European equities: Positive economic surprises

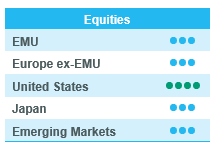

Global stock markets ended Q1 at an all-time high, fuelled by continued investor optimism. The resilience of the global economy, particularly in the US, has pleasantly surprised many.

Global stock markets ended Q1 at an all-time high, fuelled by continued investor optimism. The resilience of the global economy, particularly in the US, has pleasantly surprised many.

However, this rosy picture is not entirely cloudless. While core inflation has been on a welcome downward trend, recent spikes in energy prices and stubbornly high service sector inflation have cast some doubt on the Federal Reserve's interest rate cut plans.

This uncertainty has pushed long-term interest rates back up slightly. Geopolitical tensions, particularly in the Middle East and Ukraine, remain unresolved, but haven't significantly dampened overall market optimism.

European equity markets have performed well over the past few weeks. Since the last Equity Committee meeting held in early March, value stocks have outperformed growth stocks. This value bias has been the main driver of the recent market advance.

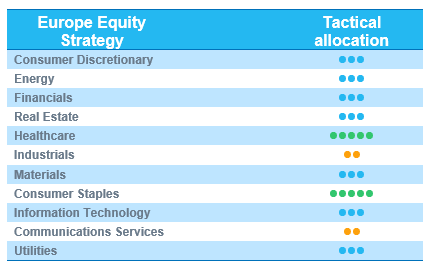

With regards to sectors, cyclical sectors have also contributed significantly to the rally, clearly outperforming compared to defensive sectors, with the exception of consumer discretionary. Materials and financials have emerged as the strongest performers within cyclical sectors.

Among defensive sectors, energy was the strongest outperformer compared to the broader European market, primarily driven by the recent rise in crude oil prices. However, other defensive sectors, such as consumer staples and healthcare, have clearly lagged over the past few weeks.

Earning expectations and valuations

The first quarter of 2024 earnings season is about to begin, with slightly positive earnings revisions ahead of it. Overall, analysts predict a modest 3% earnings growth for the entire year. However, on the back of an expected economic pick-up later this year, earnings growth should reach over 5% in the coming 12 months.

On the one hand, energy is the only sector dragging down expected earnings with negative expected growth in the coming 12 months. On the other hand, materials, industrials and healthcare are leading the pack, with high single-digit growth projections.

Furthermore, valuations appear attractive with this in mind, sitting at only 13.9 times expected earnings for the next 12 months, which is still below its long-term average.

Comfortable with defensive bias

Given the current market conditions, we believe maintaining a balanced portfolio with a slight defensive tilt is still the best approach. European cyclicals appear somewhat expensive, so we have not made any major changes to our sector allocation recently.

We remain confident in our positive stance on consumer staples, one of our strongest convictions in this uncertain market. Within consumer staples, we favour food & beverage and household & personal products companies.

We have also maintained our positive (+2) rating on the healthcare sector. European healthcare offers an attractive risk-return profile thanks to reasonable valuations, strong cash flow visibility and projected earnings growth.

Opportunity to reallocate from large to small caps

Looking ahead, a first ECB interest rate cut in June remains likely according to market consensus. In this scenario, we expect small caps to be the main beneficiaries, given their appealing valuation compared to large caps (especially cyclicals) and positive earnings momentum. Therefore, the current valuation of qualitative European small caps could be an interesting entry point relative to large caps, provided that long-term rates don’t rise in the coming weeks.

US equities: Extension of the rally

US equity markets have extended their rally since late October, continuing to gain ground even with stronger economic data and persistent inflation. Investors cheered a more dovish tone from Federal Reserve Chair Jerome Powell, who signalled that interest rates are sufficiently restrictive to get inflation back to 2%.

Value takes the lead

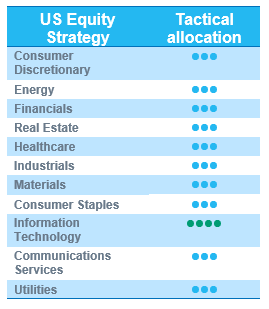

The uptrend has been broad-based, but value stocks have been the main driver, outperforming growth stocks. Sector performance has been mixed, with no clear distinction between cyclical and defensive sectors.

Energy surged on the back of rising oil prices fuelled by geopolitical tensions and the International Energy Agency's forecast of a tighter market in 2024.

Communication services, utilities and materials also fared well. Healthcare, information technology (which we downgraded to neutral in March) and consumer staples lagged behind.

Earnings season in focus

The first quarter earnings season kicks off next week. Analysts expect S&P 500 companies to report a modest 3.6% earnings growth, marking the third consecutive quarter of positive results.

Investors are cautiously optimistic, with earnings revisions remaining flat. This translates to an expected 11% growth in earnings over the next 12 months, with valuations currently at 21 times expected earnings.

Information technology, communication services and healthcare are expected to drive growth, while energy is the only sector projected to decline.

