end rates and long-end supply pressure is thus primed to generate a steepening across European curves, albeit at lower nominal levels than in the US.

Tactical Rate Opportunities

The transition to steeper curves carries profound implications for rate markets. In the US, steepening will likely take the form of a bull-steepening — driven more by front-end yields collapsing on the expectation of rate cuts than by an aggressive sell-off at the long end. This creates opportunities for investors to position in the 2- to 5-year segment, where yields remain elevated but are poised to benefit most directly from policy easing. At the long end, caution is warranted: persistent fiscal deficits, elevated Treasury supply, and lingering inflation uncertainty leave 10- and 30-year yields vulnerable to repricing. In Europe, a similar dynamic emerges: the short end anchored by an accommodative ECB, but the long end exposed to rising issuance and technical outflows. Investors may find relative value in holding intermediate maturities in the 5Y – 7Y range, while maintaining a defensive stance on the far end of the curve.

Conclusion: The Return of the Curve Slope

The re-emergence of sloping yield curves is both a signal and an opportunity. It reflects the limits of monetary policy, the persistence of fiscal expansion, and the re-pricing of inflation risk. For rates investors, steepeners and inflation-linked instruments provide attractive opportunities. For credit allocators, bull-steepening implies a supportive backdrop for short- to intermediate-term maturities. Navigating this transition with discipline and selectivity will be critical, as the return of the curve slope heralds both market opportunity and the re-emergence of volatility.