Economic signals remain uneven, data visibility is clouded by the US government shutdown, and inflation is edging higher again. Yet risk assets continue to climb, driven by easier liquidity and expectations of central bank support. After months of hesitation, European and US monetary blocs are once again moving in the same direction – cautiously toward easing. Investors, meanwhile, are trying to decide whether this alignment marks a prelude to a short-term shake-out or the start of a new, liquidity-fuelled advance. Our conviction remains risk-on, as fundamentals and technicals confirm a constructive outlook for equities, and the upward trend is likely to continue in the medium term. As a result, we have made some adjustments to our regional equity allocation and hold a balanced overweight allocation across the US, the euro zone, Japan and emerging markets our allocation to alternative strategies.

Policy Visibility Returns – but Inflation and Missing Data Complicate the Path

After a nine-month pause, the Federal Reserve has resumed its rate cut policy cycle. September’s 25 basis-point rate cut ended the long interlude and confirmed that the focus has shifted from containing inflation to preserving growth. The market now anticipates further cuts, taking the policy rate to around 3.25% by mid-2026 – a level consistent with a soft-landing scenario rather than a crisis response.

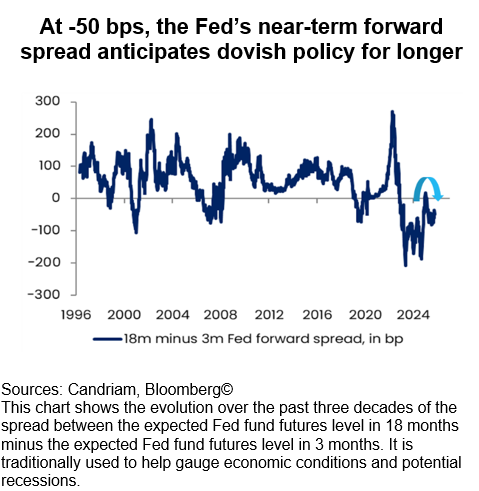

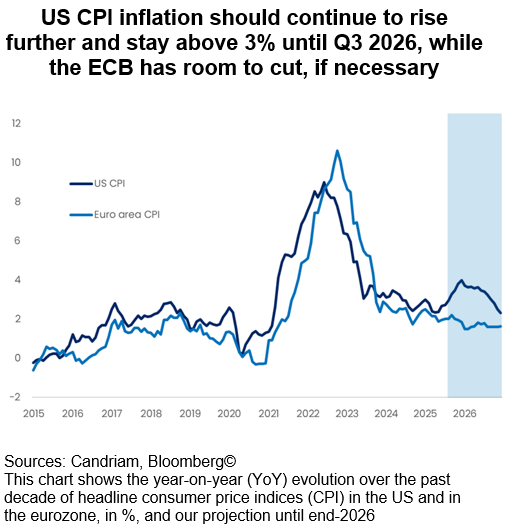

However, the current phase is clouded by two short-term complications: a modest inflation rise and the absence of reliable data. Headline US inflation has ticked higher by a few tenths of a percentage point, reflecting the renewed tariff cycle. Policymakers – and breakeven inflation rate markets – have signalled their willingness to “look through” this temporary uplift, but the optics matter. With the Federal Reserve’s near-term forward spread still negative, the signal remains clearly dovish – yet the central bank must ease against the backdrop of headline numbers that are no longer falling.

In the bond market, this tension is translating into a powerful steepening of yield curves. Short-dated yields have declined swiftly as investors price in successive cuts, while the long end has been more stable. The result is a textbook bull-steepening pattern, reminiscent of early easing cycles. Real yields, meanwhile, have fallen from their summer highs but remain historically elevated. This mix – lower short-term rates and positive real carry – is encouraging duration demand without triggering fears of overheating. In effect, the Fed’s cautious restart has re-anchored long-term expectations while allowing front-end yields to adjust to the new narrative.

Closer to us, with rates steady at 2% and inflation just above target, the ECB can afford to be patient, but its communication has turned distinctly more relaxed. Officials continue to describe policy as being “in a good place,” yet the door to further cuts in 2026 remains open should tariff effects or soft German data persist. Fiscal policy is doing some of the heavy lifting: the German stimulus package, roughly 0.5% of GDP, together with the ongoing ReArm Europe programme, gives the region a modest growth cushion in the coming quarters.

For markets, this more dovish convergence between the Fed and ECB creates a renewed sense of monetary visibility – though one filtered through the noise of incomplete information. The absence of fresh US macro data due to the shutdown leaves investors trading on expectations and positioning rather than evidence. The story is still one of easing; the plot, however, has become harder to follow.

Short-Term Volatility in a Cyclical Fog

The current market discussion can be summarised as follows: activity indicators suggest a slowdown, while inflation remains elevated enough to blur the signal. The US shutdown amplifies that uncertainty: with key data series suspended, investors must rely on second-hand indicators – shipping volumes, regional surveys, private data and market-based measures – to infer the direction of travel.

Employment is the area drawing the closest scrutiny. Hiring momentum has cooled steadily, but outright job losses are not yet visible. Our models show that employment softness typically leads payroll contraction by one or two quarters. This suggests a deceleration ahead, though not an imminent recession.