More balanced than ever

We made a minor portfolio adjustment by downgrading the healthcare sector to neutral. This decision is based purely on a top-down view, considering the strength of the US economy and its potential headwind for defensive sectors like healthcare.

Despite this tactical shift, our long-term view on healthcare remains positive. Drug approvals are at record highs, M&A activity is strong and valuations appear attractive. However, the current economic strength may limit the sector's near-term outperformance. Once we see clearer signs of an economic downturn, we’ll have an excellent buying opportunity.

Emerging equities: Robust recovery this year

In March, EM booked positive returns at +2.2% (in USD), underperforming DM (+3.0%).

The Fed kept its rates unchanged, and its chairman delivered a clear and dovish message.

In China (+1.0%), the economic landscape remained uneven. CPI turned positive in February, and manufacturing PMI surpassed 50 in March, entering the expansion zone. Nevertheless, the property crisis lingered with more news on companies’ debt issues. During the month, China held its annual congress and revealed the 2024 growth targets for GDP (5%) and CPI (3%).

Taiwan (+8.0%) and South Korea (5.4%) ended the month as leading performers within EMs, bolstered by sequential recovery in their respective industrial activities. The AI theme continued to stand out, enabling the market to uncover more compelling opportunities throughout the supply chain.

India (+0.8%) continued its resilient performance despite some profit-taking on Indian small caps. The government projects more infrastructure investment, and the country’s manufacturing PMI reached its highest level in 16 years.

In LatAm (+0.6%), Brazil (-2.5%) underperformed with weaker-than-expected industrial and consumption recovery. Large caps Petrobras and Vale were a drag. Mexico (+5.4%) was a top performer. The Mexican central bank initiated a 25 bps rate cut, marking the beginning of an easing cycle.

Turkey (+0.3%) faced mounting concerns over inflation, prompting a significant rate hike by the Turkish central bank in response. The outcome of the local elections is favourable for the adoption of more orthodox economic policies to support the economy.

US yields closed the month at 4.3%. Regarding commodities, crude gained 4.6%. Precious metals rallied amid renewed volatilities. Gold rose 9.1% and silver 9.9%.

Outlook and drivers

EM equities have demonstrated a robust recovery this year, and a confluence of tailwinds is helping to fuel the positive performance. Encouraged by the Fed’s dovish messaging, a soft-landing scenario for the US economy is becoming increasingly possible. Effectively, several rate cuts are expected throughout the year, which may reverberate to other central banks worldwide, especially in Asia.

The Chinese stock market has been receiving direct support from the government. The new head of the Chinese SEC is prioritising supervision to enhance corporate governance and IPO qualifications. The central bank and SOEs inject more liquidity into the market, through the form of principle ETFs holdings. More measures are needed to assure the country can achieve its growth targets, but the property crisis remains, as an overhang.

Regionally, EM outside China is showing notable resilience. India, in particular, is set on a strong growth track supported by public capital expenditure and favourable demographics. In LatAm, rising foreign investment in Brazil is helping to narrow the country’s current deficit, and Mexico’s first rate cut underscores its entry into an easing cycle.

The burgeoning semiconductor industry in Asia Pacific presents attractive opportunities, especially in the AI theme. As global chip leaders ramp up investment, investors are diving into the supply chain to discover transformative technologies crucial for the new generations of chips and algorithms.

Aligned with our strategy, we have dynamically calibrated the portfolio’s risk appetite in response to evolving market dynamics, maintaining a balanced position. We are awaiting further confirmation of the US’s dovish rates policy and China’s recovery, contributing to the differential growth of EM.

Positioning update

We are more optimistic on the outlook for EM equities, given receding headwinds, peaking Fed rates, a weaker USD and the better performance of growth as an investment style.

Regional view – We are downgrading Brazil to Neutral. We continue to monitor Brazil as the country is under pressure as US yields remain high.

No change to our sector views. We are positive on the semiconductor recovery, which is further aided by the AI development.

Regional views

We are downgrading Brazil to Neutral

Brazil – Neutral: Brazil showed near-term weakness, negatively impacted by the higher-for-longer US rates. The easing cycle is suppotive, and CPI figures are in line. GDP revisions are postive and domestic valuations are attractive. We continue to like the country.

Taiwan – Overweight: TSMC has delivered a strong performance, with 1Q sales growth beating expectaions. The company realised more progress in US capacity expansion, indicating a strong demand from US customers. TSMC also won more subsidies from the US government.

Korea – Overweight: Positive on Korean techs. We will monitor the elections and the potential impact.

India – Overwieght: Positive on the country’s long-term growth.

China – Neutral: The manufacturing PMI surpassed 50 in March, the first time in six months. The Chinese government also announced more investment in technology R&D.

Sector and Industry views

No change to sector views

We remain OW in tech and are monitoring cyclical evolution of semiconductors. We are positive on TSMC’s US expansion progress and the confirmed US subsidies.