European equities: Reaching new all-time highs

Despite mixed Q3 earnings, European equities closed higher in October, reaching new all-time highs, as macro data showed signs of improvement. In the Eurozone, Q3 GDP surprised to the upside at 0.2% QoQ (vs 0.1% expected and prior) but reflected large discrepancies across countries: Germany and Italy lagged, while France and Spain posted stronger-than-expected growth.

Value stocks led the way

Since our last committee meeting in October, European markets have continued to rise, in line with US equities. This positive trend was only driven by Value stocks, while Growth stocks slightly decreased. Large caps outperformed small caps within both styles.

During the period, European markets were clearly driven by defensive sectors, with very strong performances from Energy, Utilities and Consumer Staples, which benefited from positive Q3 earnings surprises. As regards the Healthcare sector, its limited gain was mainly due to Novo Nordisk, which suffered from disappointing quarterly results and a lack of visibility on US drug prices.

Cyclical sectors underperformed most defensives, although they posted decent performances, with the exception of industrials. The latter were penalised by the correction of the Aerospace & Defence segment, which was subject to profit-taking amid easing geopolitical tensions.

The IT sector declined slightly due to the Software segment, which suffered from investor concerns about potential AI-related disruption. Communication Services experienced a sharp decline following mixed quarterly earnings.

Earnings expectations & valuations

EPS growth expectations in Europe for 2025 have been slightly cut again to -0.4% (vs -0.2% four weeks ago). Consensus continues to predict EPS growth in 2025 driven by Real Estate (+11%), Healthcare (+9%) and IT (+8%), while many sectors are expected to report negative earnings growth (Consumer Discretionary, Energy, Materials, Communication Services, Consumer Staples, Utilities).

However, consensus has revised its 12-month EPS growth forecast upwards to +10.6% (vs +9.4% previously).

Since the last Equity Committee, European valuation multiples have decreased slightly, with 12-month forward P/E now at 14.8x (vs 15.1x) but still close to the high end of the historical range. IT and Industrials remain the most expensive sectors (26.7x and 20.6x, respectively), while Energy is still the cheapest (10.5x).

Utilities upgraded to +1

The utilities sector (Level 1) has been upgraded to +1 from neutral for the following reasons:

- Growth story for the coming years.

- High visibility driven by electrification and grid connections in Europe, the US and China.

- Low valuation multiples.

US equities: On track following solid earnings

Despite growing caution in the market regarding the surge in capital investments in Artificial Intelligence, US equities delivered solid performance. Investors responded positively to resilient third-quarter corporate earnings across a broad range of sectors and constructive trade talks between the US and China.

Healthcare takes the lead

US equity markets showed robust performance over the past weeks. Global sentiment improved late in the month, supported by renewed US-China trade discussions that resulted in a preliminary one-year deal. While the formal agreement is still pending, it would halt additional US tariff increases and ease China’s restrictions on rare earth exports. Strong third-quarter earnings results further reinforced the positive tone.

In this context, large caps outperformed mid- and small-cap stocks. Separately, there was no clear difference between defensives and cyclicals despite significant performance dispersion between sectors. Healthcare was the best-performing sector in recent weeks, supported by greater policy clarity and a renewed investor focus on the sector’s fundamentals. Communication Services, Information Technology and Consumer Discretionary also outperformed the broader US market, while Materials, Utilities and Financials lagged.

Strong Q3 earnings

US companies delivered solid third-quarter results, with roughly 82% of companies having already reported beating earnings estimates. The aggregate year-on-year earnings growth rate is close to 15%, marking the fourth consecutive quarter of double-digit growth.

Earnings growth was broad-based, with eight of the 11 S&P 500 sectors reporting year-on-year gains. Information Technology and Financials were the main contributors, with high double-digit earnings growth supported by strong results across semiconductors, software and capital markets.

In response to resilient earnings reports, analysts raised their forward estimates, projecting nearly 14% earnings growth over the next 12 months. Although this forecast appears somewhat ambitious, it remains achievable under supportive economic conditions.

