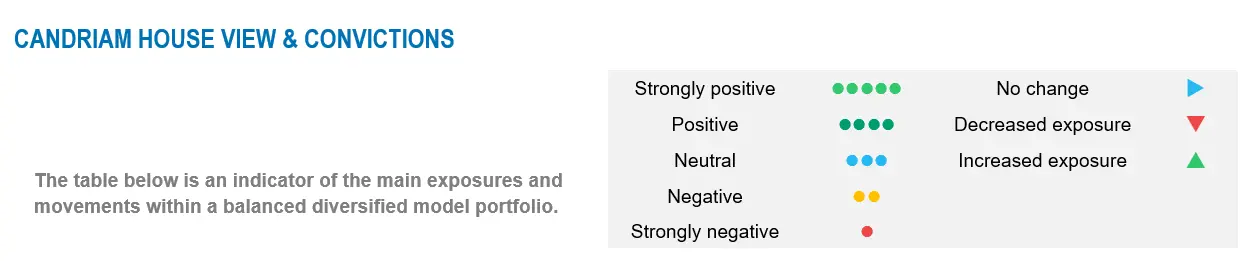

The global outlook for 2024 is complex, marked by the dual forces of economic resilience and evolving challenges. In the United States, robust growth throughout 2023, culminating in a 3.3% annualised expansion rate in Q4, sets a compelling precedent. Conversely, the euro area’s cautious recovery underscores the need for investor patience. Central banks, notably the Federal Reserve and the European Central Bank (ECB), have now embraced a prudent approach towards monetary policy easing. This backdrop necessitates a patient approach to investment. Overall, we maintain a neutral allocation towards equity indices outside Europe, a region which appears to have bottomed out but is still relatively less attractive than the rest of the world. Within the fixed income segment, we continue to harvest carry via Investment Grade credit and Emerging Market debt.

The Virtue of Patience in Growth and Policy

The remarkable growth trajectory of the US economy, with an acceleration from 1.9% in 2022 to 2.5% for 2023, illustrates the benefits of a measured and patient approach to economic challenges. Despite this robust expansion over recent quarters, real-time indicators such as activity and purchasing manager indexes may still be underestimating the economy’s momentum. Job creations have re-accelerated recently, especially in the private sector, whereas the unemployment rate remains at 3.7%.

The Federal Reserve’s decision to maintain the interest rate at 5.5% reflects a careful balancing act – awaiting more definitive signs of inflation aligning sustainably with the 2% target. Chair Powell’s emphasis on the need for greater confidence in inflation trends before considering rate adjustments further underscores a commitment to patience in policy normalisation.

