We acknowledge that several tail risks have receded over the past few weeks, bringing relief to financial markets: helped by a diminished immediate escalation risk in the Middle East, the price of oil declined substantially, therefore avoiding an overshoot in bond yields and in the US dollar. Inflation continues its downtrend and should get close to central bank targets within the next 12 months. As uncertainty remains high – from geopolitics to potential vulnerabilities to restrictive financial conditions – risks to the outlook for global growth remain nevertheless tilted to the downside.

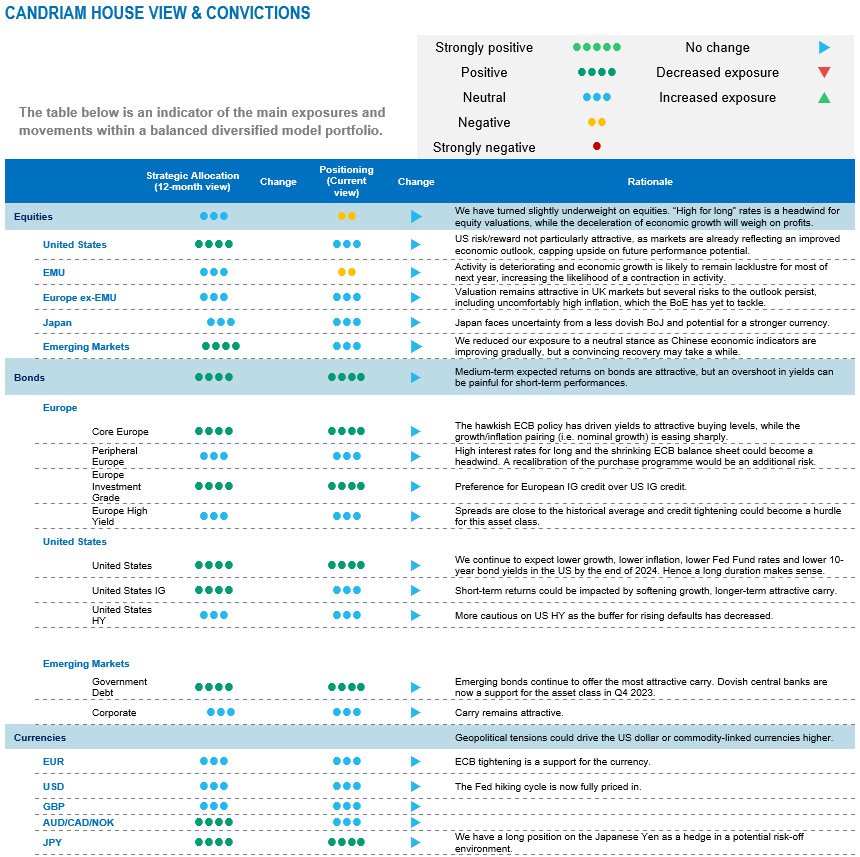

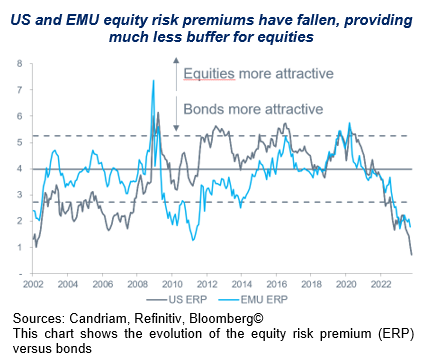

As a result, we are more confident in our asset allocation about extending duration if we believe that the peak in interest rates for the main central banks is behind us. On the credit side, we are positive on Investment Grade credit, which is a resilient asset class in a slowdown cycle and has one of the best carry-to-vol ratios. On the opposite, we consider that the equity risk premium is currently insufficiently attractive to encourage investors to reweight the asset class given the identified downside risks to our scenarios.

A growth desynchronisation

The growth desynchronisation continues. We have revised up our forecasts for economic activity in 2023 and 2024 in response to the growth achieved in the United States, while inflation is also showing encouraging signs. Wage pressures finally seem to be easing. Against this backdrop, the Fed is likely to remain in "high for long" mode, even if it does not raise rates any further.