Given this earnings growth, US equities currently trade at around 23 times forward earnings, above the 10-year average, but not yet at excessive levels. Looking ahead, sustained earnings growth will remain a key driver of equity market performance.

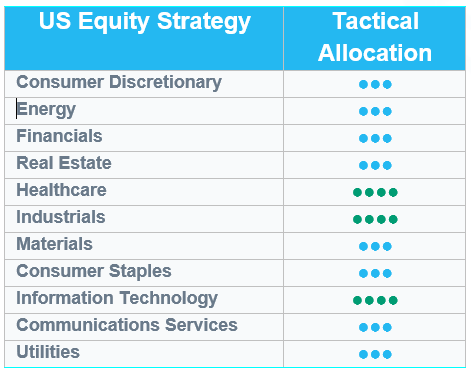

No changes in sector allocation

We maintain our current allocation, with a continued overweight in Industrials, Information Technology and Healthcare.

Since our upgrade in early September, the Healthcare sector has delivered strong performance, driven by renewed investor confidence amid improving policy visibility and reduced regulatory uncertainty. We expect this uptrend to continue, supported by robust fundamentals.

Currently, we see no immediate catalyst to adjust our positioning.

Emerging equities: Once again Asia at the forefront

Emerging markets equities gained (+4.1% in USD) in October, marking yet another chapter in their longest bull run and outperformed Developed Markets (+1.9%). The month’s rally rested on three foundations: easing trade tensions between the US and China, a global acceleration in capital expenditure tied to AI, and the Federal Reserve’s 25 bps rate cut.

Asia once again led the advance (+4.9%), propelled by extraordinary performances in Korea (+22.3%) and Taiwan (+9.8%). Korea realised its strongest monthly gain since 2009, driven by a surge in AI-related semiconductor demand, supply tightness in memory chips and investor enthusiasm over partnerships between Korean tech firms and US AI leaders. Taiwan benefited from technology exports booming and TSMC raising both its guidance and investment targets. China underperformed (-3.9%). Its markets rotated away from crowded growth trades into yield-oriented sectors like Energy and Utilities, as investors wished to see further visibility for the country’s economy.

Latin America (+0.8%) rose while lagging its emerging peers. Colombia (+8.9%) and Chile (+7.0%) posted healthy gains. Brazil (+0.7%), flattened as investors weighed tepid economic data against President Lula’s legislative victories on tax reform. Off-index, Argentina shocked markets with a 63% surge following the current president’s party win in the midterm elections. Elsewhere, Emerging Europe also delivered positive performance, buoyed by Hungary (+8.5%) and Poland (+4.5%).

US yields finished the month at 4.11%. In the commodity space, gold (+3.7%) and silver (+3.8%) continued their rise, while Brent crude declined (-2.9%).

Outlook and drivers

Tailwinds are accumulating for Emerging Markets. Most of the Emerging Market central banks embarked on monetary-easing cycles in response to moderating inflation and growth objectives. In addition, historical patterns suggest that the Fed’s rate-cutting phases tend to support Emerging Market equities. Although the US dollar has displayed near-term resilience, expectations for a gradual long-term depreciation persist, adding another layer of support that could bolster capital inflows into Emerging Market assets. Donald Trump’s diplomatic tour ahead of the APEC summit was marked by constructive engagement. His meeting with the Chinese President eventually yielded tangible progress toward easing tensions, including a one-year truce on tariffs, among other accords. Sentiment in Brazil also improved as Donald Trump’s friendly exchange with President Lula reinforced a broader trend of warming relations, in addition to Brazil’s encouraging economic momentum.

In China, the Fourth Plenum laid out a roadmap for the country’s next five-year development. The session emphasised technological self-sufficiency as a crucial pillar of sustainable growth. Domestically, policymakers reaffirmed their commitment to sustaining GDP growth near the 5% target through timely fiscal and financial measures. Externally, renewed dialogue with Washington underscored Beijing’s pragmatic approach (stabilising trade channels while maintaining strategic autonomy).