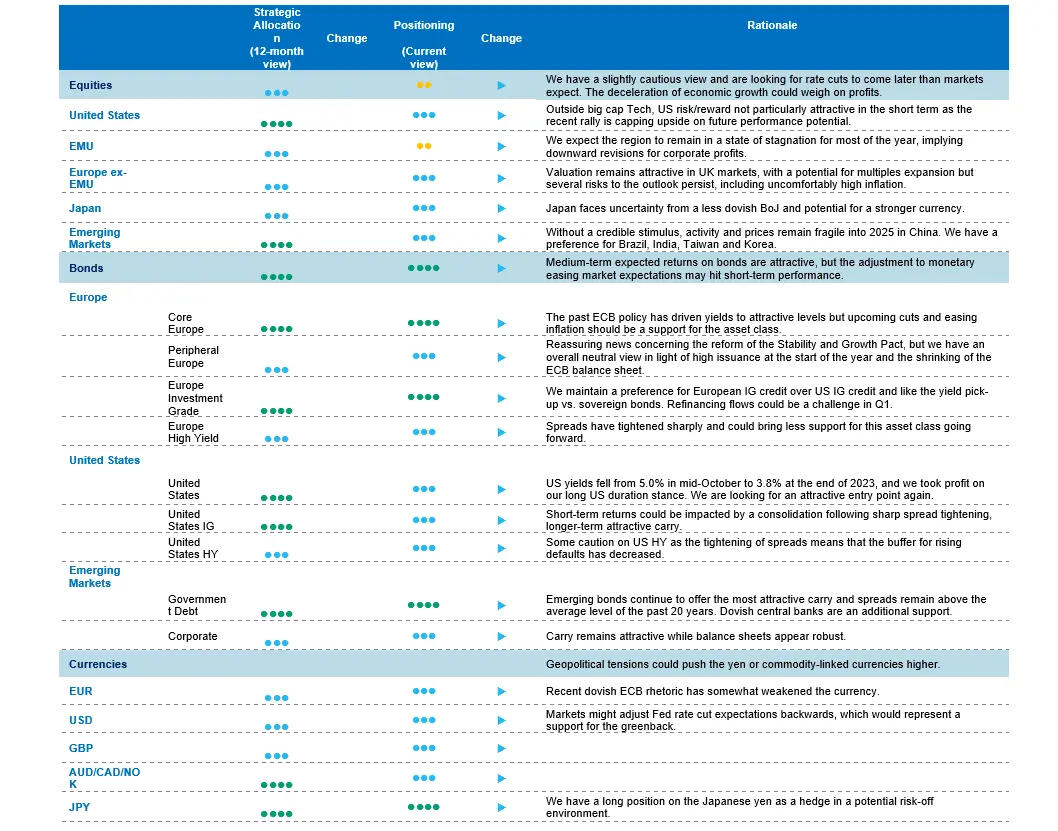

There will be no major central bank meeting in February, therefore giving enough time for markets to adjust further the timing and the amplitude of future rate cuts. The probability of a first Fed rate cut as soon as March has declined from 90% to less than 20% in just six weeks. Our expectation that the easing cycle will occur this summer is becoming more consensual.

On this side of the Atlantic, the eurozone is navigating its economic recovery with caution, as the region’s economic landscape is marked by contrasts.

While there are signs of improvement, particularly in the manufacturing sector, overall momentum remains subdued, as reflected in PMI surveys and employment data. The region is poised for slight positive GDP growth in 2024 (0.5%, as in 2023), alongside a gradual disinflationary trend. This delicate recovery process calls for a prudent and patient approach to monetary policy and economic support.

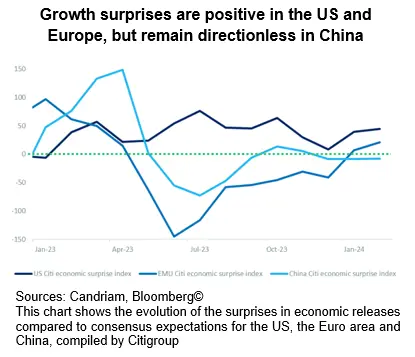

While “good” economic and corporate earnings news in the US are clearly taken at face value (pushing asset prices higher), we note that the absence of incremental “bad” news in the Eurozone is starting to be read as good news. Indeed, for the first time since November 2020, the region is seeing both positive (i.e. higher) surprises on growth and negative (i.e. lower) surprises on growth.

Investors are embracing patience

In our understanding, investors should adopt a slightly cautious stance towards global equities and prefer regional allocations outside Europe.

In the US, the market’s resilience, coupled with the Fed’s patient policy approach, suggests a selective strategy favouring sectors likely to benefit from sustained economic growth and manageable inflation. Technology, particularly AI, and healthcare sectors may offer valuable opportunities, reflecting the ongoing digital transformation and demographic trends.

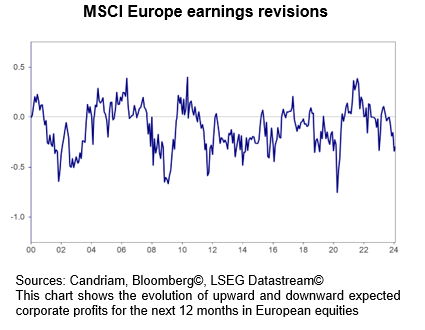

In Europe, patience may reward investors attentive to sectors that stand to gain from eventual economic stabilisation and ECB policy shifts. Pieces could start falling into place and a more vigorous signal of a more supportive policy mix could become a welcome signal for the region’s assets. now, analyst revisions of future corporate profits are very weak, acting as a headwind for European equities.