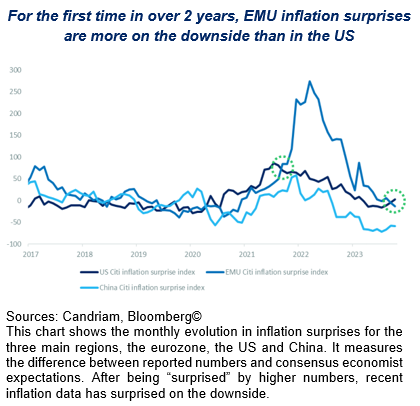

European growth is likely to remain lacklustre for most of next year, while disinflation accelerates: the annual rate of consumer price inflation for the eurozone has fallen from a multi-decade high of 10.7% in October 2022 to 2.9% just one year later, bringing it to within shouting distance of the ECB target. Policymakers are trying to remind investors that the “last mile” is the most difficult. This development does, however, take some of the pressure off the ECB, which should regain its easing capacity more quickly than expected next year, if necessary.

In China, economic activity has shown some timid signs of stabilisation, while price evolution remains deflationary. This is clearly a sign of weak domestic demand and a convincing recovery may take a while.

Europe remains in the worst fundamental situation, with economic and inflation data coming in below expectations, delivering negative surprises. At the start of Q4, not only do growth surprises in EMU remain clearly worse than in the US and in China, but inflation surprises have changed direction over the past year and are now below the surprise level registered in the US.

A constructive view on fixed income

We have currently a long bond duration, as we turned from underweight to neutral in March and to long duration since April. We are convinced that our positioning reflects the improved starting point, i.e. an attractive yield level and weaker outlook on the growth/inflation mix for next year.

We have currently a long bond duration, as we turned from underweight to neutral in March and to long duration since April. We are convinced that our positioning reflects the improved starting point, i.e. an attractive yield level and weaker outlook on the growth/inflation mix for next year.

The rationale for our long duration stance is straightforward: our strategy will benefit from the rise in interest rates and bond yields in a context of slowing economic activity and cooling inflation.

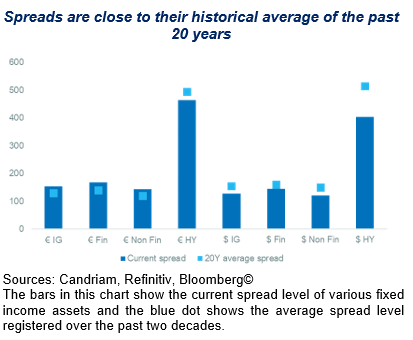

The cornerstones of our Fixed Income allocation in 2023 relied on adding yield to the portfolio via Investment Grade credit and diversification into Emerging Debt and High Yield bonds.

As sovereign bond yields have risen to multi-decade highs due to central bank tightening, the spreads of most fixed income assets are close to their long-term averages. As a result, yields at balanced portfolio level have been restored, offering some cushion beyond short-term volatility.

Currently, the yield-to-maturity of the Fixed Income bucket in a diversified portfolio stands at roughly 5%. This represents a significant change with the past: two years ago, the yield at portfolio level was close to zero.

Equities relatively less attractive

We note that equity valuations have adjusted but remain tight as positive EPS growth and high margins continue to be expected despite historic financial tightening. Further, a supportive, soft-landing US economic scenario seems priced for equities, capping further upside.

More specifically, the risk/reward ratio does not seem particularly attractive as the equity risk premium is currently insufficient to encourage investors to reweight the asset class.

Compared with last summer, we note some positive developments: the risk of a hard landing and monetary policy error has receded in the United States, and the situation in China seems to be stabilising. Geopolitical tail risks also seem contained in the short term.

On the other hand, we think that the upside on equities is limited and that the expected return is not sufficiently attractive compared with bonds in the current environment. The consensus is for earnings growth of 5-10%, which will be hard to beat given the expected slowdown in activity. The valuation, meanwhile, is already discounting a fall in real interest rates.

In terms of regional allocation, we are underweight on eurozone equities, as the likelihood of a contraction in activity has increased. We are neutral on US, Japan and emerging markets. The latter are vulnerable to pressure from US rates and the headwind of the USD.

In terms of sectors, we are sticking to our defensive preference for healthcare and staples. Cyclicals are already pricing a rebound in economic activity, which seems premature given the economic stage, a slowdown and central banks nearing the end of their tightening. Finally, given the expected gradual decline in bond yields and proven earnings resilience, we recently became more constructive on the US technology sector.