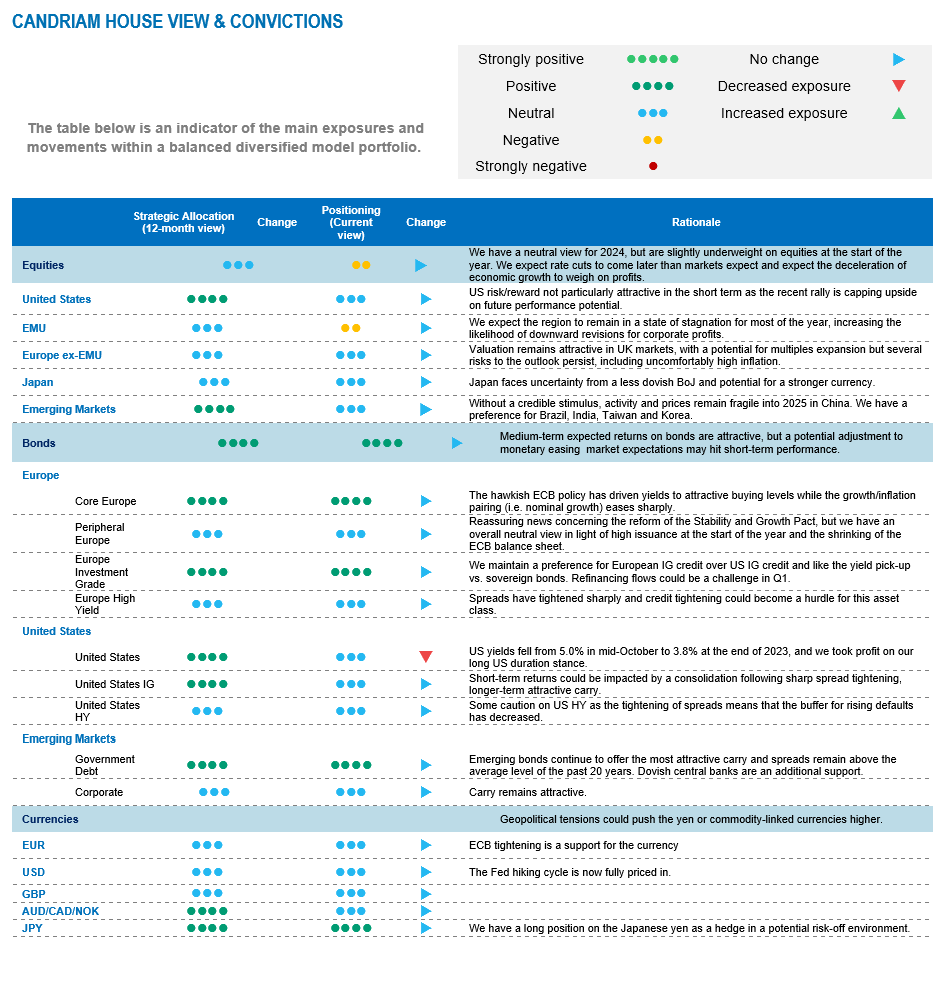

As financial assets performed particularly well in the final part of last year, our portfolios are now positioned to weather a consolidation phase: sentiment has turned bullish, imbalances have risen and Fed rate cut expectations have been brought forward to the current quarter. In our soft landing/ongoing disinflation scenario, we expect the Fed’s initial rate cut later than the market is hoping for. Therefore, we took advantage of the steep fall in US yields since mid-October to take profit on our long US duration stance and have turned neutral. Overall however, global equity indices still appear relatively less attractive than bonds, and we harvest carry via Investment Grade credit and Emerging Market debt.

2023: a desynchronisation in growth trajectories

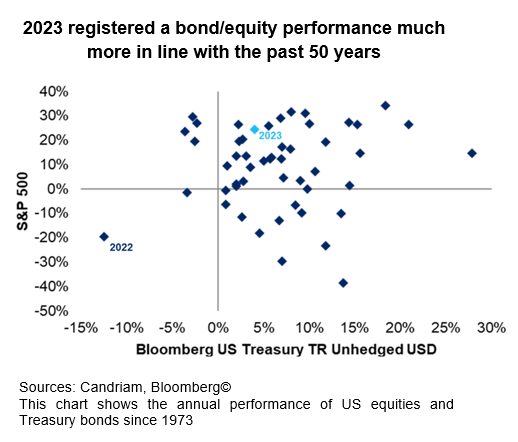

The year 2023 was marked by uneven economic performance and mixed corporate results. The year ended on a positive note for bonds and equities, but was affected by a high degree of performance dispersion and significant idiosyncratic risk. Clearly, 2022 looks like an outlier, while 2023 registered a bond/equity performance much more in line with the past 50 years. Hence, the start to the new year is less extreme than 12 month ago.

But investor sentiment and positioning have become much more positive than they were at the beginning of 2023, and this is where the question for 2024 lies: to what extent has the seemingly good news already been incorporated?

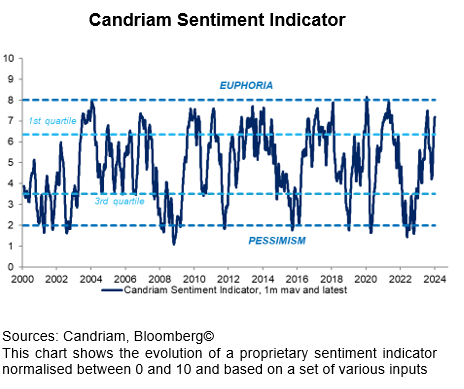

Sentiment and psychology indicators are not yet at extreme levels, but have improved towards quite high levels from a longer-term perspective.