Emerging markets, especially those not directly tied to China’s economic performance, might present attractive valuations and growth prospects, demanding a selective investment approach.

The fixed income landscape offers a nuanced palette for investors willing to navigate its complexities with patience.

US Treasuries and investment-grade bonds provide a defensive anchor in portfolios, benefiting from the Fed’s careful rate trajectory.

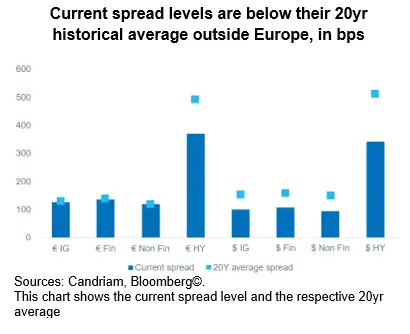

European bonds, particularly in the investment-grade segment, are appealing as we are seeking a yield pickup in a context of likely future ECB policy adjustments.

Furthermore, Emerging Market debt, supported by local central banks’ dovish stances, could offer attractive returns for those patient enough to weather potential volatility.

A well-balanced asset allocation

The theme of patience permeates the global economic and investment outlook at the start of 2024. In a world where central banks exhibit a cautious approach to policy adjustments, investors too must embrace patience as a guiding principle.

Our strategy takes into account that sentiment has turned bullish, imbalances have risen and financial markets are questioning Fed interest rate cuts as early as March. Therefore, a balanced strategy – attentive to the evolving narratives and electoral campaigns in the US, Euro area and beyond – will be crucial in navigating the opportunities and challenges that lie ahead.

Our asset allocation shows a relative preference for bonds over equities, as the equity risk premium remains insufficient to encourage investors to reweight the asset class substantially.

In our fixed income allocation:

- We are focusing on high-quality credit and remain exposed to emerging countries’ debt to benefit from the attractive carry.

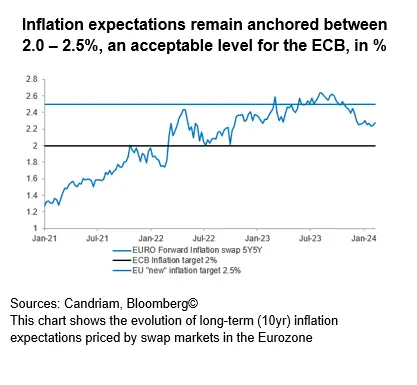

- We are also buying core European government bonds with the objective of benefiting from the carry in a context of cooling inflation, sluggish activity and upcoming central bank rate cuts. As inflation expectations remain well anchored, the ECB has started to shift to less hawkish rhetoric.

- As US yields fell from 5.0% in mid-October to 3.8% at the end of 2023, we took profit on our long US duration stance. We maintain a neutral stance on US government bonds, looking for a new, attractive, entry point as we expect markets to revise their Fed outlook.

We maintain the following equity convictions:

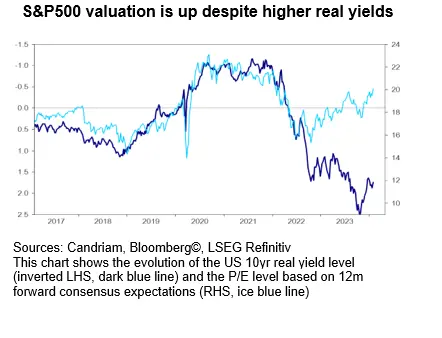

- The overall market valuation has disconnected from real yield levels in recent months, implying a less attractive buying level.

- Given relatively optimistic consensus profit growth expectations, we expect limited equity upside and are currently slightly cautious on equities, via an underweight stance on eurozone equities, being neutral on other regions.

- We are waiting for a better risk/reward and a clearer central bank signal before increasing our equities exposure.

- However, we are looking at specific themes within equities. Among them, we like Technology/AI and are looking for opportunities in beaten-down stocks in small and mid-caps or within the clean energy segment. We also remain buyers of late-cycle sectors like Healthcare and Consumer Staples.

Among hedging diversifiers, we hold:

- A long position in the Japanese yen and exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- And we expect alternative investments to perform well, as they offer some decorrelation from traditional assets.