A heavy blow

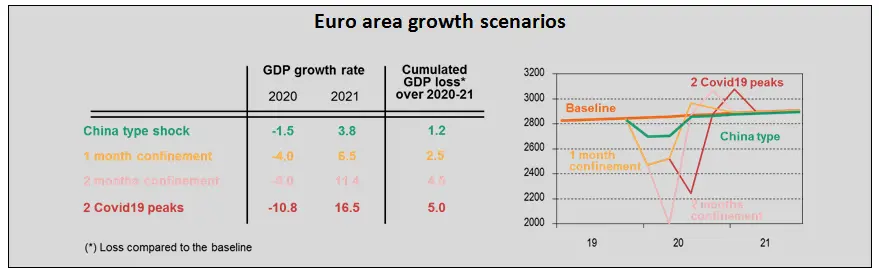

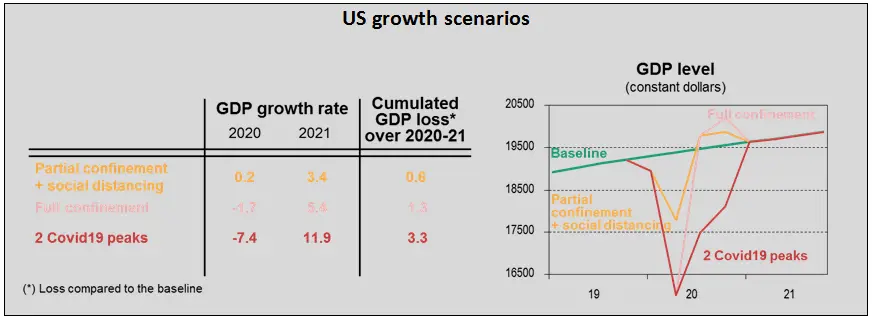

To give an idea of the depth of the shock, we made a ballpark calculation for the euro area of the impact of confinement on the activity of the main sectors: as long as confinement measures are in place, roughly 40% of the economy is being “switched off”. Maintained for one full month and progressively lifted, this implies a fall in euro area GDP of 4% for 2020. If confinement lasts for 2 months, the fall is double. Given the depth of the fall, it is unlikely confinement could be maintained for much longer than one quarter.The US case is a bit more complicated since up to now only a few States are confined (California and New York in particular) while social distancing prevails in other States. Our ballpark estimate is for a 10 % fall in the US GDP level. But as confinement is likely to be extended to other U.S. States, the fall in GDP could easily worsen to -30%: for a one-month confinement, and assuming some rebound in H2 2020, this would lead in a fall in US GDP of -2% in 2020. The impact of Covid19 could however prove socially more difficult to bear as the sectors directly affected by the confinement represent 50% of US labor force.

A strong policy reaction

While the length of the confinement will determine the depth of the fall in activity, the quality of the policy responses will shape the quickness and the strength of the rebound. Over the last couple of weeks, many policymakers have stepped in with promises to do “whatever it takes” to support their economies. Central banks have lowered their policy rates (or kept them low), have announced more buying of assets and are doing their best to contain liquidity strains. On top of its existing QE, the ECB in particular has launched a €750bn Pandemic Emergency Purchase Programme (PEPP). The PEPP is flexible and the ECB made clear that it is “fully prepared to increase the size of its asset purchase programmes and adjust their composition, by as much as necessary and for as long as needed”. In Europe at least, governments also made clear they are prepared to spend and use the power of the State in a way usually unthinkable in peacetime. Following President Macron, the British Prime Minister Boris Johnson said that his Government needed to act like a “wartime Government”.A “U-shaped” recovery

Given all the measures announced, we continue to believe a “U-shaped” recovery is still the most likely outcome: when confinement will be lifted, activity should progressively recover. For such a scenario to take place however, it is essential for productive capacities and financial channels not to have been impaired. It is also essential that confinement measures do not last for more than a quarter: keeping the economy afloat for much longer may prove difficult.While not our main scenario today, as long as a medication or vaccine is not found, we cannot exclude a more protracted evolution in which Covid19 is proving more resistant. In such a case, governments may be forced to use an “adaptive policy”[1] in which confinement, after having been relaxed, is triggered again in anticipation of intensive care units’ saturation, and is relaxed when ICU cases are bound to fall again. This “2 Covid peaks” scenario would imply a longer and deeper blow to the economies…

This scenario however, while possible, might not be the most likely as leaps in technology, such as the ability to rapidly sequence virus genomes, as well as ongoing research on drugs already in the pipeline or already treating diseases in patients which could be useful to fight COVID-19 could help shorten the time it will take to make an effective medicine. So, for the time being we stick to our “U-shaped” scenario.

[1] Imperial college, “Impact of non-pharmaceutical interventions (NPIs) to reduce COVID19 mortality and healthcare demand”, March 2020.