We note that credit spreads and volatility have fallen significantly. Similarly, various technical indicators have reflected the rise in financial markets as momentum and relative strength measures have become somewhat stretched.

In a nutshell, our overall sentiment indicator is moving towards the level reached at the end of last July, close to “euphoria” level, which could trigger a contrarian sell signal. After the strong performances registered in the last few weeks of the year, we are likely to see a phase of consolidation at the start of the year. Dry January.

2024: greater visibility for investors

While the start of the year could be somewhat bumpy, the growth/inflation mix is finally returning to "familiar" territory. Inflation has given way and is set to fall rapidly to below 3% in both the US and the eurozone, and is no longer a primary concern for investors. Similarly, according to IMF forecasts, the wide range in economic growth rates among countries should narrow considerably by 2024/2025, once the shocks have been absorbed.

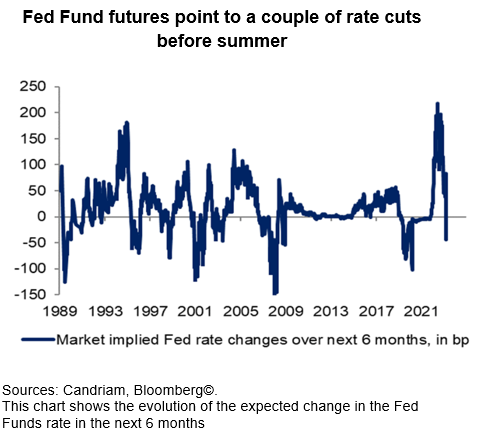

The same is true of monetary policy: we are at the end of the monetary tightening cycle, with central banks having succeeded in their mission and having restored their room for manoeuvre. The central question for investors has shifted from whether there will be rate cuts to when these will take place.

The timing of Fed cuts could be adjusted backwards

The markets expect early and large Fed rate cuts but, in our view, market pricing has somewhat gotten ahead of itself, as the likelihood of a Fed rate cut as early as March is now seen as a distinct probability. In our view, solid household income growth has been – and will continue – to be key for a “no recession” scenario this year. A soft landing in the United States remains our most likely scenario, implying no rush for the central bank to deliver monetary support. We don’t expect the first monetary easing before the end of H1 2024, leaving room for disappointments compared to today’s market pricing.

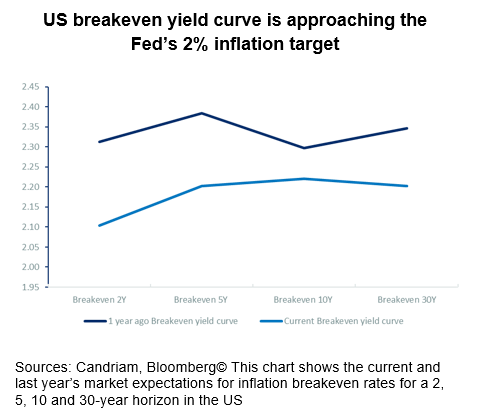

Long-term yields would need significantly lower growth to decrease from current levels, as breakeven yields are already close to meeting the Fed’s 2% inflation target. As US yields fell from 5.0% in mid-October to 3.8% at the end of 2023, we took profit on our long US duration stance.

Asset allocation: a preference for fixed income

Our asset allocation shows a relative preference for bonds over equities, as the equity risk premium is currently insufficient to encourage investors to reweight the asset class.

We have the following equity convictions:

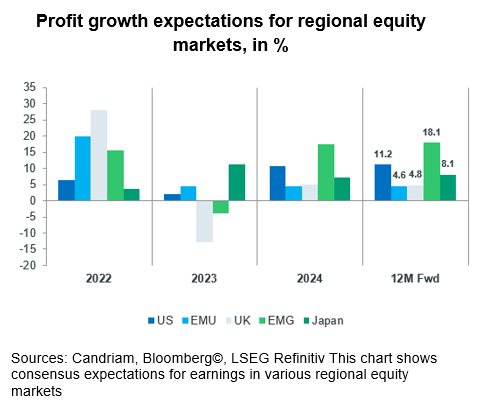

- Given relatively optimistic consensus profit growth expectations, we expect limited equity upside, and are currently slightly underweight on equities. We are waiting for a better risk/reward and a clearer (central bank) signal before increasing our equities exposure. We have a cautious view on eurozone equities and are neutral on other regions.

- However, we are looking at specific themes within equities. Among them, we like Technology/AI and look for opportunities in beaten-down stocks in small and mid-caps or within the clean energy segment. We also remain buyers of late-cycle sectors like healthcare and consumer staples.

In our fixed income allocation:

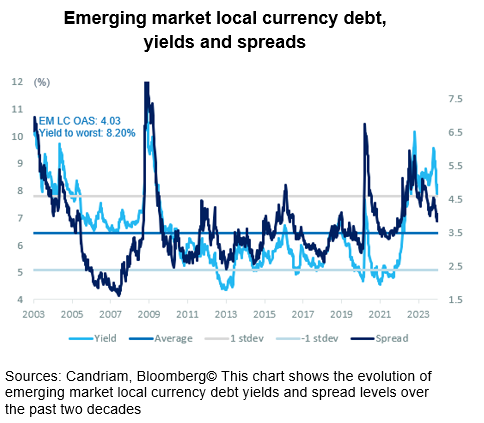

- We focus on high-quality credit and remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We also buy core European government bonds with the objective of benefiting from the carry in a context of slowing economic activity and cooling inflation.

- As US yields fell from 5.0% in mid-October to 3.8% at the end of 2023, we took profit on our long US duration stance, maintaining a neutral stance on US government bonds.

Among hedging diversifiers, we hold:

- A long position in the Japanese yen and exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- And we expect alternative investments to perform well, as they offer some decorrelation from traditional assets.