Research Papers

Research Paper, ESG, SRI, Marie Niemczyk, Jorick Liebrand

La révolution de l’intelligence artificielle (IA) IA est-elle inarrêtable ? À une vitesse

fulgurante, l’IA transforme les industries, libère de la valeur économique, génère un impact positif sur l’environnement, contribue à la résolution des défis sociaux - et en outre, offre des opportunités d’investissement convaincantes.

Research Paper, Obligations, Bob Maes, Philippe Dehoux

Euro Swap Spreads : Décomposition des classes d'actifs

Le spread d'une obligation d'entreprise par rapport à sa référence (par exemple le Bund allemand), souvent réduit à l’écart de crédit (spread de crédit), peut en réalité inclure d’autres éléments que la seule différence de risque de crédit

Research Paper, Investissements alternatifs, Pieter-Jan Inghelbrecht, Johann Mauchand, Steeve Brument

Retablir la diversification

We have previously examined the equity/bond allocation and asked, ‘Is 40/30/30 the new 60/40?’ Well, yes, we think it is. Our work shows a long-term correlation between equities and fixed income that is frighteningly close to 1.0. This increased correlation fundamentally alters the effectiveness of traditional portfolio construction.

Q&A

Q&A, Money Market, Pierre Boyer

Stratégies monétaires : quand la liquidité est reine

Money market strategies aim to offer a low-risk and liquid way for

investors to generate higher returns than traditional savings

accounts. Pierre Boyer, Elodie Brun, and Benjamin Schoofs, portfolio

managers, share their insights on the asset class.

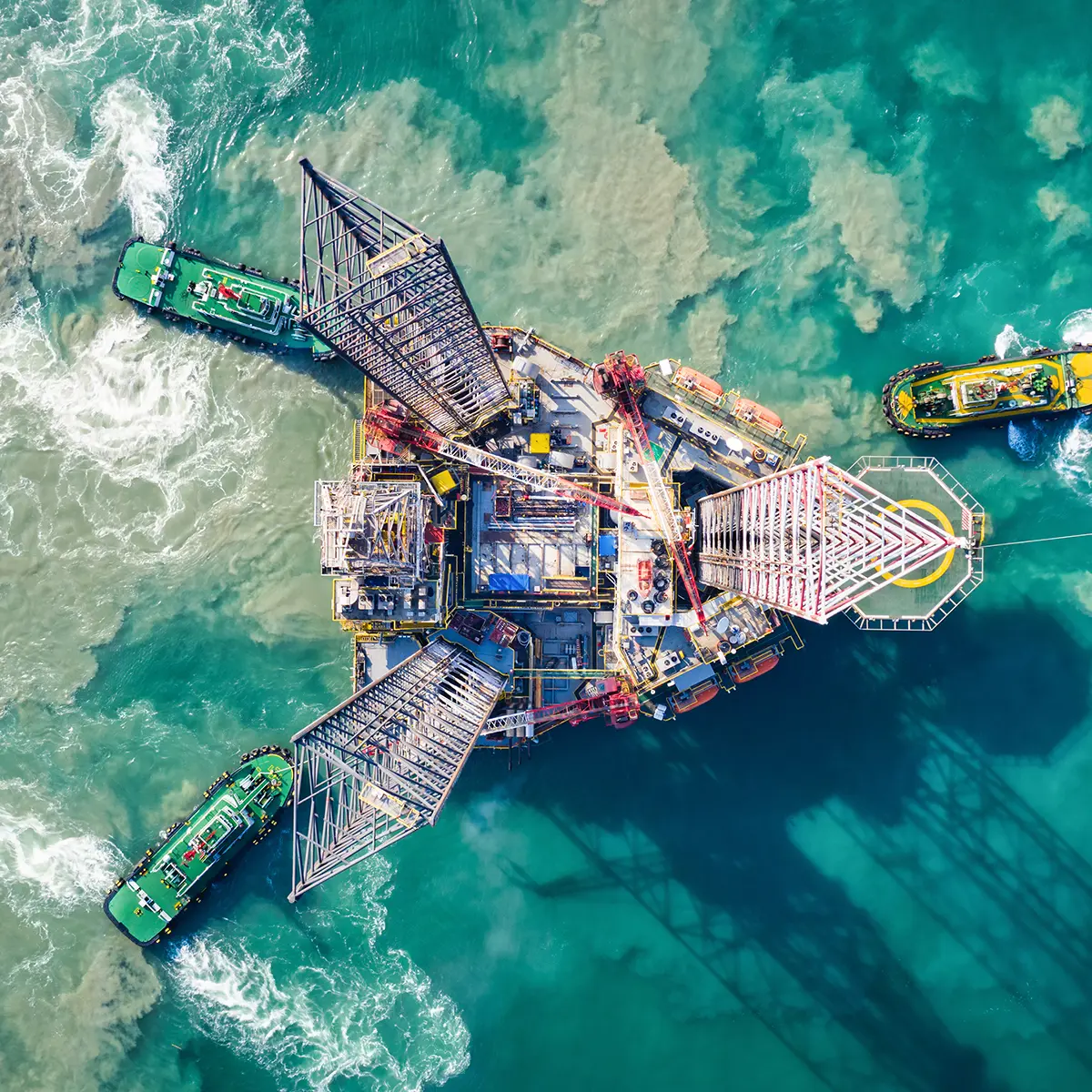

Q&A, Christopher Mey, Emerging Markets, Nikolay Menteshashvili

Elargir ses horizons : investir dans les obligations des entreprises des marchés émergents

Dans un environnement mondial en constante évolution, les marchés émergents offrent des opportunités spécifiques aux investisseurs cherchant à diversifier et à améliorer leurs rendements. Les obligations des entreprises de ces marchés représentent une classe d'actifs de plus de 1 000 milliards de dollars, alliant des fondamentaux solides à un fort potentiel de rendement. Nikolay Menteshashvili et Christopher Mey, gérants de fonds, expliquent en détail pourquoi cette stratégie d'investissement mérite l'attention des investisseurs, comment elle peut offrir des rendements attractifs ajustés au risque, ainsi que les éléments essentiels pour naviguer avec succès dans cet univers complexe et prometteur.

Q&A, ESG, SRI, Kroum Sourov, Christopher Mey, Emerging Markets

Durable : un marché émergent pour la dette émergente

Kroum Sourov et Christopher Mey, gérants de la stratégie de dette émergente durable, soulignent l’importance de ce type d’analyse pour un portefeuille obligataire. Ils détaillent le processus d’investissement de Candriam, en mettant l’accent sur la valeur relative et la gestion des risques. Cette approche est conçue pour permettre à la stratégie de s’ajuster aux marchés en perpétuelle évolution tout au long d’un cycle économique.

Codes de transparence

Veuillez trouver les codes de transparence sur les pages de Fonds.

Développement durable : présentation

Le développement durable et la responsabilité doivent faire partie intégrante de la personnalité et de la culture de l’entreprise. La responsabilité doit être dans notre ADN pour que nous puissions l’intégrer à vos investissements.