In Korea, the KOSPI reached fresh all-time highs, driven by renewed foreign inflows into leading technology names. Samsung Electronics (SEC) and SK Hynix led the rally as optimism was raised around a broader DRAM upcycle and the sustained global demand for AI-driven computing infrastructure. The Value-Up Programme continued to bolster market sentiment. The initiative, designed to enhance minority shareholder rights, reduce related-party transactions and improve corporate governance transparency, has gained strong investor support. Complementary themes such as electrical grid modernisation, nuclear infrastructure investment and “K-culture” exports, including Korean specialty foods and beauty products, also reinforced positive momentum.

Positioning Update

As for regions, we upgraded Brazil from neutral to overweight for macroeconomic positivity and easing geopolitical tensions. We downgraded Korea from a tactical perspective. The market has been very much heated, but company fundamentals remain attractive.

As for sectors, we downgraded materials from overweight to neutral. We remain positive on precious metals but took profits from the stellar performance.

Regions

Brazil upgraded from neutral to overweight

The backdrop is supportive: a weaker USD and the prospect of Fed easing typically benefit Latin America, which has some of the highest leverage to dollar weakness within Emerging Markets. Domestically, the central bank’s easing cycle is compressing real rates that remain exceptionally high, while inflation trends lower. Valuations are attractive at roughly 8.5x P/E, below the 10-year average.

Diplomatically, improving US-Brazil relations reduce headline risk and could even catalyse tariff reversals as delegations engage this week. Looking ahead, the Oct-2026 presidential election introduces optionality: while timelines are long, a more business-friendly tilt would be a clear positive. We express the view through domestic, long-duration equities, where falling real rates can re-rate cash flows.

Korea downgraded from overweight to neutral

We are tactically moving Korea to Neutral after a powerful run: MSCI Korea was +15% month-to-date and ~70% YTD, with the index at its highest overbought in 10 years. Leadership has been concentrated: Samsung Electronics (+85% YTD) and SK Hynix (+180% YTD) now represent roughly 40% of the index. The market could be vulnerable to near-term consolidation.

Meanwhile, this is not a change in structural view. We continue to like Korea for (1) AI memory leadership and the emerging DRAM/HBM super cycle, (2) depth in industrials (shipbuilding, defence, nuclear), (3) the Value-Up corporate-governance initiative, and (4) the enduring tailwinds of K-culture. We are simply seeking a better entry point after extreme momentum.

China remains overweight in our view. After a brief pullback in leaders (e.g. Alibaba, Tencent), China has outperformed EMs since April and is ~+40% YTD. In particular for Chinese techs: Internet platforms are executing and hardware localisation/import substitution is accelerating; semiconductor independence is becoming a durable investment theme.

The macro/market divergence is striking – soft data versus strong equity performance. We see three bridges: (1) Earnings: selective momentum in platforms and hardware; upcoming prints (Alibaba/Tencent) are near-term catalysts. (2) Liquidity: policy remains loose, with the central bank emphasising “cross-cyclical” (long-horizon) adjustments. (3) Flows: a trade truce tone and passive EM inflows (China as the largest-weighted country) underpin demand as global investors rotate to EM on a weaker USD and easier policy.

Valuations have re-rated as technology’s index share rises (technology’s higher multiples replacing prior low-multiple consumer/real-estate weight). Near-term, we expect some rotation to defensives and banks during pullbacks, but remain constructive on the medium-term technology-led thesis.

Argentina: Following Milei’s victory and reform agenda, the market can expect a strong upside.

Sectors

Materials downgraded from overweight to neutral

Gold shows signs of overheating; industrial metals (copper) remain supported by expected 2026 deficits, but we prefer to add on weakness rather than chase.

Technology: Our overweight view is retained. One of the best performers over the last year (~+27% in 6 months). Korea and Taiwan remain well supported by earnings revisions and AI infrastructure demand.