For households, the real test will come in 2026, when the accumulated impact of tariffs begins to erode purchasing power. For now, nominal wage growth remains slightly above current inflation, and the positive wealth effect from rising asset prices continues to support spending. Consumption is therefore holding up – not because fundamentals are improving, but because the adjustment has been delayed.

Financial markets, however, are already pricing the next chapter. Equities have extended their rally through early October, reflecting a belief that policy support will outrun any temporary weakness in activity. Credit spreads remain historically tight, and volatility remains subdued. In this environment, every missing data release becomes a source of speculation, every corporate earnings update, a macro proxy.

The upcoming Q3 earnings season thus takes on outsized importance. Analysts expect mid-single-digit growth overall, with technology driving the cycle. So far, it is earnings resilience – not yet liquidity – that explains much of the market’s strength. As the earnings season window opens, investors will notably be watching forward guidance for 2026 to gauge how companies see the tariff environment feeding through to costs and demand.

In short, the near term remains cyclical and noisy. The combination of an inflation uptick, incomplete data and an overextended rally argues for temporary volatility – historically a usual pattern for the month of October. Yet the underlying macro tone – disinflation returning in 2026, central bank easing, and gradual fiscal expansion – continues to favour risk assets once the fog lifts.

Europe’s Steady Ground and the Medium-Term Outlook

Europe’s story is less dramatic but increasingly constructive. Growth remains modest, with manufacturing surveys stabilising just around 50 points, but the direction has turned positive since the start of this year. As shown above, inflation is easing towards 2%, giving the ECB freedom to stay accommodative, and fiscal policy is becoming a tailwind rather than a drag: Germany’s budget stimulus and EU recovery spending are expected to support demand into 2026. As a result, sentiment has somewhat improved from the lows of late summer. We have adopted a positive stance towards the region.

The weaker phase in France’s political cycle has not spilled over into broader spread levels, and corporate funding conditions have normalised. In fixed income, German Bund yields oscillate between 2.6% and 2.8% on the 10-year, with volatility at multi-year lows. Exchange rate-adapted yields remain attractive relative to the US, encouraging international flows. Credit markets tell a similar story. Investment-grade spreads near 75 bps and high-yield around 280 bps provide limited upside but stable carry. Ratings momentum is still positive, issuance is orderly, and investor demand for yield persists. We maintain our long duration via German Bunds.

Investment Implications

Together, these elements define an environment that is still driven by earnings growth but increasingly underpinned by improving liquidity conditions. The Q3 reporting season will test whether profitability can sustain current valuations. Should earnings hold while policy eases, the transition from cyclical resilience to medium-term expansion – the beginnings of a melt-up – could follow naturally. For now, the markets continue to move between data voids and policy signals, advancing not in a straight line but in a series of hesitant steps.

We therefore remain overweight on equities, with a balanced allocation across the US, the euro zone, Japan and emerging markets. Positive momentum is being driven by Technology and Industrials, while easing pressures in the Healthcare sector have removed a headwind.

On the fixed income side, our strategy is overweight on emerging market debt, supported by attractive yields, tariff relief, a relatively weak US dollar under a more dovish Fed, and improved investor flows. We also remain constructive on core-European (German) duration, while in credit, we continue to prefer European Investment Grade over High Yield, which has been upgraded to neutral – we observe a lack of premium to take more risk on this asset class, which is taken at portfolio level via the above-mentioned overweight on equities.

In currencies, we favour the Japanese yen and maintain selective long positions in EM currencies, and we remain underweight on the US dollar. We acknowledge that the US dollar remains the key pivot for emerging markets and precious metals. Recent positioning on a weaker USD and stronger gold looks somewhat stretched. With the equity rally, easing geopolitical tensions and doubts about Europe’s economic momentum, some of these trades could unwind in the near term.

In our strategy, we continue to hold precious metals, alternatives and market-neutral strategies: gold and silver have demonstrated that they represent a strong hedge in a world of geopolitical complexity, real rate volatility and a more dovish Fed. We also maintain our allocation to alternative strategies.

Candriam House View & Convictions

Légende

-

Opinion très positive

-

Opinion positive

-

Neutre

-

Opinion negative

- Opinion très négative

- Aucun changement

- Exposition réduite

- Exposition accrue

| Positionnement (vue actuelle) | Variation | |

|---|---|---|

| Action mondiales |

|

|

| États-Unis |

|

|

| Zone euro |

|

|

| Europe hors zone euro |

|

|

| Japon |

|

|

| Marchés émergents |

|

|

| Obligations |

|

|

| Europe |

|

|

| Europe "core" |

|

|

| Europe périphérique |

|

|

| IG Europe |

|

|

| HY Europe |

|

|

| États-Unis |

|

|

| États-Unis |

|

|

| IG États-Unis |

|

|

| HY États-Unis |

|

|

| Marchés émergents |

|

|

| Dette publique en devise forte |

|

|

| Dette publique en devise locale |

|

|

| Devises |

|

|

| EUR |

|

|

| USD |

|

|

| GBP |

|

|

| AUD/CAD/NOK |

|

|

| JPY |

|